AMD on Tuesday reported its financial results for the fourth quarter of 2023 as well as for the whole fiscal year. The company posted a strong end to the year as its data center GPU business rose on increased demand from the AI craze. However, the company posted a lower-than-expected guide, so its shares tumbled 6% in after-hours trading. An interesting wrinkle here is that the company expects to sell $3.5 billion worth of its MI300-series AI GPUs in 2024, though it says it will not be supply-constrained, which essentially means that demand for the new GPU is at least somewhat limited as it ramps — Nvidia, whose AI GPUs are in a constant state of shortage due to incredible demand, is said to have a 52-week wait time for a new GPU, so many would have expected AMD to have a similar problem. Regardless, AMD says that its MI300 sales are on pace to be the fastest revenue ramp of any product in the company's history as it increased its projected sales from a previous $2 billion estimate to $3.5 billion.

AMD also posted a lower-than-expected guide, saying that its Q1 revenues from the client, embedded, and gaming segments are projected to decrease sequentially. In particular, revenue from semi-custom products (which mainly consist of console SoCs) is expected to experience a substantial double-digit percentage drop of "more than 30%." The company also forecasts that its data center segment revenue will remain flat in Q1 compared to the previous quarter, as a seasonal dip in server sales is likely to be offset by a robust increase in AI and HPC GPU sales, namely the Instinct MI300-series products.

