Intel has long held a commanding market share lead over AMD, but ever since the launch of first generation Ryzen CPU family in 2017, AMD has slowly been chipping away at Intel's lead. Aside from the disruptions caused by the pandemic, AMD's server, mobile and desktop sales have been on an upward trajectory for many years, although Intel still maintains a large lead in all three categories.

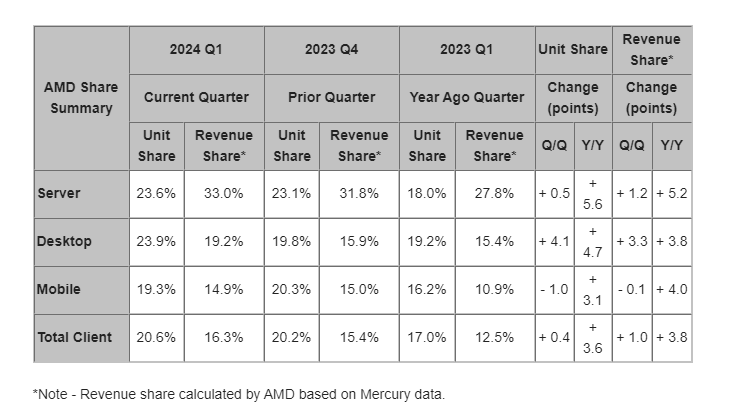

According to a report by Mercury Research, and provided by AMD via email, AMD's x86 client shipments increased by 3.6% year-on-year, climbing from 17% overall, to 20.6%. That still leaves Intel with a commanding lead, but it will leave the blue company concerned as it struggles to meet revenue expectations.

A break down of the numbers shows AMD is continuing to gain in the server market, led by strong sales of its 4th Gen Epyc processors. AMD gained an impressive 5.6% year-on-year, bringing it to 23.6% of the overall server market. Its revenue share increased to 33%—a company record according to AMD—which indicates sales of high-margin products are going very well.

Moving on to the desktop market, AMD picked up 4.7% year-on-year giving it a 23.9% share of the desktop x86 market. Personally I'm a little surprised at that gain given that Ryzen 7000-series processors have been on the market for well over 18 months, although demand for Ryzen 8000-series APUs is surely a contributing factor. AMD's desktop revenue share was 19.2%, up from 15.4% in the same quarter a year ago. That's a healthy increase of 3.8%.

The laptop market is still a tough one to crack. AMD's unit share increased from 16.2% in Q1 2023 to 19.3% in Q1 2024. That is a healthy gain, though still behind the desktop and server market shares. More impressive is AMD's revenue share gain, at 14.9% compared to just 10.9% a year ago.

That 19.3% share is actually a drop compared to the Q4 2023 result of 20.3%, that can be attributed to the ramp up of Intel's Meteor Lake CPUs, although AMD claimed sales of its Ryzen 8040 notebook chips have doubled over the past year.

Overall, these numbers look good for AMD. Intel will be particularly concerned over AMDs increasing share of the lucrative server CPU market. It has few short-term answers to AMD's core count and power efficiency advantages.

Both companies will be hoping to benefit from the fledgling AI PC and laptop market over the rest of 2024. Not that AI hype means all that much to gamers right now. Our eyes are already looking towards AMD's Zen 5 and Intel's Arrow Lake CPUs to come later in the year. Can AMD steal more of Intel's market share? Or is Intel cooking something up that will surprise everyone? Stay tuned.