Looking to buy stocks?

If so, you may want to take a gander at this Morningstar list. It what the research firm's analysts consider high-quality stocks that are substantially undervalued and have strong competitive advantages.

The firm defines “high quality” as companies with strong profits and balance sheets. High-quality stocks have registered returns almost twice that of the overall market so far this year, according to Morningstar.

It determines valuation according to its fair-value estimates of companies’ stock prices. And it gives them wide moats, which means Morningstar sees the companies with competitive advantages that will last at least 20 years.

Here are the stocks, in order of valuation as of March 2, starting with the most undervalued. Recent prices are as of March 9.

Alphabet (GOOGL), the Internet search colossus. Morningstar fair value estimate: $154. Recent price: $95.

Teradyne (TER), a semiconductor equipment provider. Morningstar fair value estimate: $167. Recent price: $104.

Veeva Systems (VEEV), a cloud-based software provider. Morningstar fair value estimate: $275. Recent price: $174.

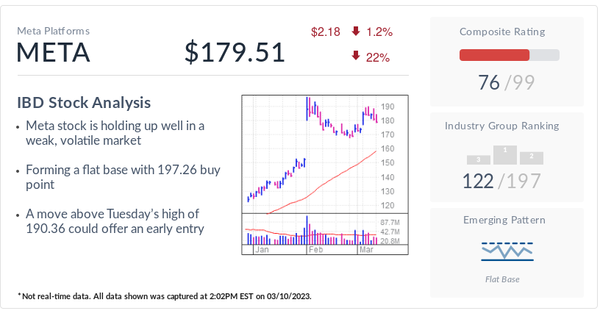

Meta Platforms (META), the social media giant. Morningstar fair value estimate: $260. Recent price: $185.

Lam Research (LRCX), a semiconductor fabrication-tool provider. Morningstar fair value estimate: $620. Recent price: $498.

Adobe (ADBE), the online creative services company. Morningstar fair value estimate: $425. Recent price: $340.

Microsoft (MSFT), the software titan. Morningstar fair value estimate: $310. Recent price: $257.

Pfizer (PFE), the pharmaceutical stalwart. Morningstar fair value estimate: $48. Recent price: $40.

BlackRock (BLK), the world’s biggest money manager. Morningstar fair value estimate: $810. Recent price: $657.

CME Group (CME), the financial exchange. Morningstar fair value estimate: $215. Recent price: $179.

Analyst Commentary on a Few of the Picks

Alphabet: In the fourth quarter, a weak macroeconomic environment hurt the company’s ad business, which represents nearly 80% of revenue, wrote Morningstar analyst Ali Mogharabi.

“However, we are also pleased with continuing strong growth in the subscription and cloud businesses. With less uncertainty about the economy and an increasing focus on cost efficiency, we expect ad-revenue growth to return in the second half of this year, followed by margin expansion in 2024.”

Lam Research: “The firm is the leader in dry etch, a critical step in the chipmaking process where material is selectively removed,” writes Morningstar analyst Abhinav Davuluri.

“Lam's leadership position creates scale advantages that fuel research and development spending at levels only Applied Materials (AMAT) and Tokyo Electron (TOELY) can match.”

To be sure, he believes Lam’s next several quarters will be “challenging.” But, “we expect Lam to return to healthy growth in 2024.”

Meta: “It reported better-than-expected fourth-quarter results, despite currency headwinds, macro uncertainty, and deceleration in overall digital advertising growth,” Mogharabi wrote.

“Meta also appears to have improved ad conversions on its apps and measurability…. On the user front, the firm’s network effect remains intact, displayed by daily and monthly user growth.”

Further, “we are pleased with management’s effort to exert cost control while accelerating top-line growth,” he said.

CME: “It has a dominant position in many of the contracts that trade in its exchange and is well diversified across multiple product lines,” wrote Morningstar analyst Michael Miller.

“In the long term, we anticipate that the company will continue to benefit from secular growth in the need to hedge commodity, energy, and interest rate exposure. CME also has a history of generating incremental growth through the introduction of new futures contracts.”

The author of this story owns shares of Alphabet, Meta, Adobe, Microsoft, Pfizer, BlackRock and CME.