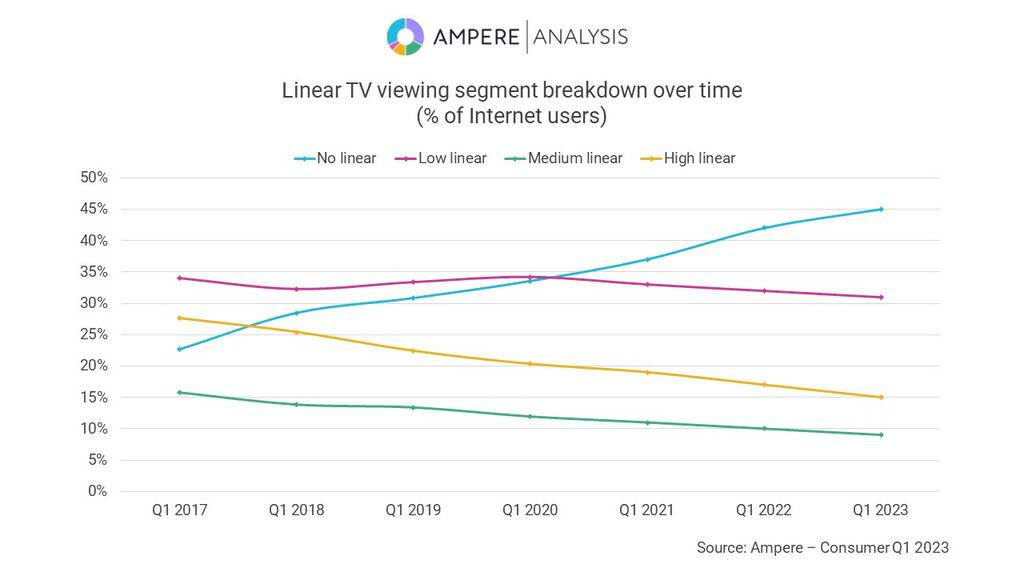

LONDON—In just two years, the proportion of internet users claiming to watch little to no linear TV in a typical day grew 22% to almost half (45%) according to a report just published by Ampere Analysis. Based on proprietary consumer research carried out with 54,000 adults aged 18-64 across 28 markets worldwide, the findings show that while younger groups are most disengaged with broadcast TV, 35% of those claiming to watch no linear TV were over 45 years old—a rise from 28% in Q1 2017.

According to Ampere, despite broadcasters’ traditional audiences moving away, there are opportunities to retain viewers through a mix of live and event content, and via enhancing broadcaster streaming offerings.

The reports showed that the number of high linear TV viewers—those who watch at least four hours of broadcast TV daily—has declined over the last two years, down from 19% of respondents in Q1 2021 to 15% in Q1 2023. In comparison, the number of internet users saying they watch four-plus hours of VoD content in a typical day is up from 58% in Q1 2021 to 62% in Q1 2023.

Despite the declines, Ampere says it is far too early to write off linear TV. The stability of low-level viewing (less than two hours per day) suggests that many internet users still tune in for key live events such as sports, major reality TV shows, and exclusive dramas, according to the researcher, who adds that these content pillars should remain a key part of acquisition and commissioning strategies for linear broadcasters

Additionally, while consumers are turning away from linear broadcast TV, broadcasters’ investment in their own VoD services has ensured they can still engage those audiences who prefer to watch via streaming, Ampere adds, noting that engagement with these broadcast-led video services has increased by 26% since Q1 2023.

“At first glance, the decline in linear TV viewing looks to be a worrying trend for broadcasters as their traditional audience begins to drift away, said Minal Modha, Research Director at Ampere Analysis. “However, as the increased engagement with broadcast-led video services shows, if the linear channels can continue to adapt and provide a strong OTT offering for audiences switching from scheduled TV channels, they have an opportunity to retain them, albeit on a different medium."