/Amazon%20-%20Image%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Amazon, Inc. (AMZN) stock is deeply depressed after last week's tumble. It means both at-the-money (ATM) and out-of-the-money (OTM)put options now have high yields. That provides a great potential buy-in point for value investors, while also getting paid to wait.

AMZN closed at $198.79 on Friday, Feb. 13, 2026. This is down 10.7% from $222.69 on Feb. 5, just before its after-market Q4 earnings release.

But, its one-year low is between $167.32 and $170.66 from April 8, 2025, to April 21. If AMZN were to fall to that trough range, it could mean another 14% to 16% drop.

That possibility is pushing put options premiums very high. This provides a great opportunity for value investors.

Shorting ATM and ITM Puts in AMZN

ATM Puts. Investors who want to buy AMZN stock at Friday's low price may consider selling short at-the-money (ATM) put options that expire in one month.

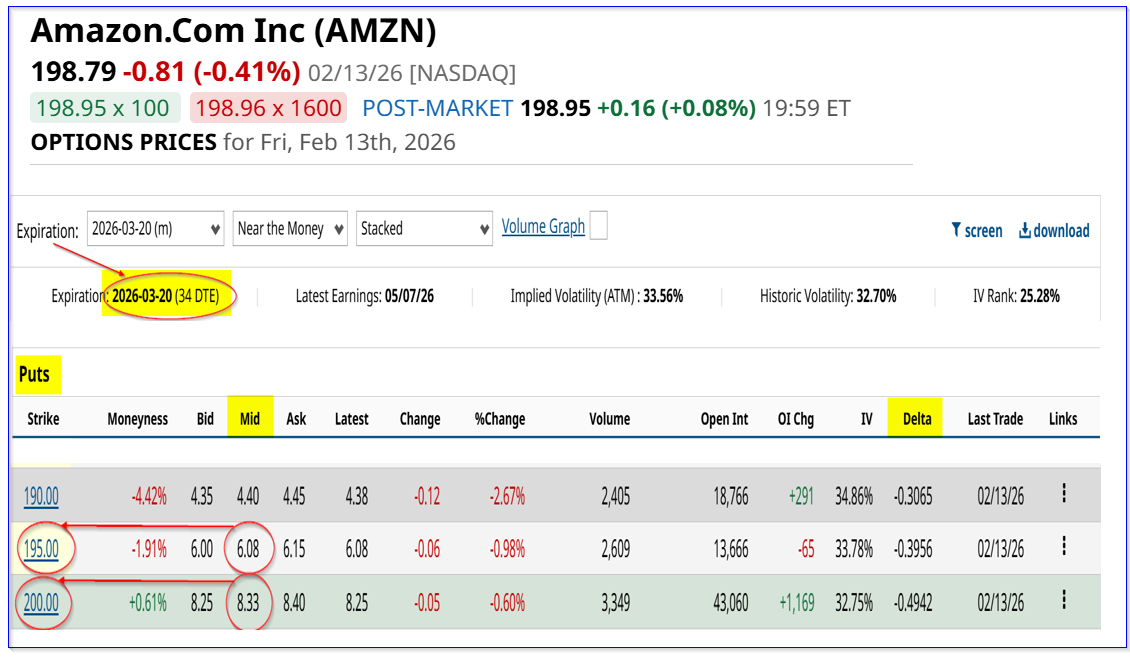

For example, look at the March 20, 2026, option expiration period, 34 days to expiry (DTE).

It shows that the $200.00 put option has a $8.33 midpoint premium. That provides an investor with an immediate yield of 4.165% over the next month (i.e., $8.33/$200.00).

However, a more conservative play is this: sell the $200 put and use the premium to buy the $195 put for the same period. That protects against any downside and still provides income.

For example, here is how that works:

$8.33 put income ($200 strike) - $6.08 put cost ($195 strike) = $2.25 net credit

$2.25 / $200.00 invested = 0.01125 = 1.125% yield over the next month

So, for example, if AMZN closes at $170 on March 20, here are the results:

$200 short put exercised = $170 - $200 = $30 unrealized loss

$195.00 put purchase = $195-$170 = $25 realized gain

Net premium credit: $8.33- $6.08 = $2.25 realized net income

Net Result: $25+2.25-$30 = -$2.75 net loss

That is less than 1.4% of the $200 net investment (i.e., -1.375%) and represents the worst that could happen if AMZN falls to $170 over the next month. Meanwhile, the investor still owns 100 shares of AMZN stock at a low buy-in cost of $200, and $197.75 ($200 - $2.25) on a breakeven basis.