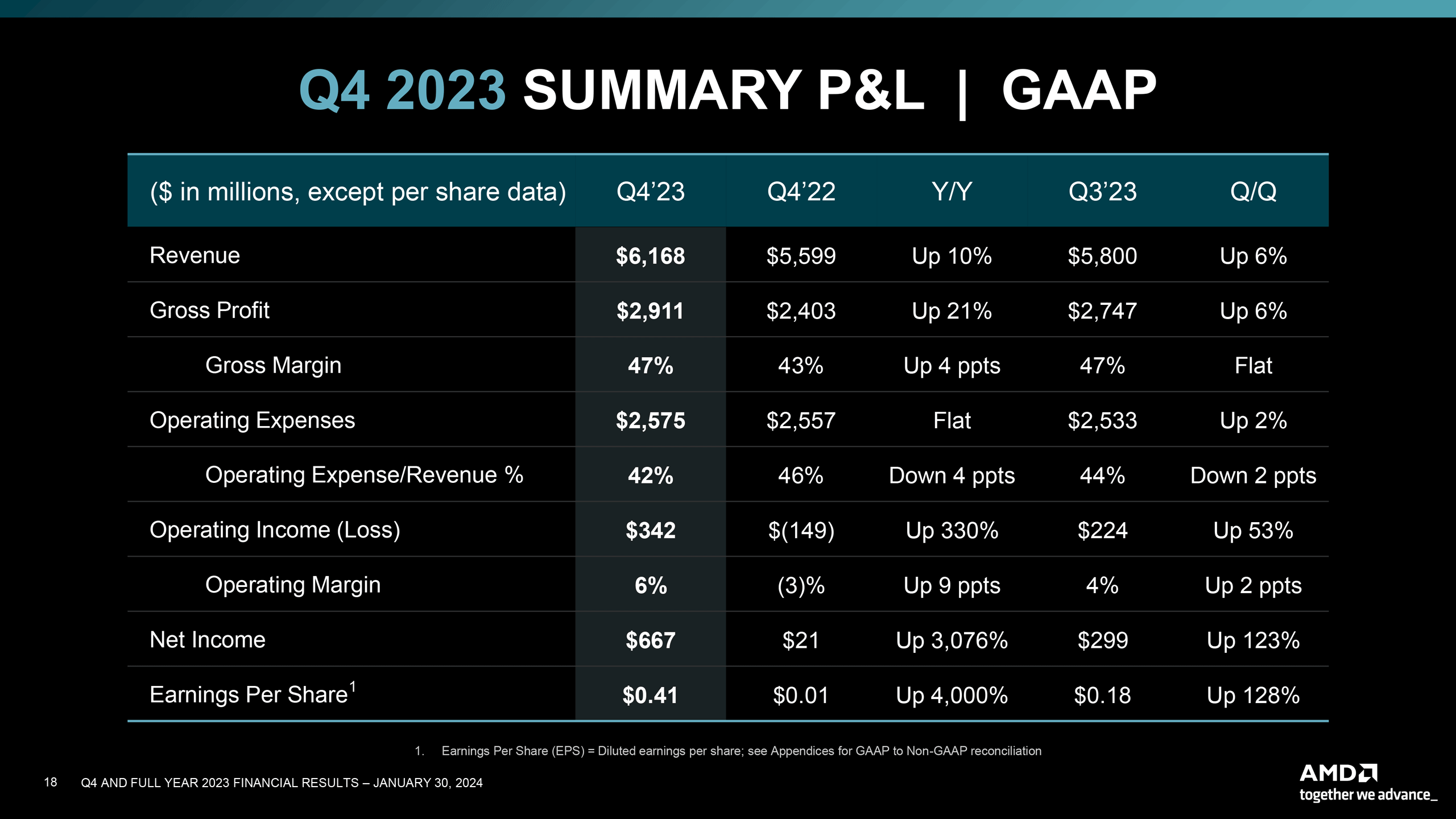

Despite the looming challenges in the year ahead, AMD posted mixed results for the final quarter of its fiscal 2023. The company's fourth-quarter sales were $6.168 billion, up 10% year-over-year, whereas AMD's 2023 revenue totaled $22.68 billion, which is down 4% year-over-year. The company's results for the year were a mixed bag as, on the one hand, it increased its sales of data center processors, but on the other hand, shipments of its client platforms declined, just like sales of gaming hardware.

AMD received $6.168 billion in revenue for the fourth quarter of 2023 and earned $667 million in net income, up significantly year-over-year and quarter-over-quarter. The company's gross margin increased to 47%.

When it comes to the full year, AMD earned $22.68 billion, down 4% year-over-year, whereas its net income totaled $854 million, down 35% year-over-year, which is the second consecutive yearly net income decline for the company. Meanwhile, AMD's gross margin increased by 1% to 46% year-over-year.

"We finished 2023 strong, with sequential and year-over-year revenue and earnings growth driven by record quarterly AMD Instinct GPU and EPYC CPU sales and higher AMD Ryzen processor sales," said Lisa Su, chief executive of AMD. "Demand for our high-performance data center product portfolio continues to accelerate, positioning us well to deliver strong annual growth in what is an incredibly exciting time as AI re-shapes virtually every part of the computing market."

