AMC Entertainment (AMC) shares started Friday trading off as much as 12%, partly as the broad equity market opened lower following the stronger-than-expected jobs report from July.

But the theater chain's earnings were the main culprit. The company issued a better-than-expected report but still posted a loss of 20 cents per share. Revenue of $1.16 billion was essentially in line with expectations.

And the company’s special dividend stole the headlines. The Leawood, Kan., company declared a payout of one AMC preferred-equity unit — called Ape units — for each Class A common share.

AMC seeks to list the preferred shares on the New York Stock Exchange under the ticker symbol APE. The symbol is a nod to the retail investors who follow the stock and call themselves "apes."

The rise in AMC stock could be giving a boost to videogame retailer GameStop (GME), which has turned positive on the day, while another short-squeeze favorite, home-goods retailer Bed Bath & Beyond (BBBY) is up almost 30%.

So has the show at AMC Entertainment just starting?

Trading AMC Stock

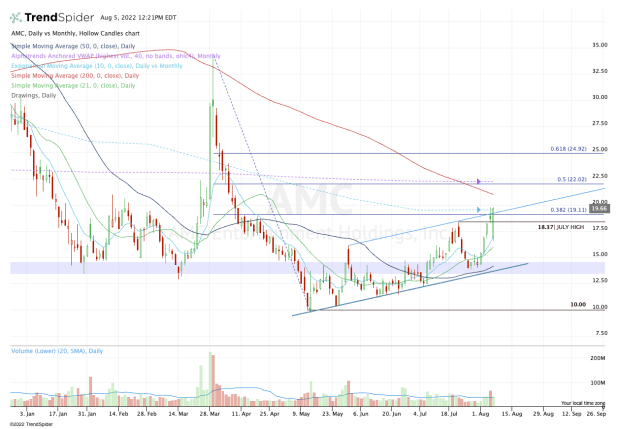

Chart courtesy of TrendSpider.com

AMC stock is putting together an impressive trading session. The shares gapped down to the 10-day moving average and immediately began to rally. Not only that: They also traded back up through the July high, keeping a monthly-up rotation in play.

Now, though, the shares face an important level. If AMC stock can close above $19.75, they head above the 10-month moving average, channel resistance and yesterday’s high.

If the stock can do that, AMC could potentially push up toward the $22 level.

To get there, it will also need to clear the 200-day moving average. If it can, the $22 level has the monthly VWAP measure and the 50% retracement. Above that opens the door toward $25.

While some fundamental investors may be bothered by the company’s “Ape shares” or believe the stock is overvalued, it’s hard to deny the bullish price action at the moment.

On the flip side, keep an eye on the $19.11 and the $18.37 levels. Losing these levels would put AMC stock below the 10-month moving average and channel resistance, as well as the July high and the 38.2% retracement.

From a technical perspective, it would deal the bulls a sharp blow, even though AMC will still be above the post-earnings low of $16.50 and the 10-day moving average.

If it loses these marks, $15 and the 50-day may be next.