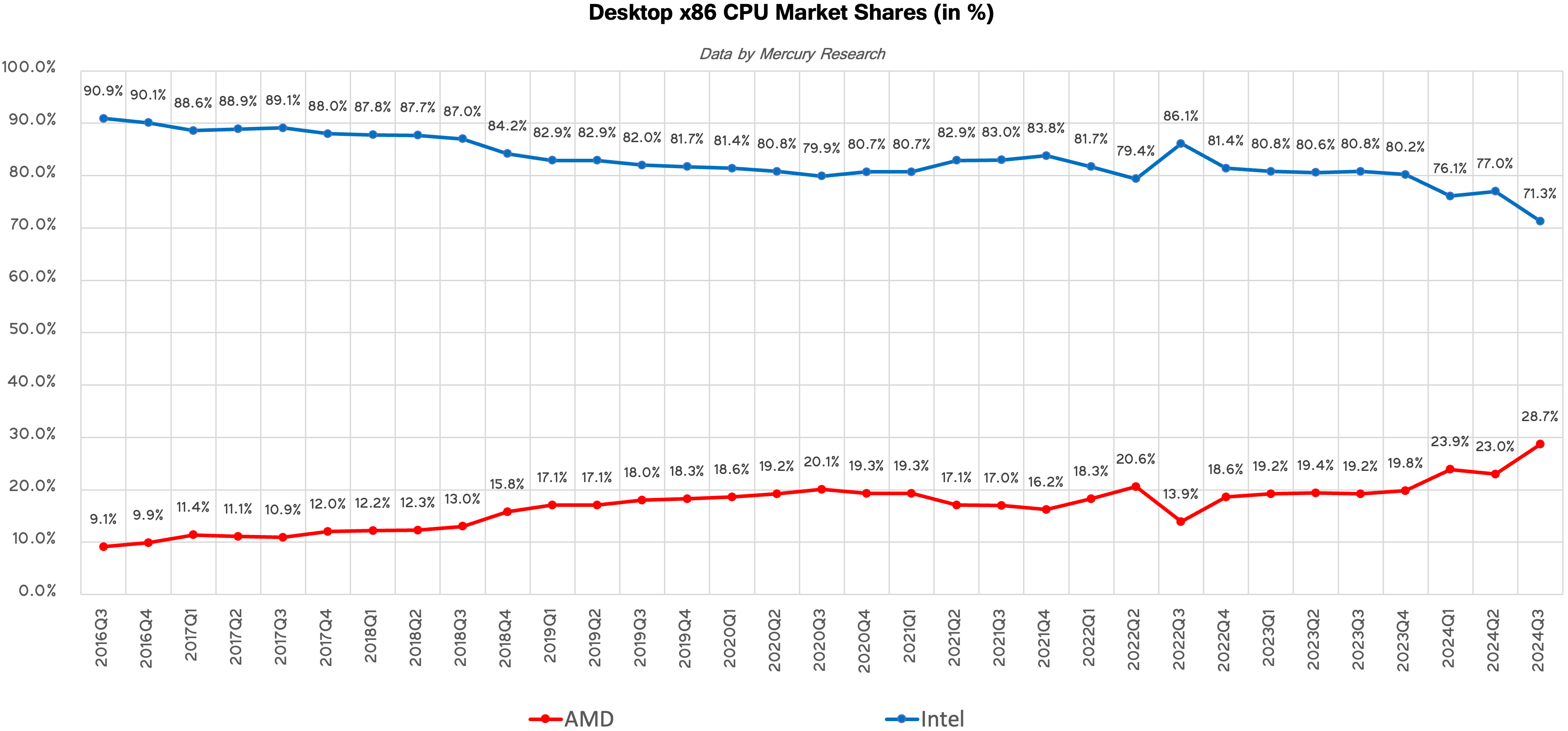

AMD has gained a substantial 5.7 percentage points of share of the desktop x86 CPU market in the third quarter compared to Q2, the largest quarterly share gain since we began tracking the market share reports in 2016. It also represents an incredible ten percentage point improvement over the prior year. AMD also raked in a strong increase in revenue share, jumping 8.5 percentage points over the prior quarter, indicating that it is selling a strong mix of higher-end CPU models.

During the quarter, AMD launched its new Ryzen 9000-series family of processors amid a scandal related to stability issues with Intel's Raptor Lake chips, which generated a flood of negative press for the company over the course of several months, and inventory adjustments for one of Intel's customers. AMD now commands 28.7% of the desktop processor market. AMD also continued to gain share in the laptop and server markets, though its gains on the desktop side of the business were the most impressive, according to Mercury Research.

