A new report by Antenna revealed that consumers are increasingly gravitating towards specialized streaming services.

According to the research company, nearly a third of SVOD customers transacted with a specialty SVOD platform by the end of the second quarter.

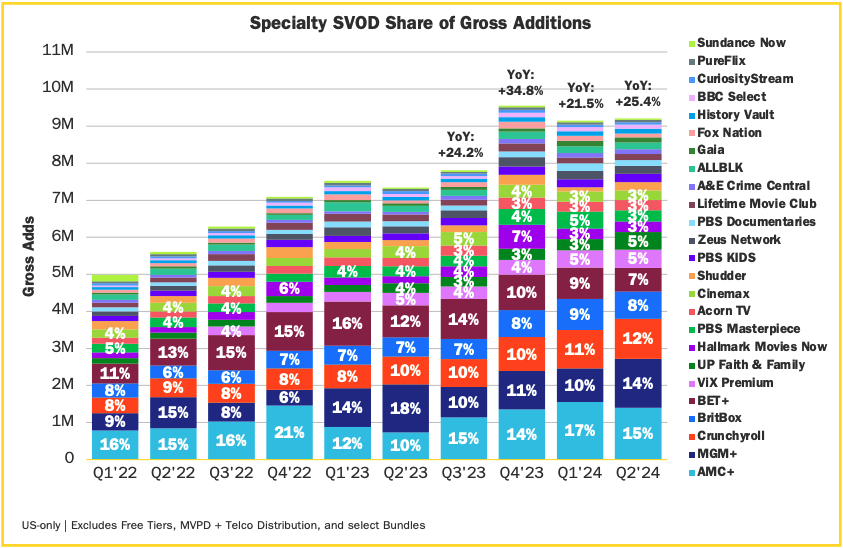

Specialty SVOD services include AMC+, MGM+, PBS Kids, PBS Documentaries, PBS Masterpiece, Puireflix, Sundance Now, Crunchyroll, BET+, BBC Select and many more.

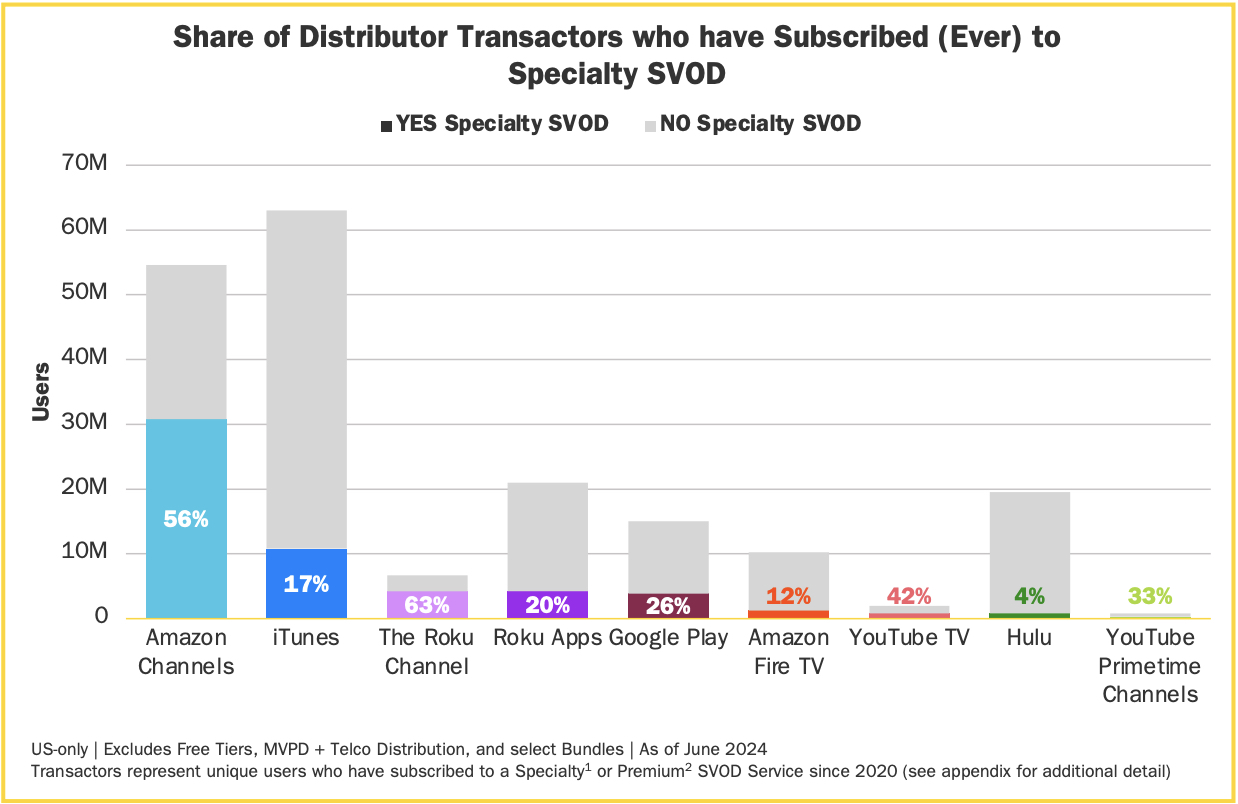

Antenna found that 58% of sign-ups to those niche services were generated through Amazon Prime Video Channels, the digital store that allows customers to shop for individual titles as well as purchase new streaming subscriptions.