Datacenter Platforms Set Records

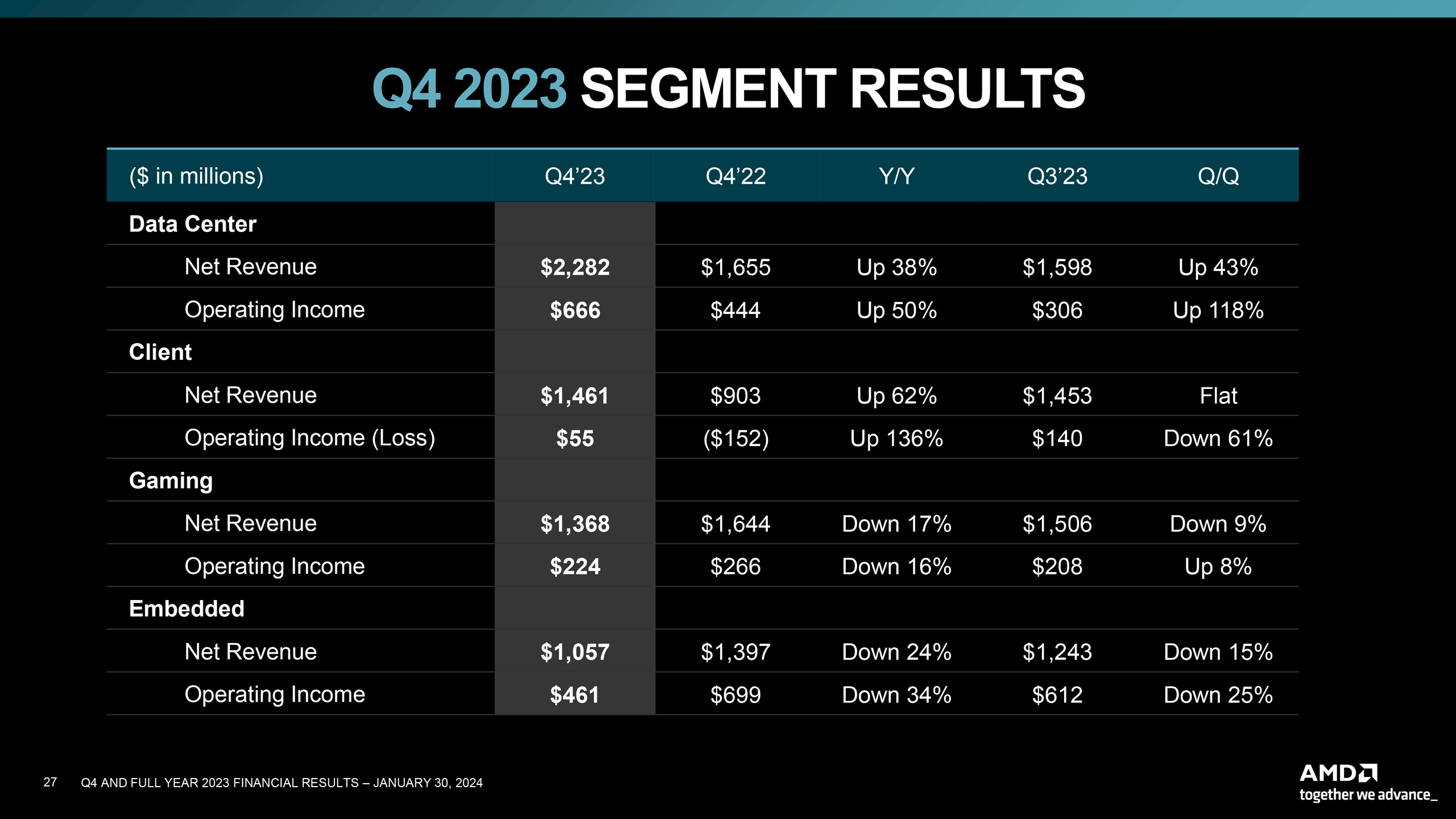

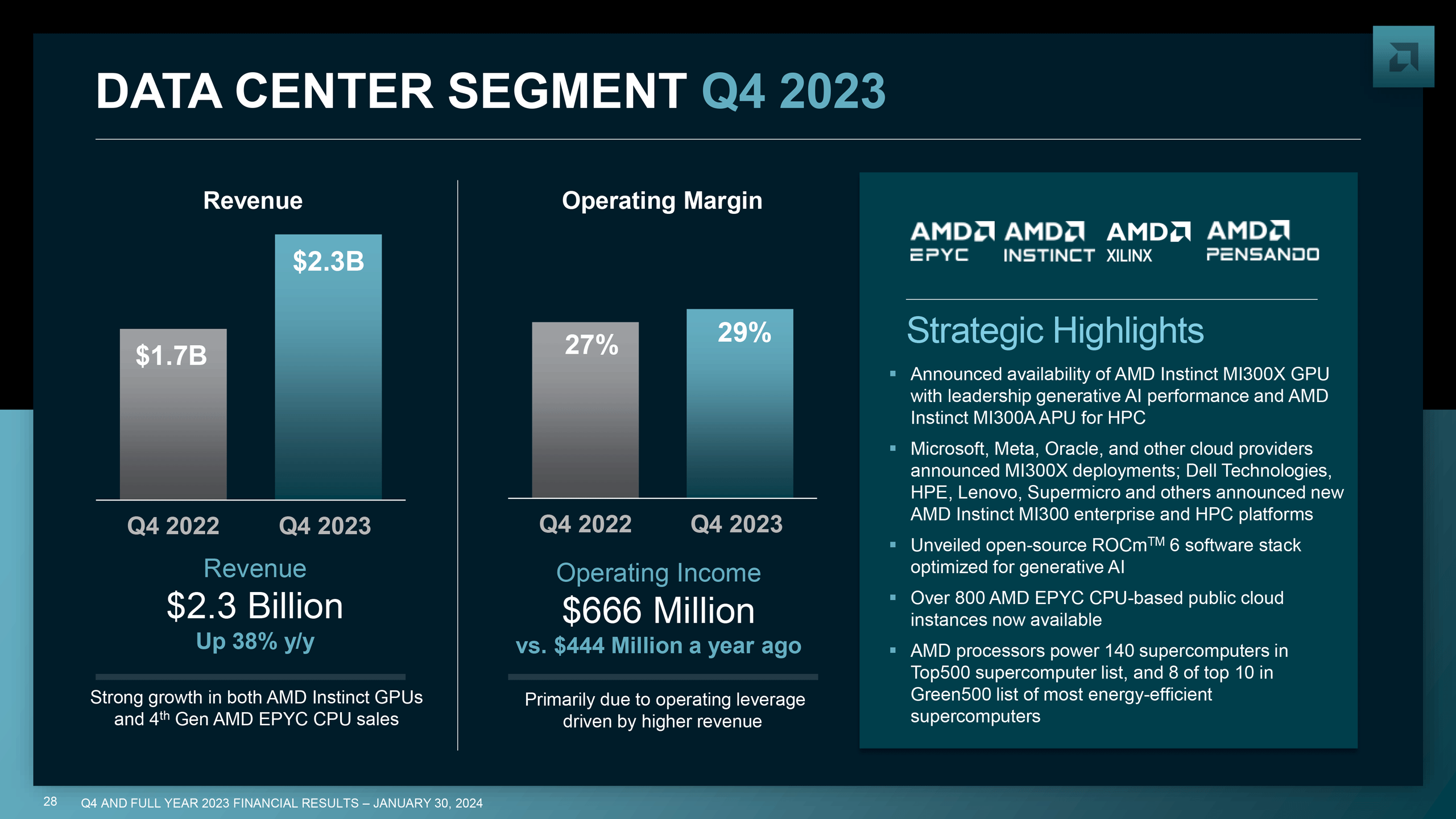

AMD's data center business unit earned $2.282 billion in revenue for Q4 2023 (up 38% YoY) and reported an operating income of $666 million (up 50% YoY) as the company ramped up shipments of its 4th Generation EPYC processors for datacenters and increased shipments of its Instinct GPUs for artificial intelligence and high-performance computing applications. This is the best quarterly result for AMD's data center business ever, though we should keep in mind that the results of this unit now include sales of Pensando hardware.

As for the whole year, net revenue of AMD's datacenter division amounted to $6.496 billion, up 7% year-over-year, which makes it the best year for the business unit. Meanwhile, operating income of the division dropped 31% to $1.267 billion.