Similarly, an investor could short the $195 put for $6.08, buy the $190 put for $4.40 (for a net income of $1.68 or 0.86% yield). If AMZN closes at $170 on March 20, the net loss is just $3.32, or just 1.70% of the $195.00 cost.

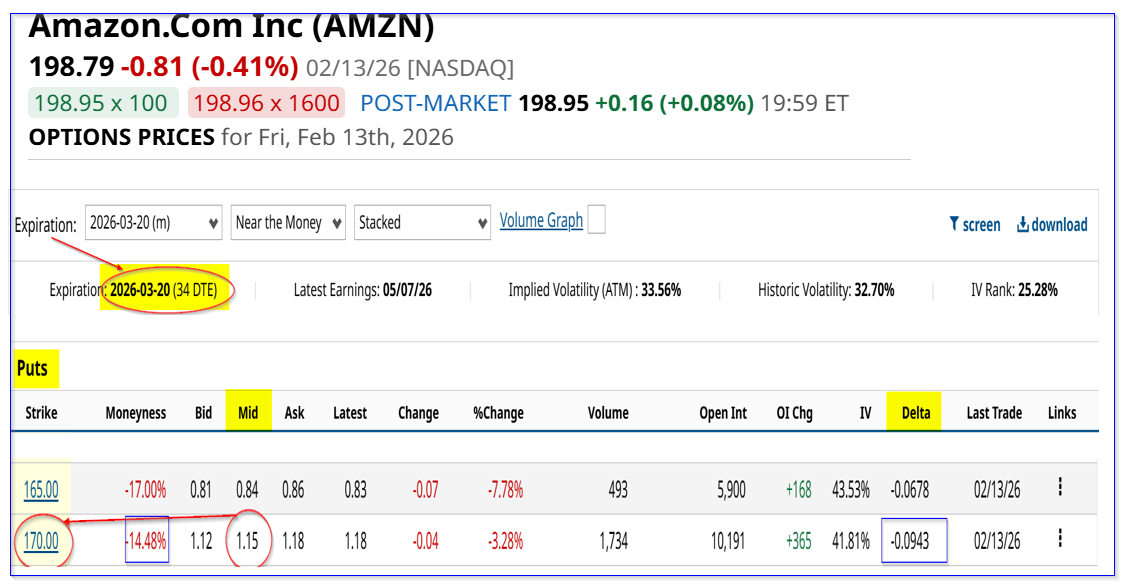

OTM Puts. Another way to do this is to short deep out-of-the-money (OTM) puts. For example, the $170 puts expiring March 20, 2026, almost 15% lower, have a midpoint premium of $1.15.

That provides an investor with an immediate yield of 0.6765% (i.e., $1.15/$170) over the next month. Meanwhile, even if AMZN closes at $170, the investor has a lower breakeven buy-in point of $168.85 ($170-$1.15), which is 15.0% lower than Friday's close.

So, which is the better play? Let's look at the expected returns (ER).

Expected Returns (ER)

Let's say there is just a 40% chance that AMZN hits $170 in one month. That means there is a 60% chance it could be higher than that.

That implies there is a 60% chance it stays at today's price, or roughly $200.

Here is the expected return (ER) for the ATM play:

$170: 0.40 x -($2.75/$200) = $0.40 x -1.375% = -0.55%

$200: 0.60 x $0 capital loss +$2.25/$200 = 0.60 x 1.125% yield = 0.675%

So, the expected return (ER) is: -0.55% + 0.675% = 0.125% over the next month.

However, the one-month yield from the $170 OTM short-put play is higher: 0.6765%. So, its expected return is better than the conservative ATM play above.

The bottom line here is that, given Amazon's high put option yields, it makes sense to short out-of-the-money (OTM) puts with strike prices almost 15% below today's price.