Shares of Advanced Micro Devices (AMD) are racing higher on Wednesday, up almost 8% at last check.

The post-earnings reaction enables long investors to let go a a sigh of relief -- not only because of Intel's (INTC) lackluster update but because AMD shares were only slightly higher in post-market trading last night.

Advanced Micro Devices delivered a slight top- and bottom-line beat, and while its revenue outlook for next quarter was a tad light vs. expectations, investors are giving it a thumbs up.

I'll reiterate: Wall Street right now seems to be giving companies something of a pass on earnings, punishing only the truly bad quarters. As long as the results are within the realm of expectations, then the reaction seems to be relief more than anything else.

For what it’s worth, Nvidia (NVDA) stock is reacting favorably on AMD's numbers, too. The graphics-chip specialist's shares were up about 3.5% at Wednesday’s high.

Trading AMD Stock on Earnings

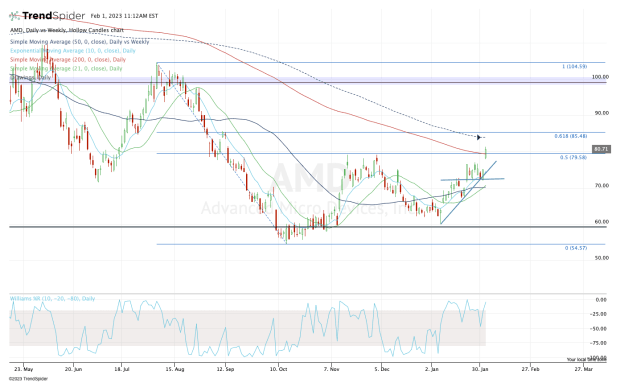

Chart courtesy of TrendSpider.com

AMD stock is doing a great job of pushing through the $80 area. This zone is critical as it marks key resistance from the fourth quarter, the 50% retracement of the larger range, and the declining 200-day moving average.

But — there’s almost always a but — we have to get through the Fed on Wednesday and Big Tech earnings on Thursday.

If AMD stock can close above $80 on Wednesday, it’s a huge development for the bulls. It opens the door to the $85 area, where the stock finds its 61.8% retracement and declining 50-week moving average.

Above that puts $90-plus in play.

A bearish reversal from here would look bad, cementing $80 as resistance until proven otherwise.

The post-earnings gap-fill is at $75.20. While bulls don’t want to see a pullback to this level after such a strong initial reaction to the earnings, AMD stock is still technically okay if it holds the gap-fill and the 10-day moving average.

If, however, it breaks below $72.50, the 50-day and 21-day moving averages come into play. Below these measures and the action becomes considerably more bearish.

AMD is a high-quality chip stock that underwent a very painful peak-to-trough decline in 2022, cratering more than 66% from the highs. Now it's trying to power higher, and the bulls have some momentum. How it trades the rest of this week will be key.