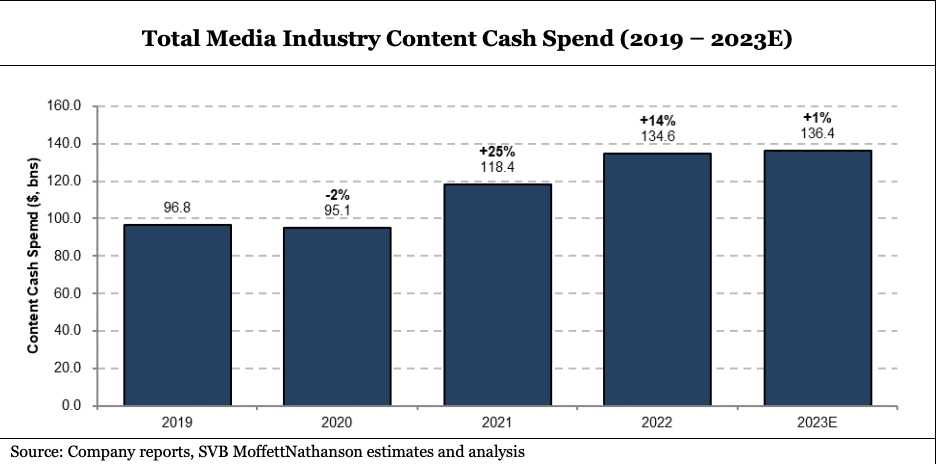

After exceeding 25% year-over-year growth during the peak year of the “Streaming Wars,” media spending on video content will grow by just 1% in 2023, writes MoffettNathanson's Robert Fishman.

“After two years of strong double-digit content spending growth, we foresee a flattening in 2023,“ the media analyst said. “As more companies shift their focus away from solely subscriber growth, we would expect industry content spending to be relatively flat or even decline in the out years.”

Recent earnings calls from Warner Bros. Discovery, Disney, Comcast and Paramount Global more than underwrite Fishman's thesis in his latest report, “Media Content Spend Post-Streaming Wars.“

These media conglomerates are trying to reign in EBITDA losses on direct-to-consumer streaming, which collectively exceeded $10 billion among them, while maximizing the fading profits on older linear platforms.

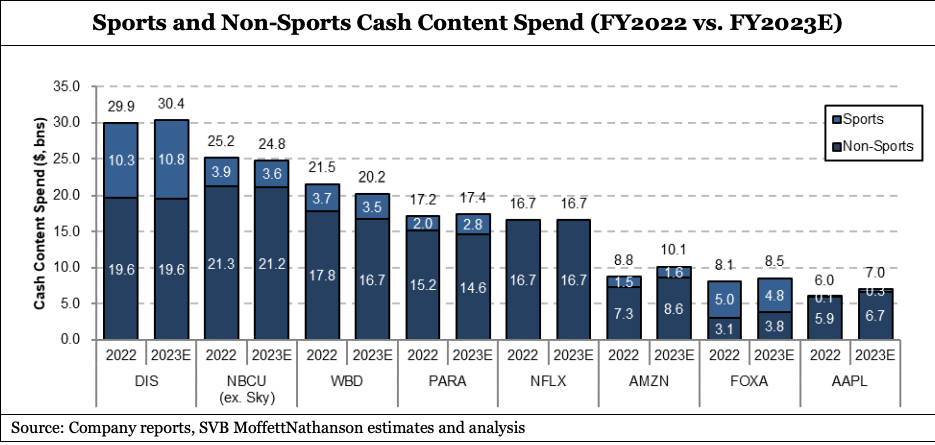

This year, conglomerates including WBD and Comcast NBCUniversal will actually be spending less on content, Fishman's analysis predicts.

“As we now painfully know, money is no longer cheap,” Fishman said. “Wall Street’s attitude towards streaming has now largely reversed course as more skeptics raise the question of whether streaming is a good business (a question we have long been asking). In turn, companies are no longer willing to spend whatever it takes, in part because attitudes and strategies have shifted and rationalized, but also because their balance sheets no longer have what it takes.”

The streaming party may be over, with Fishman identifying Amazon Prime Video’s half-billion-budget for its Lord of the Rings: Rings of Power as the ”peak of the bubble” in terms of DTC content spent.

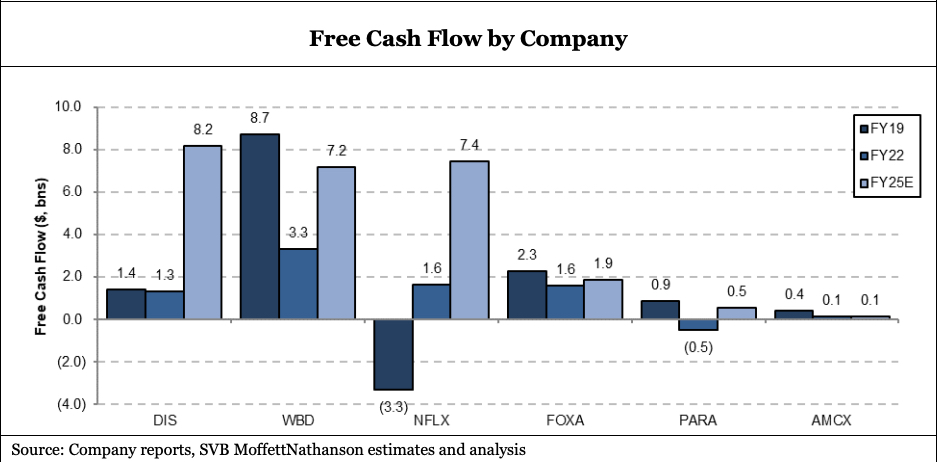

Fishman sees most of the major media conglomerates recapturing a level of free cash flow they had before they started spending freely on DTC, with some media companies relying on their linear platforms (WBD among them) more than others to accomplish that goal. ■