While other distributors, including Apple, have recently gained some footholds in the market, Amazon continues to dominate new specialty SVOD sign-ups.

According to Antenna, 30.8 million (56%) of Amazon Prime Video subscribers who have used Prime Video Channels have at some point subscribed to a specialty SVOD.

iTunes, which trails Amazon in terms of converted customers, is the only other distributor to see more than 10 million users try specialty SVOD.

That’s likely due to how easy Amazon has made it for specialty SVODs, who traditionally rely more heavily on third party distributors to secure viewership, to be discovered and purchased by new customers.

In return, Prime Video Channels saw 3.1 million specialty SVOD subscription adds, year-over-year.

That’s significantly better than the 2.6 million collective additions earned by all of Amazon’s competitors.

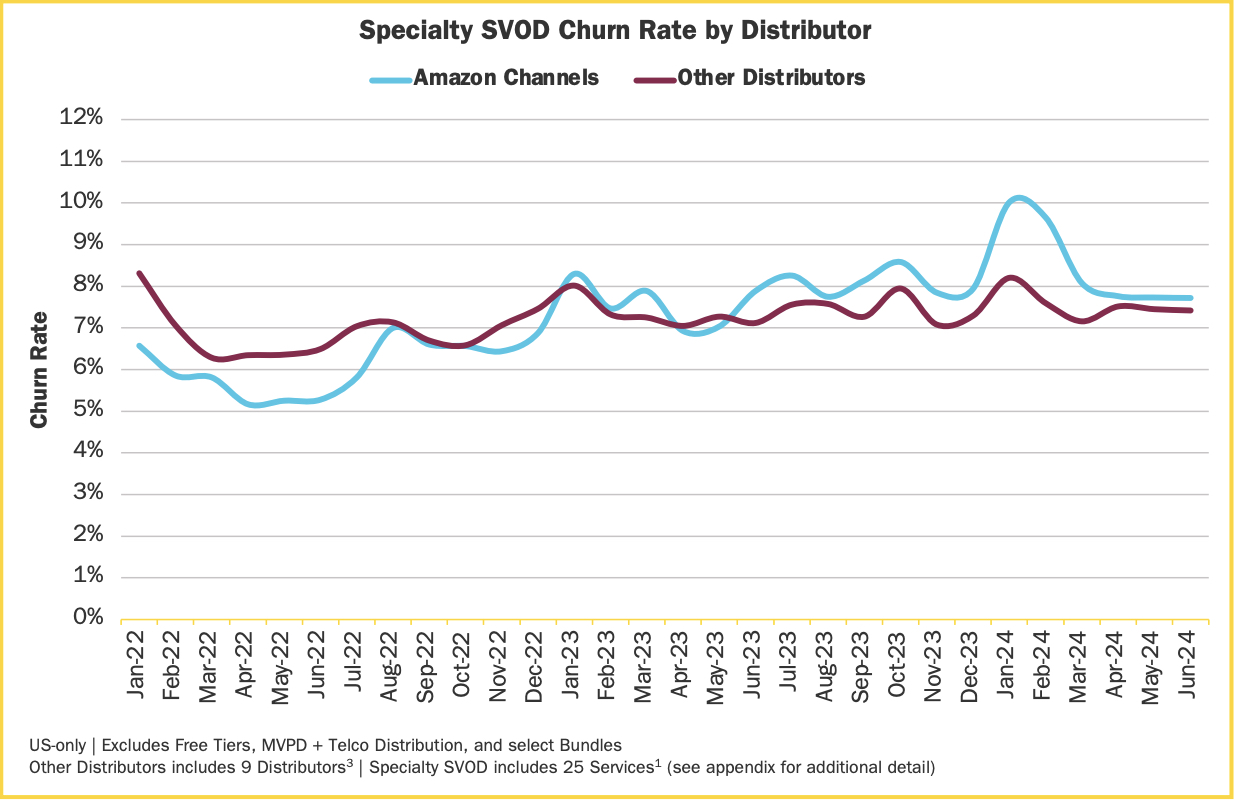

And despite Amazon’s higher rate of specialty SVOD additions, the churn profile on Amazon Channels is similar to that of other distributors, with a 7.7% churn rate at the end of Q2.

