AMD’s stock is down more than 35% on the year, pressured by broader tech-sector and chip-stock weakness. Bulls are hoping the CPU and GPU supplier's (AMD) first-quarter earnings report will help reverse this trend.

On average, analysts polled by FactSet expect AMD to report first-quarter revenue of $5.01 billion (up 45% annually), GAAP EPS of $0.83 and non-GAAP EPS of $0.91. However, analyst estimates haven’t been updated to account for AMD’s acquisition of top programmable-chip developer Xilinx, which closed in mid-February.

AMD typically provides quarterly and full-year sales guidance in its reports. Consensus second-quarter and 2022 revenue estimates, which also haven’t been updated to account for the Xilinx deal, respectively stand at $5.14 billion (up 34%) and $21.48 billion.

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging AMD’s earnings report, which is expected after the close on Tuesday, along with an earnings call scheduled for 5:00 P.M. Eastern Time. (Please refresh your browser for updates.)

6:11 PM ET: AMD's call has ended. Shares are up 7% after-hours to $97.55 after AMD reported Q1 revenue of $5.89B, with Xilinx (acquired in mid-February) contributing $559M and AMD's existing businesses contributing $5.33B (above a $5.01B consensus).

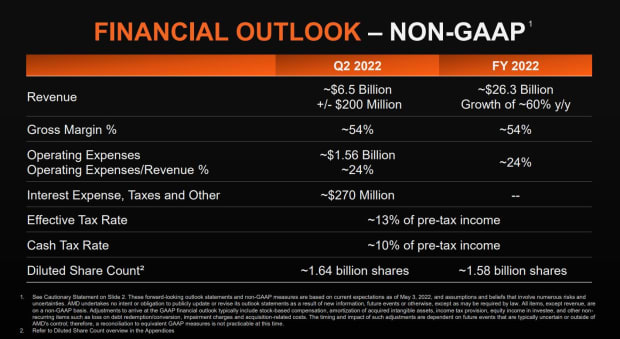

AMD also guided for Q2 sales of $6.5B (+/- $200M), while stating Q/Q growth will be driven by server CPU sales and a full quarter of Xilinx contributions. And it raised its full-year sales guidance by $4.8B to $26.3B, while citing both Xilinx and strong server CPU and console SoC demand.

On the call, CEO Lisa Su disclosed server CPU sales more than doubled Y/Y again in Q1, and that GPU and console SoC sales saw strong double-digit growth. She also noted AMD is seeing demand soften in parts of the PC market, while adding AMD still expects to grow its PC CPU sales this year thanks to revenue share gains.

Thanks for joining us.

6:02 PM ET: A question about AMD's views on software monetization.

Su: You should expect to see us invest a lot more in software. Regarding monetization, it's about the overall solution we deliver to customers. We'll share more at our analyst day event.

6:01 PM ET: A question about AMD's efforts to go after the AI training and inference markets (where Nvidia currently has a huge presence).

Su: AI is a huge opportunity for us. We're thinking about it holistically, across silicon and software. Xilinx brings us a lot of AI inference capabilities. I think you'll see a much broader set of AI offerings from us in time.

Peng: We have an AI engine that's deployed in many end-markets, from data centers to cars. We're also investing in AI software solutions. We're excited about the revenue synergy opportunity.

5:58 PM ET: A question about whether the data center market is expected to slow.

Su: We haven't see that yet. Our planning with customers extends into 2023. And from what we can see, there's robust demand.

5:57 PM ET: A question about expected semi-custom growth.

Su: Semi-custom demand is strong. We work closely with our customers here. Console demand still appears to be above supply in the retail channel. We expect 2023 to be another strong year for semi-custom, and for sales to be up. There's a strong lineup of games on the way, and that should boost demand.

5:55 PM ET: A question about the puts and takes for AMD's full-year guide. Are sales expected to plateau?

Su: I don't see a plateau. We expect server CPU sales to keep growing, and for console SoCs to grow thanks to seasonality. PCs are also expected to benefit from seasonality, though we're kind of modeling sub-seasonal growth. Xilinx is expected to keep growing.

5:53 PM ET: A question about AMD's expected organic Q2 growth.

Su: The Q2 guide is driven by a full quarter of Xilinx and server CPU strength. Our PC and gaming businesses tend to be more second half-weighted.

5:52 PM ET: A question about AMD's internal and open-source software efforts.

Su: Software is very important. Xilinx has a strong software stack, and we have our own. We do believe in open-source. That's part of our effort to provide more complete solutions.

