Megacap tech has been a huge driver for the S&P 500 this year. In fact, just a handful of names are responsible for a big chunk of the market’s gains — including Alphabet (GOOGL) (GOOG).

Yet, while the shares are up 23% in 2023, it’s the second-worst performer in the FAANG group.

Meta (META) is the top performer, up 94% or about triple the next best performer, which is Apple (AAPL).

Only Netflix (NFLX) lags Alphabet’s year-to-date gains, up 13%. And Alphabet has the worst one-year performance of the group, down about 4% over the past 12 months.

The same observation holds true -- meaning Alphabet stock is the worst performer on the one-year measure and second-worst on the year-to-date measure — when we include Nvidia (NVDA) and Microsoft (MSFT).

Don't Miss: Chip Stocks Are a Leading Indicator; Here's What They're Saying Now

So where does this leave Alphabet?

Investors clearly aren’t snapping up the stock, even though it beat earnings and revenue expectations and announced a $70 billion buyback. (Investors bought up Apple under similar circumstances.)

It boils down to one simple question: Will Alphabet stock break out and play catch up, or is its relative weakness a sign for investors to avoid it?

The charts are trying to help answer that question now.

Trading Alphabet Stock

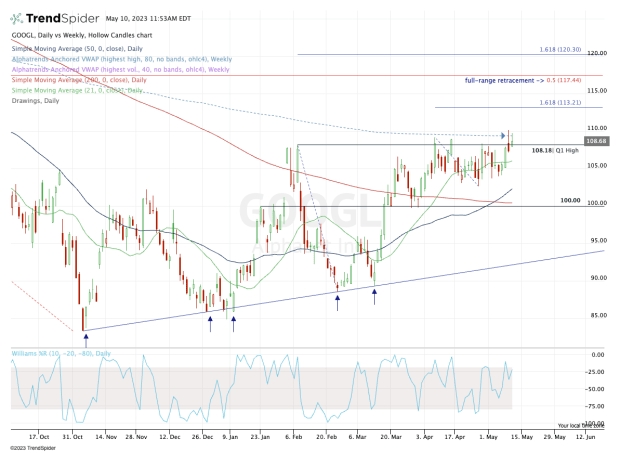

Chart courtesy of TrendSpider.com

Alphabet stock has been consolidating above $100 for about two months. But each rally above the first-quarter high near $108 ends up losing momentum and falling back into the current range.

If the stock is going to break out and play catch up, this is the first big level to clear. It’s been a tricky trade so far, as the stock has made some false breakouts. The shares have closed over the first-quarter high on a daily basis, then went on to fail.

Now, though, the shares are trying to hold above this mark. If they can do so and clear this week’s high of $110.15, the bulls could be looking at a catch-up trade in Alphabet.

Don't Miss: Tyson Foods Stock Is Slumping; Here's Where It Could Find Support

One tricky measure I’m sure most traders are likely missing?

The stock is testing the weekly VWAP measure, a level not tested since August when it acted as stiff resistance to an otherwise pretty clean-looking setup.

Will that be the case again? I don’t know, but I do know that it’s a key level to keep an eye on going forward.

If Alphabet stock clears this mark, the $113 level is the absolute minimum first upside target for longs. That’s followed by $117.50, then $120.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.