AMD owns about 20% of the desktop CPU market and nearly a quarter of servers according to new figures for the third quarter of 2023 from Mercury Research. That's up by about 5% in both cases compared to AMD's share this time last year.

Mercury also says that for the market as a whole, both desktop and mobile CPU sales grew in Q3 2023 at "well above normal seasonal rates." Their overall conclusion? "The market is indeed exiting the turbulent downturn created by a post-COVID bubble of excess shipments and inventory that began in mid-2021."

On the mobile side, Mercury's figures show a more modest uptick for AMD of 3.8% market share year on year. But the research outfit notes that AMD's mobile figures are likely flattered by inventory adjustments in the so-called channel rather than necessarily reflecting, you know, laptop sales for AMD.

Still, if you track things back over a longer time frame, AMD really is on the up and up. As recently as 2018, it had virtually no market share in servers. Now it owns nearly one quarter of the market.

AMD's laptop and desktop share never collapsed to the same catastrophic extent as its server sales, but it dipped below 10% on the desktop in 2016 and it was still below 10% in laptops in 2018. So the overall trajectory is pretty stellar. Which is probably why AMD's market capitalization, or its overall worth as a company according to its share price multiplied by the number of shares, is $183 billion as these words are typed and Intel's is actually lower at $159 billion.

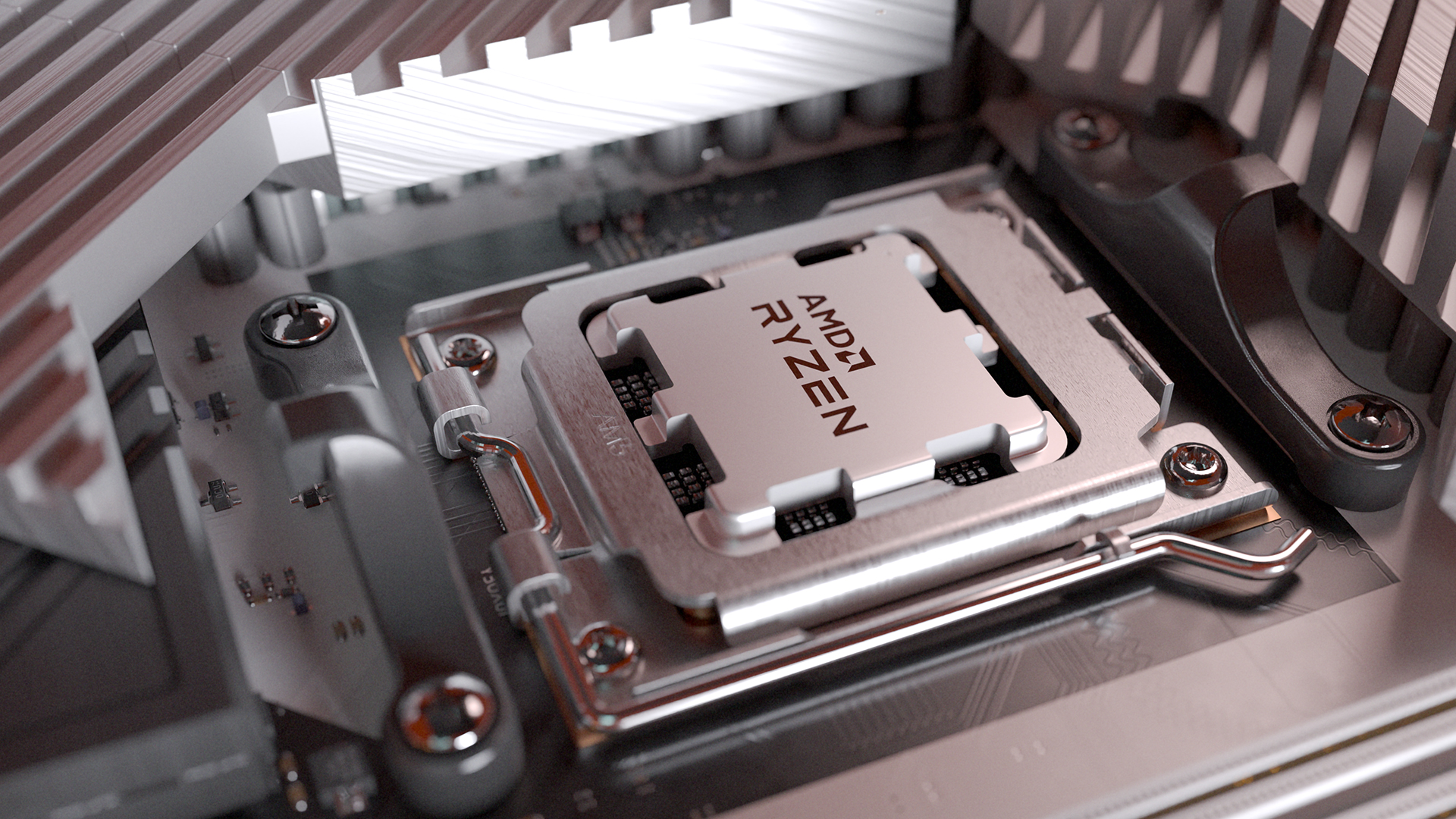

Best CPU for gaming: The top chips from Intel and AMD.

Best gaming motherboard: The right boards.

Best graphics card: Your perfect pixel-pusher awaits.

Best SSD for gaming: Get into the game ahead of the rest.

Of course, AMD's success does mean that we should all have rather different expectations of the company. Gone are the days when we could rationalise AMD's failings on the basis that it was the plucky penniless upstart taking on the incomprehensible might of Intel. AMD, too, is now one of the big boys.

As happens, that attitude ought to apply not just to CPUs, where AMD is going gangbusters, but GPUs too. AMD's market share in the graphics space has not recovered to nearly the same extent and it's getting harder to excuse that as a consequence of AMD being too small and too poor to take on Nvidia.

For sure, Nvidia is the richer company. Its current market cap is well over a trillion dollars. But as AMD continues to succeed in CPUs, its failure to truly regain traction in the PC gaming graphics market is becoming rather frustrating.

.jpg?w=600)