5:51 PM ET: A question about AMD/Xilinx's opportunity to handle more data processing at the network edge, and how it compares with its data center opportunity.

Su: The whole strategy behind AMD is to have the best compute engines and put them in solutions for specific end-markets. Between CPUs, GPUs, FPGAs, DPUs and adaptive SoCs, we have a broad lineup. There's interest in joint solutions in comms infrastructure. We think there'll be more customization for big customers. And our product line helps us address that. We'll share more at our June analyst day event.

5:48 PM ET: A question about AMD's opportunity to grow its CPU attach within systems containing Xilinx FPGAs.

Peng: By pairing FPGAs and adaptive SoCs with AMD's products, we can offer a more complete solution. We're working on new products and are excited about the opportunity.

5:46 PM ET: A question about enterprise server CPU growth.

Su: We've made great cloud progress. We've also made strong enterprise progress. In Q1, we grew enterprise at about the same pace as cloud. We're still cloud-weighted, but we expect both enterprise and cloud to see strong growth.

5:44 PM ET: A question about whether AMD can shift wafer supply from PC CPUs to other products that are supply-constrained.

Su says some wafers can be shifted, though less so from Xilinx since a lot of its product sales involve mature process nodes. Also says there's a lot of "fungibility" for AMD's substrate capacity.

5:42 PM ET: A question about AMD's server CPU ASPs.

Su: As we offer more value, we'd expect our ASPs to keep rising. Though a quarter's ASP can be affected by the mix between cloud and enterprise.

5:41 PM ET: A question about server CPU sales. Can AMD double its full-year server CPU sales?

Su: The server CPU business continues to be very strong. We expect to grow it very strongly over the next few quarters. We continue bringing in additional supply. The demand is there.

Su also says AMD thinks it can grow PC CPU sales this year in spite of its full-year TAM forecast.

5:38 PM ET: A question about PC demand.

Su: As we started the year, we thought the PC TAM in 2022 could be flat to slightly down. But we're now modeling a high-single-digit decline. We're focused on premium segments. Our Ryzen 6000 notebook processors are very competitive. We're still under-represented in the commercial PC market. We expect to continue gaining revenue share in the PC market. And the company now has many other levers for growth.

5:36 PM ET: A question about expectations for Genoa.

Su: Server CPUs are getting more optimized for workloads. We're seeing that already with Milan. There's "a lot of excitement" for Genoa. Bergamo is "more specific" to the needs of large hyperscalers. As our business has grown, we can invest more broadly in customized solutions.

5:34 PM ET: A question about data center's Q1 revenue contribution. And one about the medium-term opportunity for data center GPUs and FPGAs.

Su: Data center was a low-20s % of Q1 revenue. We're "incredibly excited" about the long-term data center opportunity. We're excited by how Genoa and Bergamo look, and also about the GPU portfolio. Last year's data center GPU growth was driven by HPC. But we're now very engaged on the AI front for GPUs.

Xilinx chief Victor Peng: Demand for Xilinx's compute engines and networking products are strong. Customers want optimized solutions. And we can do that both through Xilinx and Pensando.

5:30 PM ET: A question about supply chain pressures and the impact of China lockdowns.

Su: We've been working on supply for the last 18 months. We've made significant progress improving wafer and substrate supply. China hasn't had a significant impact on our own supply chain. But we have been working with customers whose hardware builds have been impacted, and that's factored into our guidance.

5:29 PM ET: A question about what kind of organic 2022 growth AMD now expects.

Su: We're significantly increasing full-year guidance. We previously guided for 31% organic growth. We now expect mid-30s organic growth. We're still seeing strong demand in many markets. We're seeing softness in some parts of the PC market, but not all of it.

5:26 PM ET: First question is about macro and supply chain issues.

Su: We had a very strong Q1. Strength was broad-based. We continue bringing more server CPU supply online. There is some PC softness, but we've been shifting our mix to the premium segments of the PC market for several quarters. We saw significant Q/Q growth in our PC business. We continue working with customers to make sure we optimize our builds with theirs.

5:23 PM ET: The Q&A session is starting.

5:22 PM ET: Full-revenue growth is expected to be driven by Xilinx and higher server CPU and semi-custom (console SoC) revenue.

Kumar also notes 2022 will be a 53-week year, with an extra week in the fourth quarter.

5:21 PM ET: Regarding AMD's Q2 sales guidance, Kumar says Q/Q growth is expected to be driven by Xilinx and higher server CPU revenue.

5:20 PM ET: Kumar says AMD is changing its segment reporting. There will be 4 segments going forward: Data Center, Client, Embedded and Gaming.

