When Amazon launched in 1995, founder Jeff Bezos had a fairly modest goal. He wanted to disrupt the book-selling business. Bookstores, by their very nature, were inefficient because customers were encouraged to browse, handle the merchandise, and linger in stores without spending any actual money.

Amazon (AMZN) -), by getting rid of the brick-and-mortar store, lowered costs and decimated the industry. Two major bookstore chains Borders Books and Waldenbooks closed while the remaining industry titan, Barnes & Noble, got smaller and was at times at risk of going under itself.

Related: Retail-theft expert has an answer for Walmart, Target and Kroger

Bookstores were (and the remaining ones still are) generally popular with their customers. Most people who work in or operate bookstores have a passion for books and want to share that with customers. Despite that, Amazon's convenience and pricing put thousands of physical bookstores out of business.

While shopping in a bookstore is genuinely pleasant, the same can't be said of buying a car through the traditional car dealer system.

"87% of American adults dislike something about the process of purchasing a vehicle at a traditional car dealership," according to a survey of 2,135 Americans over the age of 18.

That's a situation that a lot of companies have tried to fix and Amazon has decided to throw its hat in the ring by creating an online marketplace for cars in partnership with Hyundai (HYMTF) -).

Image source: Getty Images

What is Amazon trying to do?

While Carvana (CVNA) -) and other companies have sold used cars online, Amazon's partnership with Hyundai will allow it to sell new cars as well as used ones. The partnership, however, goes beyond just selling cars.

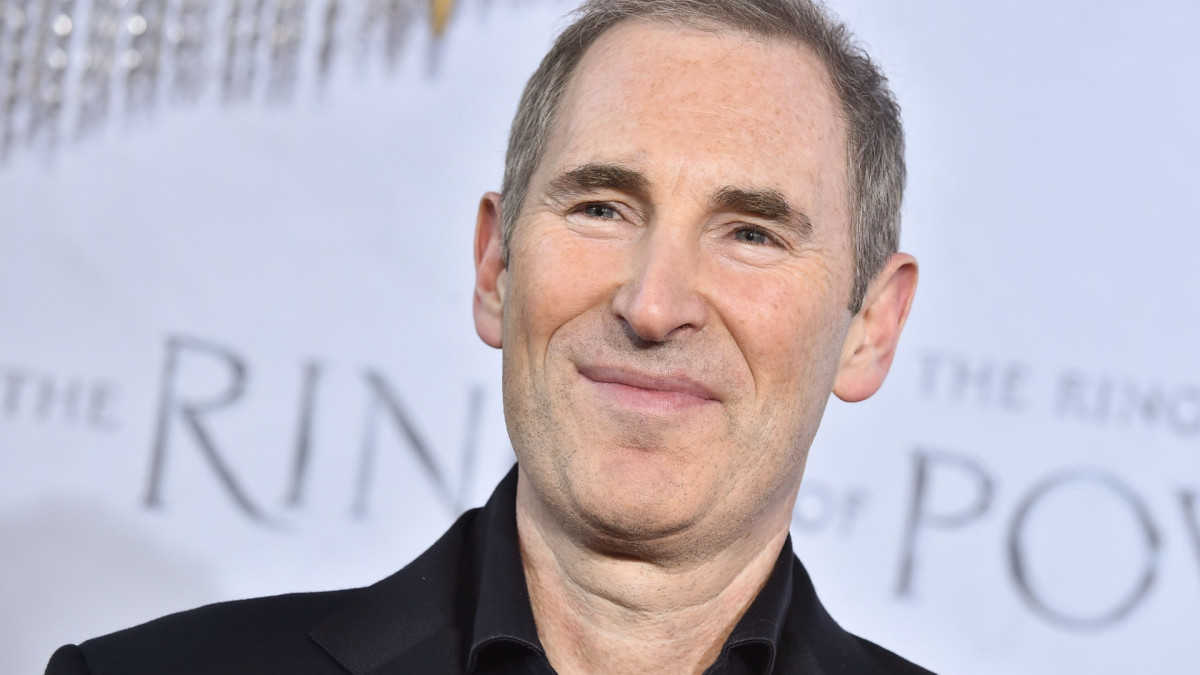

"In 2024, auto dealers for the first time will be able to sell vehicles in Amazon’s U.S. store, and Hyundai will be the first brand available for customers to purchase," Amazon CEO Andy Jassy shared in a blog post. "This new digital shopping experience will make it easy for customers to purchase a new car online, and then pick it up or have it delivered by their local dealership at a time that works best for them."

This will bring the car-buying process online and skip the traditional negotiation process, but it won't actually take the dealer out of things. Amazon won't be selling directly from the manufacturer. Instead, it will give Hyundai customers a friction-free way to buy from the company and offer Amazon customers access to used cars.

Diana Lee, the CEO of Constellation, a global SaaS company with a proprietary marketing compliance technology working with most of the biggest car companies, answered questions about the impact of the move in an email interview with TheStreet.

ALSO READ:

- The best Black Friday and Cyber Monday deals for gamers on Amazon

- The tiny Keurig shoppers call 'the best coffee brewer' is just $50 for Black Friday

- This Oprah-Favorite Carry-On Is Finally Under $100 for Amazon Black Friday

Amazon tries to disrupt car sales (sort of)

TheStreet: What cars will Amazon be able to sell?

Lee: Amazon has the potential to sell new Hyundai vehicles, as well as used and certified pre-owned (CPO) Hyundais. Additionally, they can offer used and CPO vehicles from various other makes and models.

TheStreet: Does this blow up the current dealer model?

Lee: Amazon is unable to disrupt the current traditional model for selling new cars, where dealer franchises of original equipment manufacturers (OEMs) handle the sales. The existing franchise agreements in the US prohibit the direct sale of new cars through non-dealer-owned, direct-to-consumer platforms. Dealers are responsible for owning their inventory and must operate within the confines of their franchise agreements.

TheStreet: Will this end the days of "I have to talk to my manager" negotiating?

Lee: By adopting a direct pricing model, Amazon could eliminate the need for negotiations and the phrase "I need to speak to my manager" when it comes to used vehicles.

TheStreet: Will this create price transparency for consumers?

Lee: Amazon's involvement could lead to increased price transparency, with vehicles listed at a fixed price and reduced need for negotiations in the future.

TheStreet: What barriers remain for Amazon?

Lee: The primary obstacle lies in the franchise agreements prevalent in the U.S. Unless OEMs engage in direct negotiations with Amazon regarding pricing and agreement structure, dealers will not be permitted to sell new cars through the Amazon platform. Most OEMs are currently hesitant to devalue their brand by allowing franchisees to engage in price competition on platforms like Amazon, where new cars can be sold below invoice, affecting profit margins and brand value.

TheStreet: Will Tesla sell through Amazon?

Lee: Tesla, with its existing one-price structure that doesn't involve negotiations, could potentially sell through Amazon. However, they may choose not to do so in order to maintain control over the platform through which all their new cars are purchased.