After stocks finished strongly on Tuesday, they're mixed on Wednesday. But Alphabet (GOOGL) (GOOG) stock is clearly trying to rally.

The search, cloud and advertising giant's shares gained more than 4% on Tuesday. And in so doing they reclaimed their 10-day and 21-day moving averages.

But they stopped right at their 50-day.

This left traders in a quandary. Will Alphabet stock be rejected by this key moving average or will it continue higher?

Let's add a catalyst to the latter argument: the Mountain View, Calif., company plans a 20-for-1 stock split on July 18, just 12 days from now.

For what it’s worth, when Amazon's (AMZN) 20-for-1 split was set for June, the shares began to rally seven trading sessions -- 12 days -- ahead of the split. Further, they rallied roughly 25% in that span, although the move came alongside a notable rally in the broader market as well.

Could Alphabet be set for a similar type of move?

I don’t think we’ll see a 20%-plus gain in the coming week, but we could definitely see some upside follow-through.

Trading Alphabet Stock

Chart courtesy of TrendSpider.com

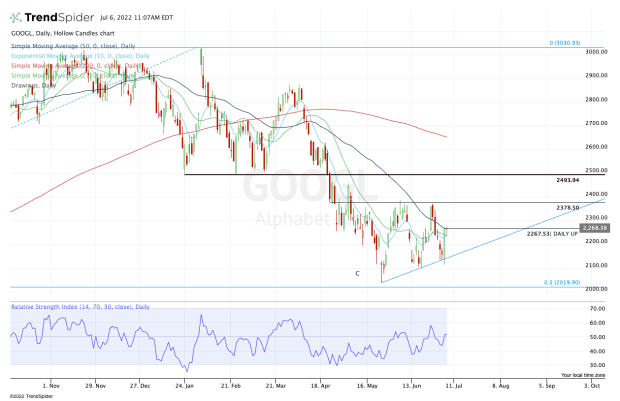

As I look at the chart, yesterday’s rally came at precisely the right time. The market was rolling over and at must-hold support, while Alphabet stock was sitting on uptrend support (blue line).

Support held and the shares pressed higher and closed near the highs of the day. So did the market.

The opening dip was bought on Wednesday morning and now the shares are threatening to rotate over Tuesday’s high.

If Alphabet stock goes daily-up over $2,267.53, it could push up toward $2,300.

But the level I’m truly focused on in that scenario is $2,375. That comes into play near last week’s high, but it’s been resistance for several months now. A rally to that level will make for a nice trade and it creates the potential for even more upside.

The June high sits up near $2,387. If Alphabet stock runs to $2,375, then a monthly-up rotation isn’t that far off. If that triggers, it could open the door to $2,500, which was major support in the first quarter.

A caveat: This is the rosy scenario.

We also must remember that Alphabet is in a downtrend and a bear market, and such a rally may have trouble taking place. That's even as Alphabet and the overall market are due for a bounce and even as the company has a stock split coming up.

On the plus side, Alphabet stock has created a series of higher lows and did not make new lows in June. The broad market, on the other hand, set a series of lower lows.

On the downside, a break of the 10-day and 21-day moving averages suggests caution and increases the odds that the stock retests uptrend support.

A break of uptrend support could put the June low in play near $2,100, followed by the 2022 low near $2,037.