5:19 PM ET: Kumar continues recapping AMD's Q1 financial performance. Notes enterprise, embedded & semi-custom op. margin hit a record 35%, aided by revenue growth, operating leverage and a one-time licensing gain.

He also says Xilinx is expected to be accretive to non-GAAP EPS in 2022.

5:17 PM ET: Kumar says higher Epyc sales were the biggest Y/Y driver of AMD's non-Xilinx gross margin growth.

5:16 PM ET: Devinder Kumar is now talking.

5:15 PM ET: AMD has added to its AH gains. Shares are now up 7.8%.

5:14 PM ET: Su says Xilinx saw strong Q1 demand in data center, telco and embedded end-markets. Adds AMD sees strong Xilinx demand going forward across all end-markets, and is working to increase supply.

Also notes AMD sees revenue synergies with Xilinx in AI inference (new products expected next year) and elsewhere.

5:11 PM ET: Su says AMD expanded customer and partner sampling for its next-gen Epyc server CPUs (Genoa) in Q1, and remains on track to launch Genoa in 2H22. Also says shipments for high-core-count Bergamo CPUs remain on track to start in 1H23.

5:09 PM ET: Su notes the PC market is "experiencing some softness," while adding AMD's focus on premium, commercial and gaming PCs helps its out.

GPU revenue rose by a strong double-digit % Y/Y, with desktop GPU sales nearly doubling Y/Y. Data center GPU sales were flat Y/Y.

Semi-custom sales rose by a significant double-digit % Y/Y. 2022 is expected to be a record year for semi-custom. Embedded revenue more than doubled Y/Y, led by automotive (Tesla

Server CPU revenue more than doubled Y/Y again, and rose by a double-digit % Q/Q. Cloud and enterprise server CPU revenue both more than doubled Y/Y.

5:06 PM ET: Su says revenue rose 55% Y/Y in Q1 excluding Xilinx. High-end PC CPU sales are said to have grown by a strong double-digit %, with Su stating AMD believes it once more gained PC CPU share.

She also says AMD once more saw record notebook processor sales.

5:04 PM ET: Su notes AMD took major steps in early 2022 to reshape its business, including the Xilinx and Pensando acquisitions. Goes over each company's offerings and how they complement AMD's.

5:03 PM ET: Lisa Su is talking.

5:02 PM ET: AMD is going over its safe-harbor statement. Typically, AMD's call features prepared remarks from CEO Lisa Su and CFO Devinder Kumar, after which the execs take questions from analysts.

5:01 PM ET: The call is starting.

4:58 PM ET: The Q1 call should kick off in a couple of minutes. I'll be covering.

4:56 PM ET: Looking at AMD's balance sheet, the company's "prepaid expenses and other current assets" rose to $725M from $312M at the end of Q4.

Xilinx likely has a bit to do with this. But AMD's efforts to secure more wafer capacity could also be a factor.

4:50 PM ET: AMD's full Q2 and 2022 guidance. Notably, the company's expected full-year diluted share count of 1.58B is 60M below its expected Q2 share count of 1.64B. That suggests buybacks are set to continue at a healthy clip.

4:48 PM ET: Here's what AMD had to say about Xilinx's Q1 performance. With the acquisition closed, management might talk a little more on the call about its plans for integrating Xilinx's products and IP with AMD's existing offerings.

4:43 PM ET: Q1 free cash flow totaled $924M, up from Q1 2021's $832M. AMD ended Q1 with $6.53B in cash and $1.79B in debt.

4:40 PM ET: Boosting EPS: AMD spent $1.9B on stock buybacks in Q1, up sharply from Q4's $756M.

In late February, the company announced a new $8B buyback authorization that goes on top of a $4B authorization that had ~$1B remaining at the time.

4:38 PM ET: Of note: While AMD's Q2 sales guidance of $6.5B (+/- $200M) might include more than $1B worth of Xilinx revenue, its Q2 sales consensus was only at $5.14B. That suggests Q2 guidance could be ~$300M above consensus at the midpoint excluding Xilinx.

4:31 PM ET: GPU archrival Nvidia, which reports in 3 weeks, is up 1.2%. Intel is pretty much unchanged.

4:30 PM ET: AMD is holding onto its post-earnings gains. Shares are up 4.1% after-hours to $94.85.

