Coming into Amazon's (AMZN) earnings report, the shares have been the clear laggard within the FAANG group. Investors' reactions, however, have varied widely.

Netflix (NFLX) plunged on its results, falling more than 20% the day after reporting and 30% over the next two days.

Then Apple (AAPL) steadied the ship with its strong post-earnings reaction, while Alphabet (GOOGL) (GOOG) fired to all-time highs on its results.

Alphabet's declaration of a 20-for-1 split even stirred up speculation as to whether Amazon would split its stock as well.

With Meta’s (MVRS) 25%-plus post-earnings fall, though, there’s simply no way to know how Amazon will fare (Here's some guesses).

Amazon shares are down more than 6% on Thursday and are now down on the week despite a nice rally in the prior few days. The stock is down in five of the past six weeks and is working on its third straight monthly decline (although it’s early in the month).

Now we have to wonder: Does Amazon get an Alphabet-like reaction to earnings that sends it higher or a Meta-like reaction that sends it lower?

Trading Amazon Stock

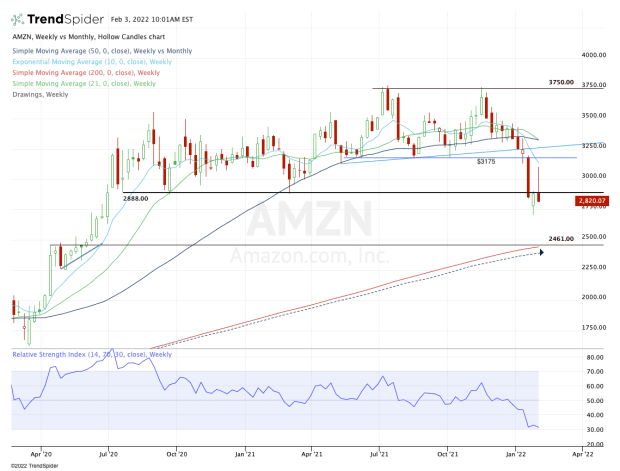

Chart courtesy of TrendSpider.com

It was not that long ago -- in November -- that Amazon stock was trying to break out to new highs. In reality, this stock has been range-bound between $2,880 on the downside and $3,500 on the upside.

When it did clear $3,500, Amazon was able to rally to $3,750, but that’s where the good fortune ended (and it did so more than once).

After uptrend trend support failed and Amazon broke below $3,175, it put range support back in play near $2,880, a level it hadn’t tested in almost a year.

Unfortunately, the stock broke below this measure and then was rejected by it in the following week.

The charts are not all that inspiring, but we’ll see if the earnings report can change that sentiment.

Obviously, $2,880 is key and how the stock closes this week in relation to that level will be noteworthy. But given the ranges we’re seeing, we have to look beyond that level.

On the downside, if Amazon breaks last week’s low near $2,700, it could open the door down to the $2,500 area. Just below this zone we have all sorts of key measures to watch.

There’s the 200-week and 50-month moving averages, as well as the prior breakout zone in the $2,450 to $2,500 area.

If Amazon ends up falling that far, I would expect this zone to act as support.

On the upside, let’s see whether the shares can reclaim $3,000 and this week’s high near $3,100.

Above $3,175 and we could see a test of the 21-week and 50-week moving averages.