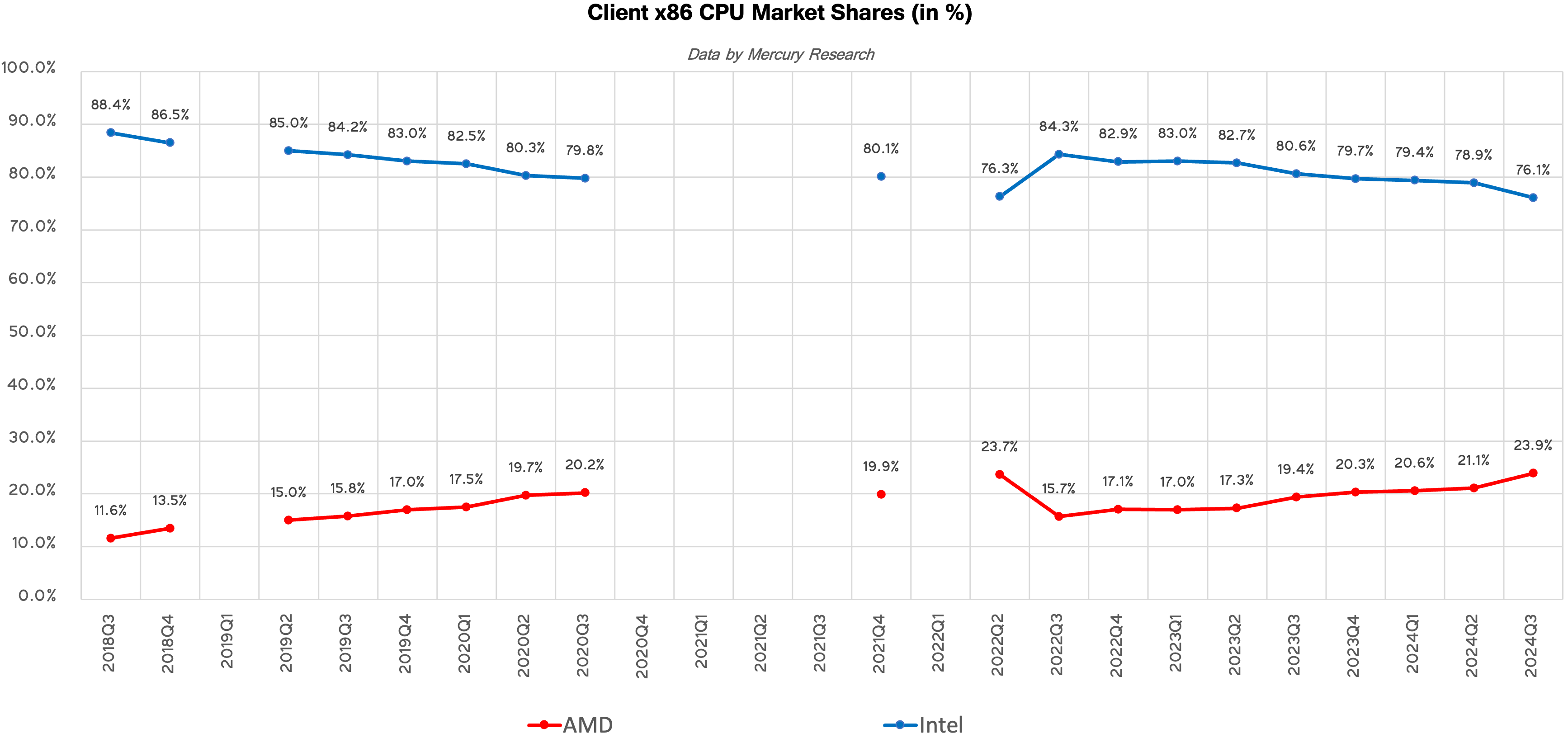

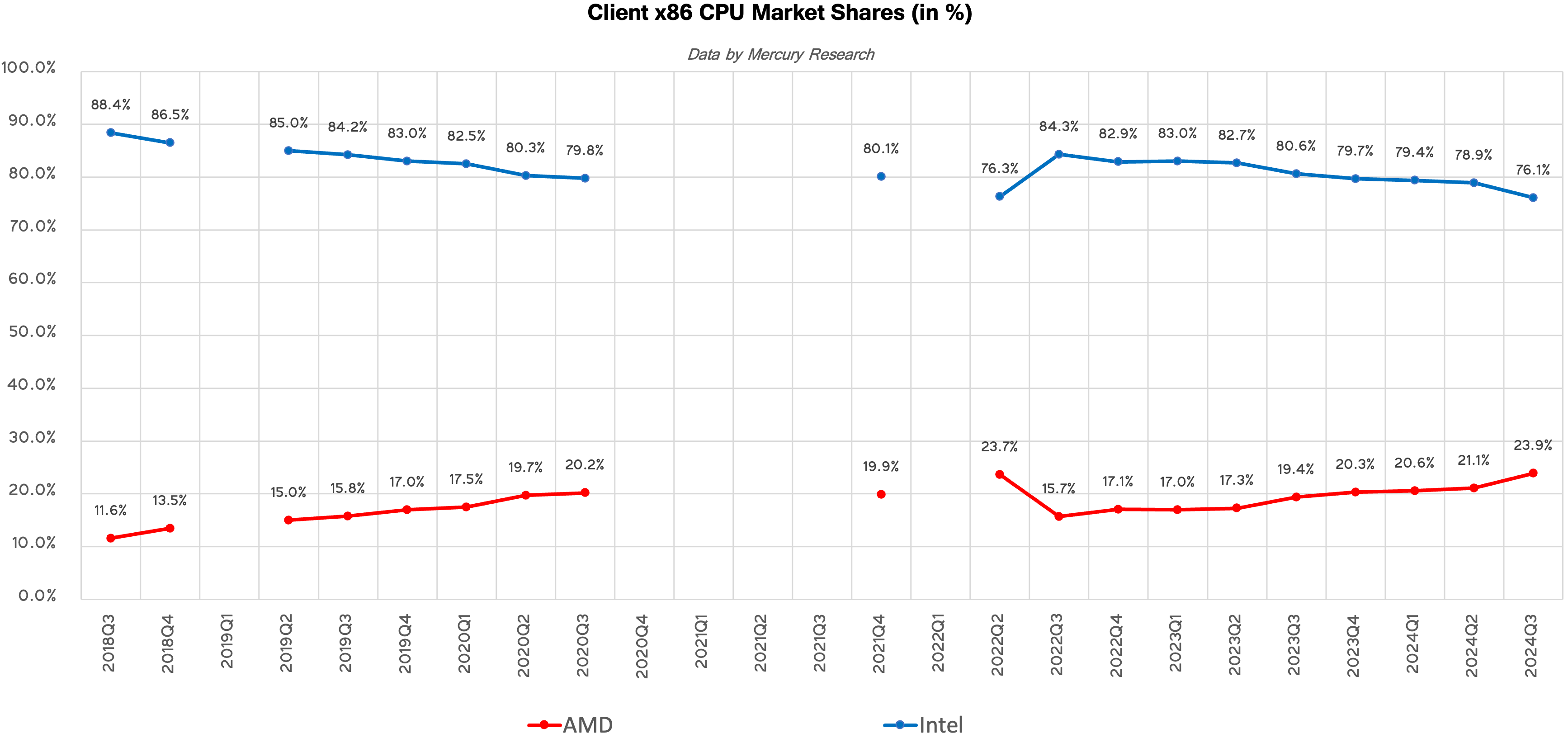

In Q3 2024, Intel maintained a strong lead in the client PC market, commanding 76.1% of the market in terms of units, while AMD held a smaller 23.9% share. However, the dynamics are not in Intel's favor, as AMD gained 2.9 percentage points (pp) quarter-over-quarter and 4.6 pp year-over-year, which are significant achievements. Intel will, of course, continue to lead in client PCs for the foreseeable future as the company has extensive and diverse product offerings for client PCs, an entrenched position in the corporate PC sector, and access to its vast manufacturing capacities.

Desktop PC, Mobile, Client Revenue / Unit Share

AMD's biggest breakthrough in the third quarter was, of course, gaining 5.7 pp of unit share of the desktop x86 CPU market. The company now commands 28.7% of the market, up a whopping 9.6 pp compared to the same quarter a year ago, which is likely the highest share the company has had in at least 15 years. AMD's desktop CPU revenue share also increased by 7.7 pp year-over-year to 27.3%.

Intel's desktop share dropped to 71.3%, and Dean McCarron with Mercury Research tells us Intel explained the decline was caused by an inventory correction at one of its customers. If this is true, then Intel's share may bounce back in Q4 2024.