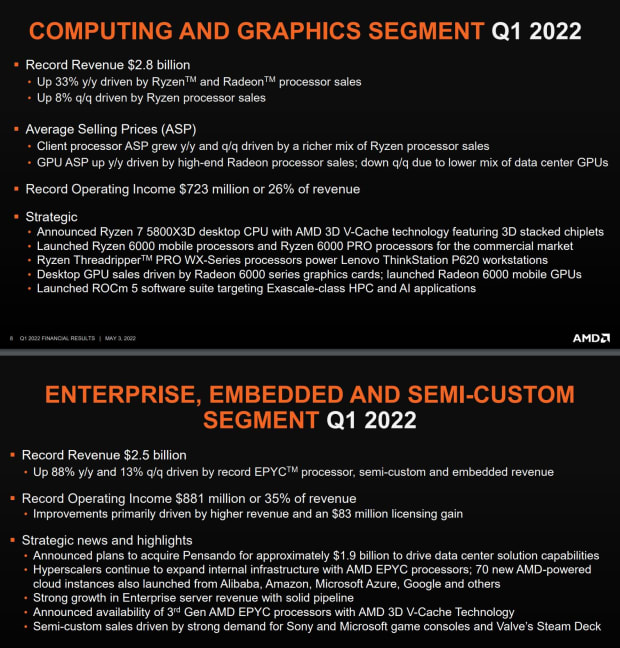

4:30 PM ET: A recap of AMD's Q1 Computing & Graphics and Enterprise, Embedded & Semi-Custom performance. As was the case in Q4, PC CPU ASP was up Q/Q and Y/Y, while GPU ASP was down Q/Q and up Y/Y.

4:26 PM ET: AMD says that excluding Xilinx, its non-GAAP GM was 51%, slightly above guidance of 50.5%. The company notes that along with Xilinx, strong server CPU sales are a tailwind, as is mix shift in PC CPU sales towards more expensive/higher-margin CPUs.

4:23 PM ET: Here's the earnings release. And here's the Q1 slide deck.

4:22 PM ET: With Xilinx's help, AMD posted a non-GAAP gross margin of 53% -- up 240 bps Q/Q and 660 bps Y/Y, and comfortably above pre-Xilinx guidance of 50.5%.

For both Q2 and the full year, AMD is guiding for a non-GAAP GM of 54%. Its pre-Xilinx, full-year, GM guidance was 51%.

4:18 PM ET: The Enterprise, Embedded & Semi-Custom segment (it covers server CPUs, console SoCs and CPUs for embedded systems) saw revenue grow $13% Q/Q and 88% Y/Y to $2.53B, beating a $2.35B consensus.

4:17 PM ET: AMD's Computing & Graphics segment (it covers GPUs and PC CPUs) saw revenue rise 8% Q/Q and 33% Y/Y to $2.8B, topping a $2.67B consensus.

4:15 PM ET: For the entire quarter, Xilinx's revenue is said to be up 22% Y/Y to $1.04B.

4:14 PM ET: AMD notes Xilinx contributed $559M in revenue and $233M in op. income in Q1 following the deal's closing. Thus Q1 revenue excluding Xilinx is $5.33B, above a $5.01B consensus and AMD's January guidance of $5B (+/- $100M).

4:12 PM ET: Shares are up 4.2% after-hours to $94.99.

4:12 PM ET: AMD guides for Q2 revenue of $6.5B, plus or minus $200M. And the company is now guiding for full-year revenue of $26.3B (+60% due to both organic growth and Xilinx).

4:11 PM ET: Results are out. AMD reports Q1 revenue of $5.89B, GAAP EPS of $0.56 and non-GAAP EPS of $1.13. The figures include contributions from Xilinx as of 2/14.

4:07 PM ET: With AMD's server CPU, GPU and console SoC sales having been supply-constrained in recent quarters, improving wafer supply could be a near-term tailwind. Foundry partner TSMC has been making huge capex investments, and cooling demand for low-end PCs and smartphones could free up some wafers for products aimed at other end-markets.

4:00 PM ET: AMD closed up 1.4% today to $91.13. The company typically reports a little after the bell (the Q4 report was published at 4:15 PM ET).

3:59 PM ET: Amid broader selling pressure for tech stocks, AMD's stock is down 22% since the company posted a strong Q4 report on Feb. 1. But for the time being, demand appears to remain quite healthy for the company's GPUs, console SoCs and server CPUs.

3:53 PM ET: The FactSet consensus is for AMD to post Q1 revenue of $5.01 billion (close to its January guidance midpoint of $5B) and non-GAAP EPS of $0.91. However, these estimates don't account for the Xilinx acquisition, which close on Feb. 14.

3:51 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging AMD's earnings report and call.