/Allegion%20plc%20HQ%20sign-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Valued at a market cap of $13.9 billion, Allegion plc (ALLE) is a global provider of security and access solutions that designs and manufactures mechanical and electronic locks, door hardware, and access control systems for residential, commercial, and institutional markets. Headquartered in Dublin with major operations in the U.S., the company operates across more than 130 countries through its Americas and International segments, supported by well-known brands such as Schlage, Von Duprin, and CISA.

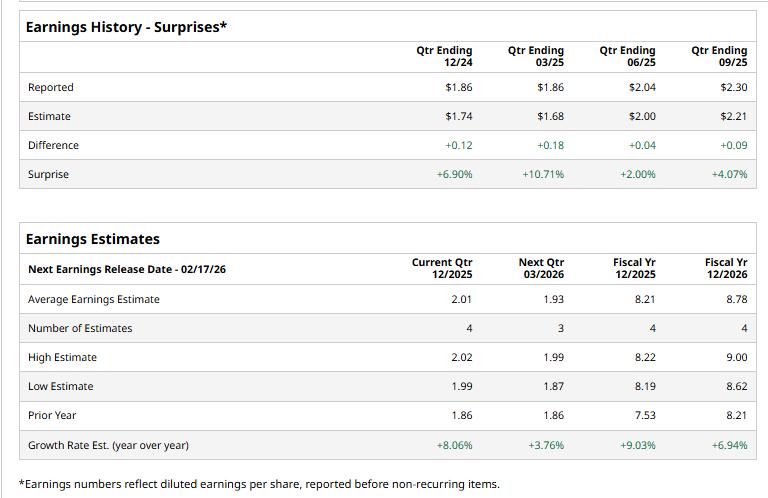

The security company is expected to announce its fiscal Q4 earnings for 2025 in the near future. Before this event, analysts expect ALLE to report a profit of $2.01 per share, up 8.1% from $1.86 per share in the year-ago quarter. The company has a solid trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters.

For FY2025, analysts expect Allegion to report a profit of $8.21 per share, up 9% from $7.53 per share in fiscal 2024. Its EPS is expected to further grow 6.9% year over year to $8.78 in fiscal 2026.

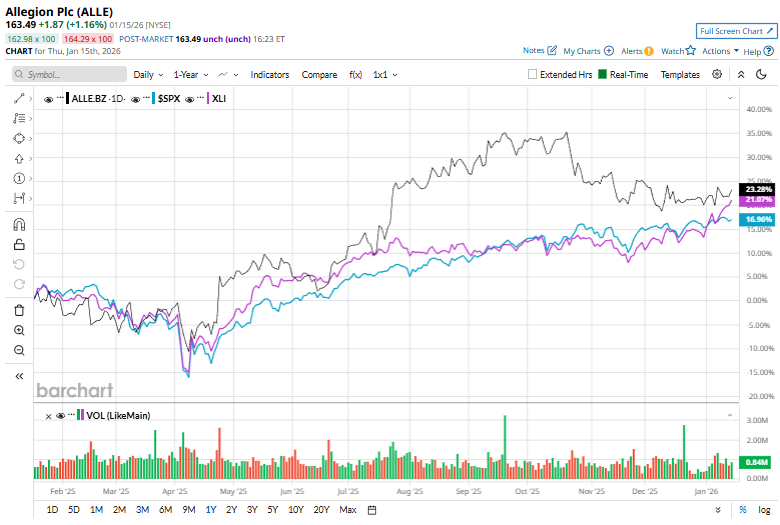

Allegion has rallied 24.9% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 16.7% uptick and the Industrial Select Sector SPDR Fund’s (XLI) 22.5% return over the same time frame.

Despite the robust price momentum, shares of Allegion declined 2.4% on Dec. 16 after Wells Fargo cut its price target to $175 from $185 while maintaining an “Equal-Weight” rating, signaling a more cautious outlook. The drop was also influenced by the stock trading ex-dividend, as shares typically fall by the value of the dividend when new buyers are no longer entitled to the $0.51 payout.

Wall Street analysts are moderately optimistic about ALLE’s stock, with a "Moderate Buy" rating overall. Among 12 analysts covering the stock, three recommend "Strong Buy," and nine suggest "Hold.” The mean price target for ALLE is $182.70, implying an 11.7% premium from current price levels.