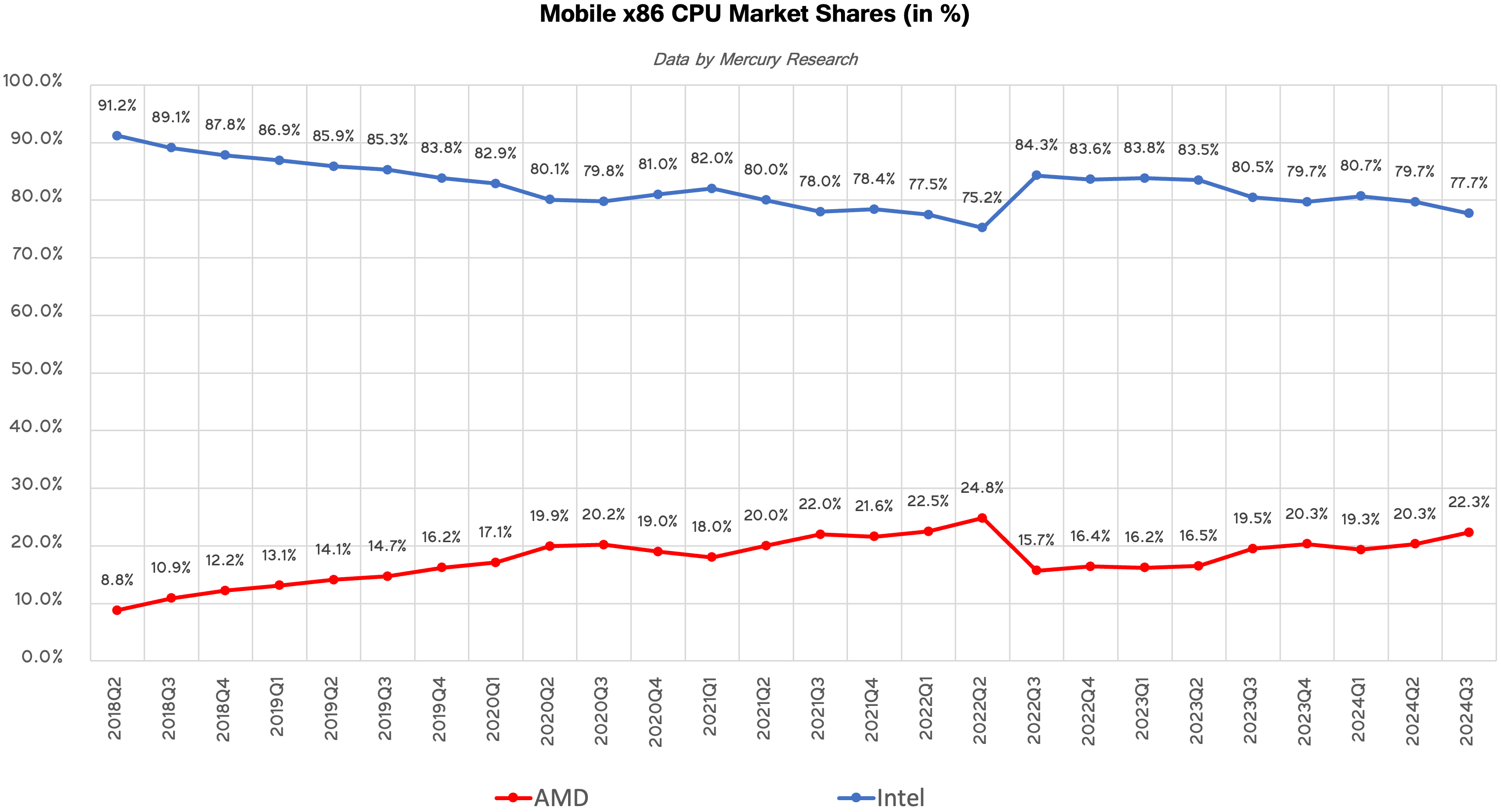

In the laptop segment, AMD saw steady growth compared to both the previous quarter (+2 pp) and the same period last year (+2.8 pp), perhaps because the company launched its Ryzen AI 300-series products slightly ahead of Intel's Lunar Lake and could sell more of these new products to early adopters of x86-based Copilot+ PCs. In Q3 2024, AMD held 22.3% of the x86 laptop processor market, whereas Intel's share decreased to 77.7%.

22.3% is not exactly AMD's record mobile CPU market share, as the company commanded 24.8% in Q2 2022.

Server Revenue / Unit share

When it comes to servers, AMD's share totaled 24.2% as the company gained 0.1 pp unit share sequentially and 0.9 pp year-over-year, which is a rather modest increase but reflects the company's gradual market share gain. However, the company also increased its revenue share to 33.9%, a 2.7 pp gain year-over-year. Typically, AMD advances its share amid the ramp-up of its latest EPYC processors when its server partners roll out products based on them, so it is reasonable to expect the company to post a market share gain in the coming quarters.

Intel, of course, retained its volume lead with a 75.8% unit market share. Yet, as it usually happened in the recent quarter, AMD managed to sell more higher-end CPU models than Intel, which is reflected by its revenue share, which is higher compared to its unit share. It is also noteworthy that for the first time, AMD's data center business unit outsold Intel's data center and AI group in Q3 2024 ($3.549 billion vs $3.3 billion).