Every active stock investor knows just how well the semiconductor names have been performing this year and helping lead that group higher is Advanced Micro Devices (AMD).

It’s one of several semiconductor stocks helping to lead the rally and in particular, it’s AMD and Nvidia (NVDA).

While AMD is nowhere near Nvidia’s 85% year-to-date gain, its 43% rally so far this year is multiples better than the S&P 500. It’s also more the double the return we’ve seen so far in the Nasdaq.

Don't Miss: Buy-the-Dip Setup Appears in Salesforce Stock: Here's the Trade

Now investors are looking for a buy-the-dip opportunity in this name.

A few weeks ago, I took a “big picture” look at AMD stock, highlighting how it was running into major resistance near $100.

Despite Nvidia’s seemingly endless run to the upside, AMD stock was not able to break out over this area.

Now though, it has buyers looking for an opportunity on the long side. Here’s why.

Trading AMD Stock

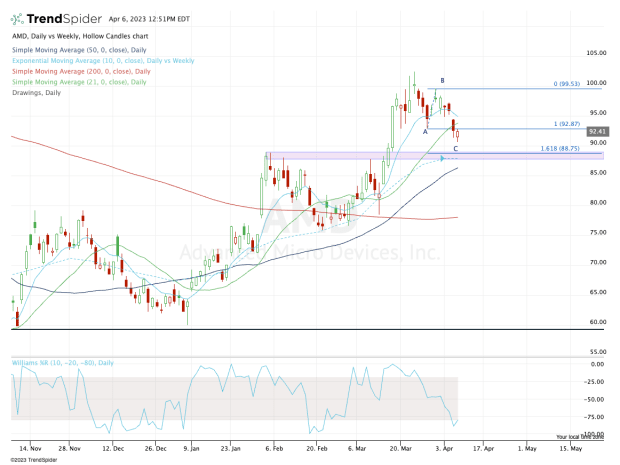

Chart courtesy of TrendSpider.com

At some point, the bullish uptrend will end and AMD stock will either consolidate or pull back. Until that trend ends though, investors should continue to look for buying opportunities.

AMD stock opened near yesterday’s low and quickly reclaimed it. That paved the way to today’s rebound off the low. Shares are down just slightly in Thursday’s session as opposed to the 2.1% loss the stock was sporting at the low.

Maybe that’s the depth of the pullback we get.

DON'T MISS: Trading C3.ai Stock After Accounting Concern Ignites Selloff: Chart

However, bulls would love to see a dip into the $88 to $89 area.

Not only is this a prior breakout zone, but it’s also where the rising 10-week moving average comes into play. Lastly, we have an “ABC” correction playing out — as noted on the chart — and it’s from that range where we get the 161.8% downside extension, which comes into play at $88.75.

So for all of these reasons, bulls should look to buy a dip to this area for a trade. A slight overshoot could put the 50-day in play.

On the upside, $95 could serve as some resistance as AMD tries to regain its 10-day and 21-day moving averages, along with a prior support level. However, a strong push above that level opens the door back up to the $100 area.