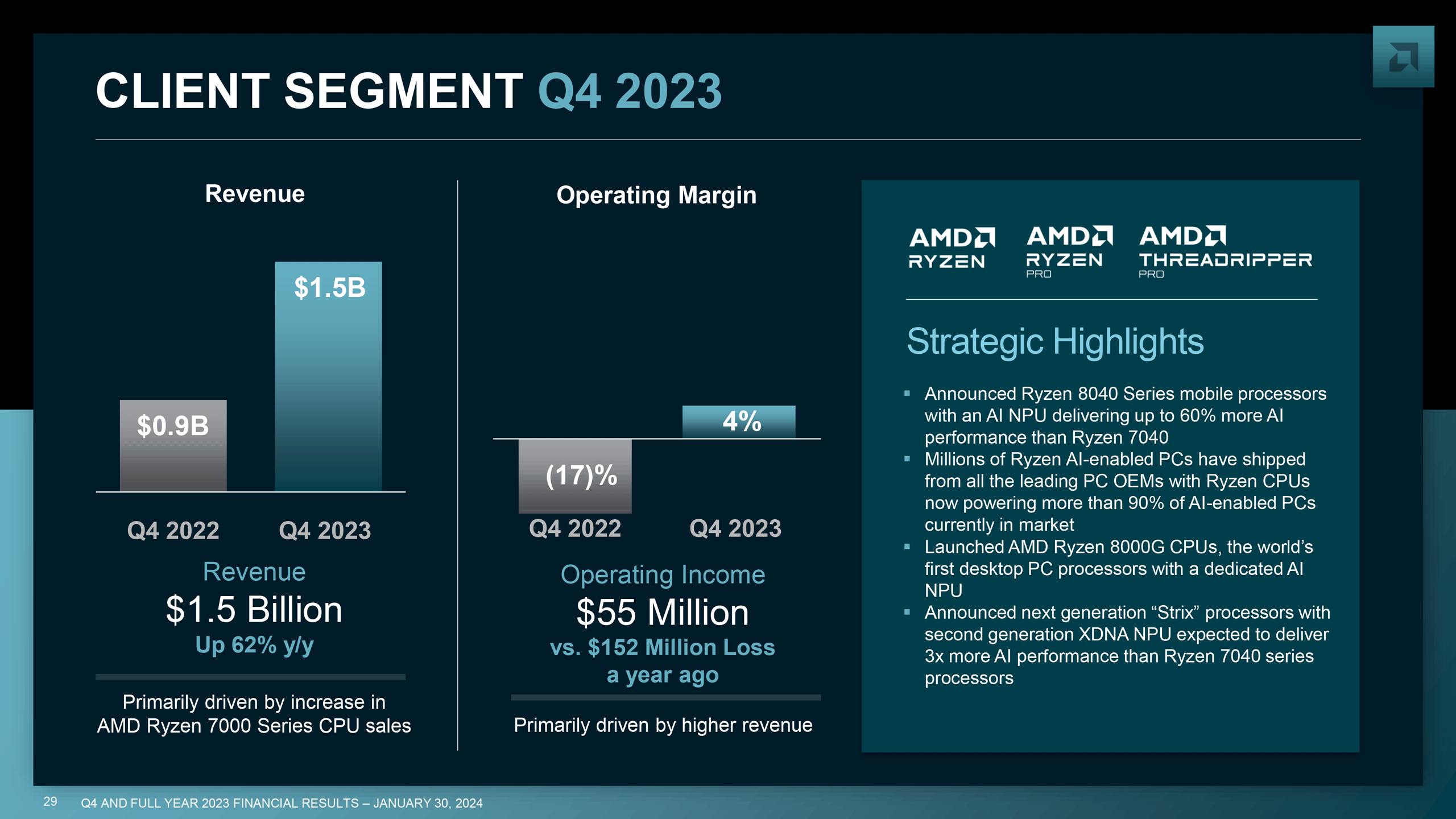

Sales of Client Platforms Decline, But Show Signs of Recovery

As far as sales of client platforms are concerned, AMD's client business unit managed to increase its Q4 2024 revenue to $1.461 billion, up 62% year-over-year as the PC market began to recover and AMD succeeded in boosting sales of its latest Zen 4-based Ryzen 7000-series processors. The business unit earned $55 million in operating income, up 136% YoY.

Yet, since the PC market was weak last year, AMD's client PC business declined by 25% year-over-year to $4.651 billion and lost $46 million for the whole year, which is a dramatic change as the firm's client PC unit's operating income was $1.19 billion in 2022.