Though churn continues to be a problem for specialty SVOD, viewers who subscribe through Amazon’s Channels are just as likely to retain their membership.

The data shows that, compared to its streaming competitors, Prime Video excels at steering customers towards its specialty streaming partners and keeping them there.

And that’s notable, considering the growth of specialty SVOD has, in recent years, begun to outpace the growth of premium SVOD, admittedly off a smaller customer base.

In 2022, there were 24 million gross subscriber additions to SVOD platforms, followed by 32.3 million in 2023 and now 18.4 million in the first half of 2024.

According to Antenna, it’s because consumers increasingly crave a broader set of streaming options as they continue to cut the cord to traditional TV.

“As the largest premium streamers focus on profitability, they are deploying ‘fewer, bigger’ programming strategies which focus on shows that appeal to the masses,” wrote Antenna’s co-founder, Jonathan Carson. “This leaves an opening for specialty players who have a tight focus on a specific genre or audience.”

According to Antenna, the greatest challenge for specialty SVOD services will be to create committed customers, which the analytics firm suggests would be best achieved through bundling.

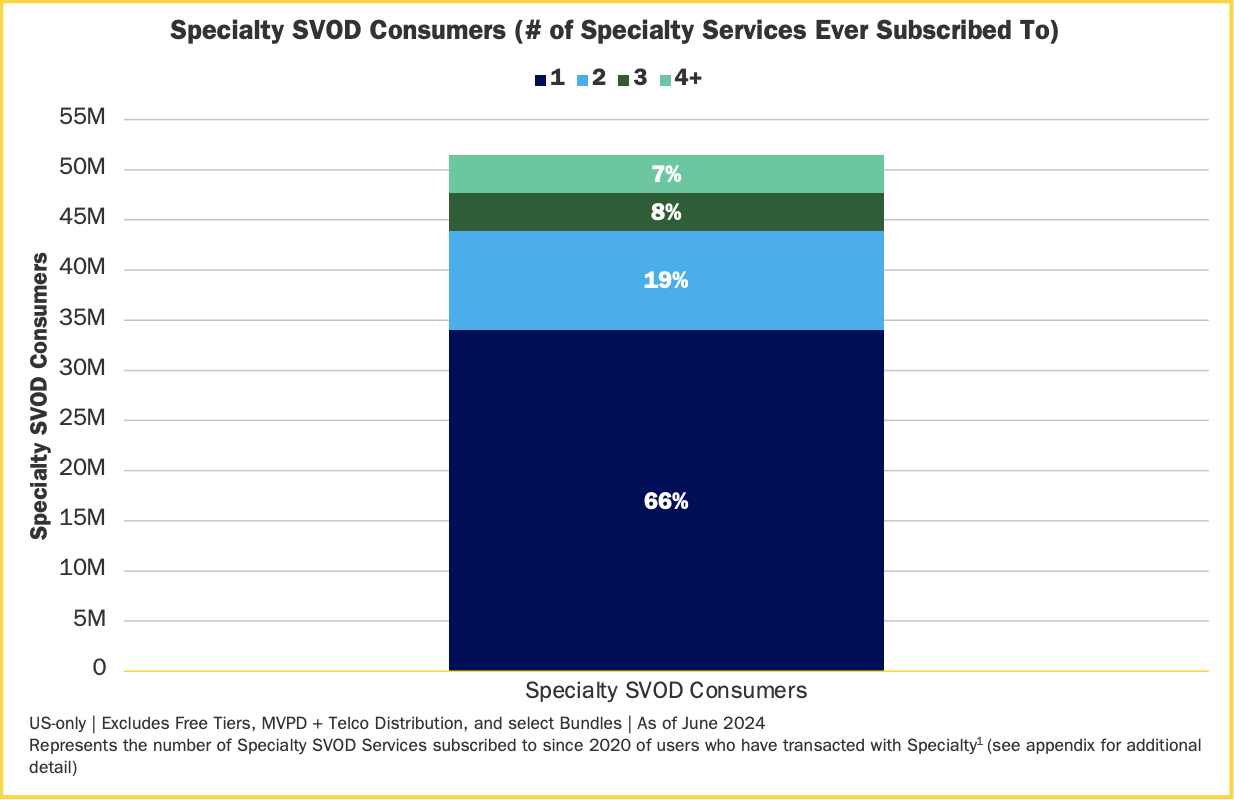

Antenna’s data shows that currently, two thirds of specialty SVOD subscribers have just one niche service, while only 19% have subscribed to two services, 8% have subscribed to three services and 6% have subscribed to more than four niche platforms.