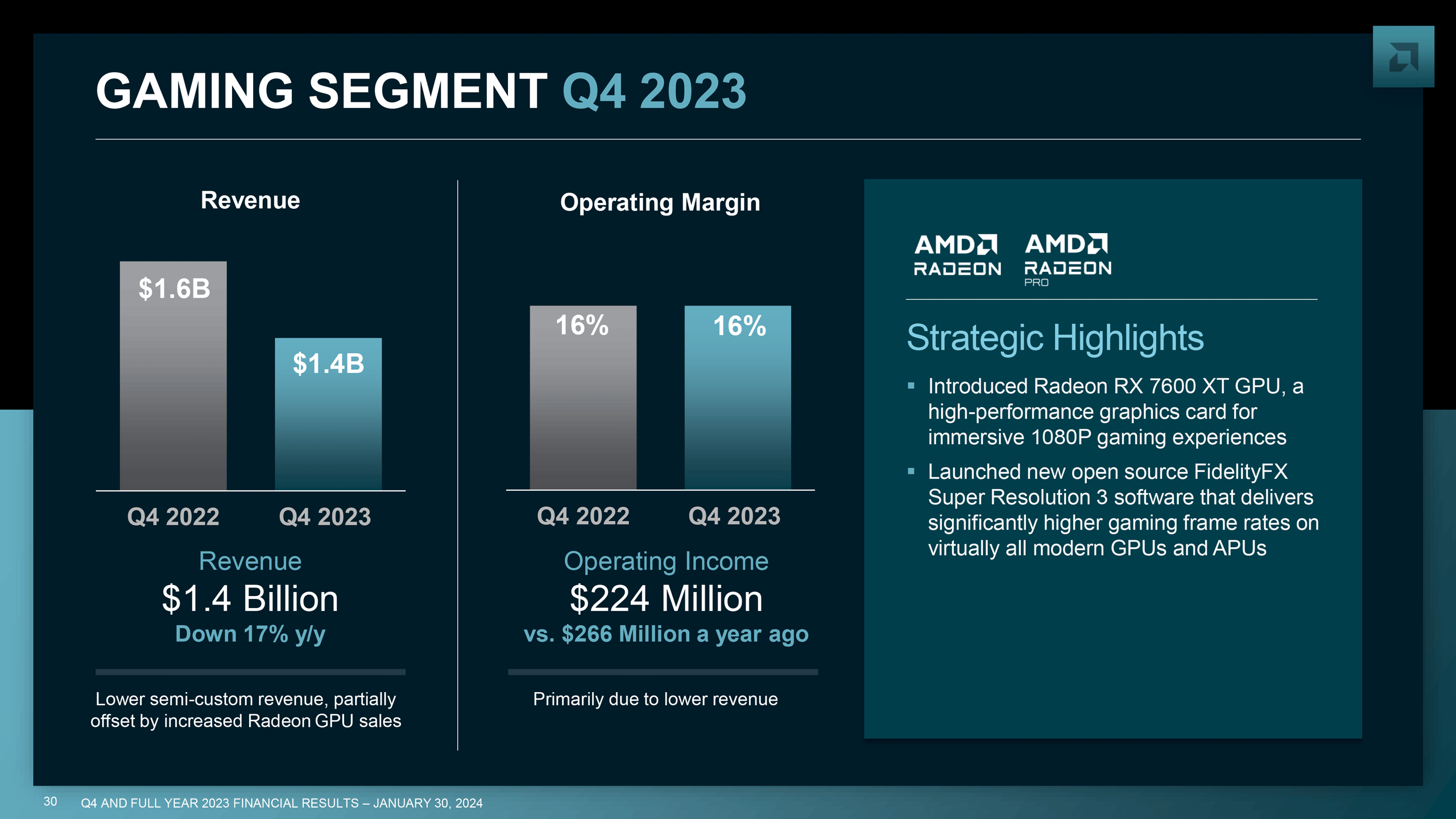

Gaming Segment

AMD's gaming hardware business unit — which sells discrete Radeon graphics processors and system-on-chips for consoles — earned $1.368 billion for the fourth quarter of 2023, down 17% compared to the same quarter a year ago, while its operating income decreased to $224 million. AMD says that while sales of its Radeon GPUs increased, sales of game console SoCs declined.

For the whole year, the gaming hardware business unit earned $6.212 billion in revenue, down 9% YoY, and its operating income reached $971 million, up 2% YoY. Again, AMD attributes these revenue declines to decreasing sales of its processors for consoles, which have to get cheaper every year. Nonetheless, AMD's gaming unit was the company's second-largest business.

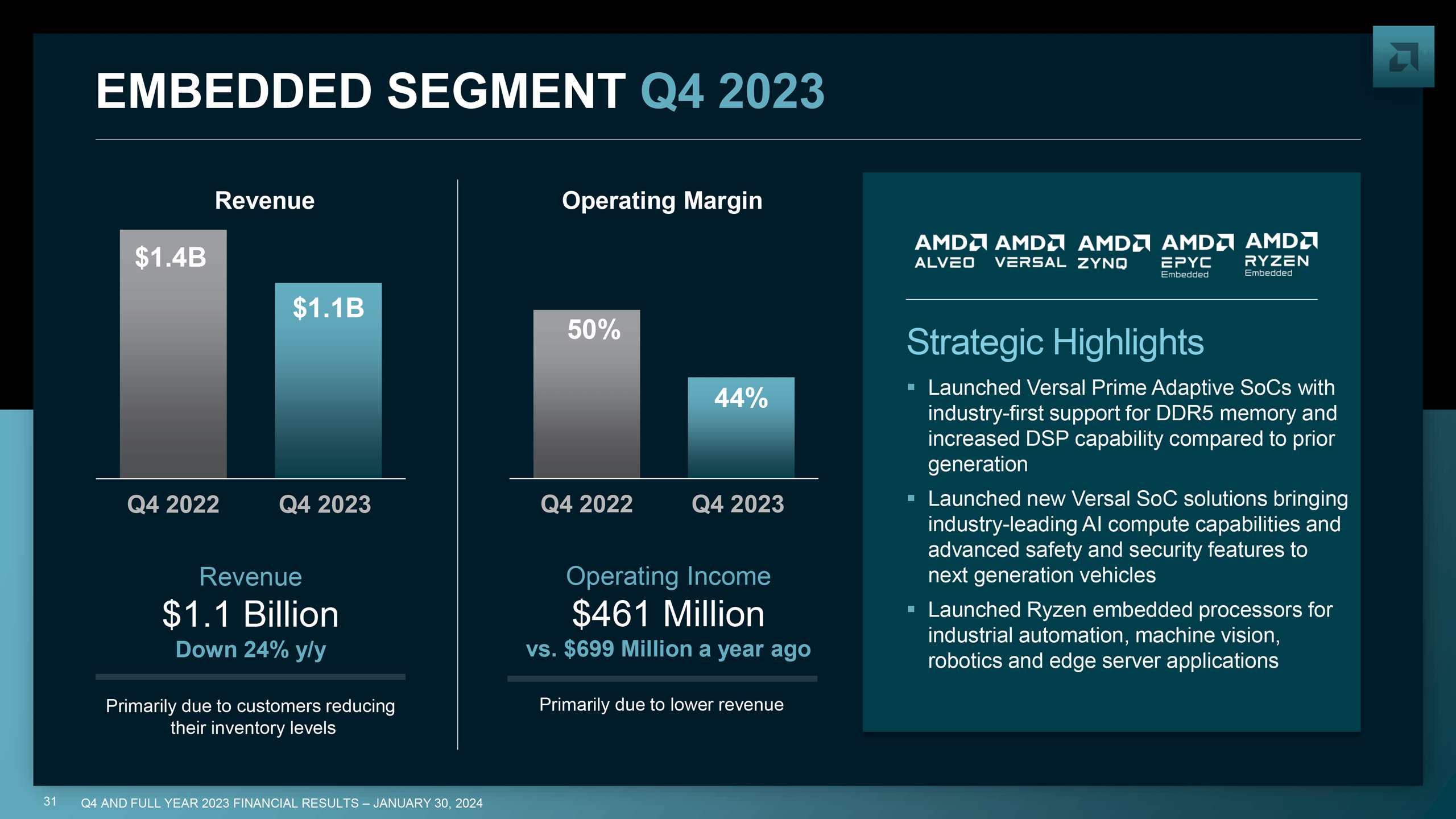

Embedded Segment

The revenue from AMD's embedded segment amounted to $1.057 billion, a decrease of 24% from the previous year, largely as a result of customers decreasing their stock levels, according to AMD. Yet, the unit remained profitable and earned $461 million in net income.

As for the whole year, the revenue for the embedded segment reached $5.3 billion, marking a 17% increase from the previous year. This growth was chiefly attributed to the full-year contribution of revenues from the acquisition of Xilinx, which was finalized in February 2022. For the whole year the unit earned $2.628 billion, up 17% from the previous year.

Outlook

While, in general, AMD's results look good and predictable, the company provided a rather conservative outlook for the first quarter.

AMD anticipates its revenue for the first quarter of 2024 to be around $5.4 billion ± $300 million. The company forecasts that its data center segment revenue will remain flat compared to the previous quarter, as a seasonal dip in server sales is likely to be offset by a robust increase in AI and HPC GPU sales, namely the Instinct MI300-series products.

Meanwhile, revenues from the client, embedded, and gaming segments are projected to decrease sequentially. In particular, revenue from semi-custom products (which mainly consist of console SoCs) is expected to experience a substantial double-digit percentage drop.