Alibaba Group Holdings Inc (NYSE:BABA) gapped up over 9% Friday but immediately ran into a group of sellers who knocked the stock down to almost completely fill the empty range.

The Hang Seng Index closed in Hong Kong up 5.36%, for a total increase of 8.73% this week. Conversely, the S&P 500 is down about 4% since Friday’s close, pressured by the Federal Reserve’s decision to hike interest rates by 0.75% for the fourth consecutive time.

China-based stocks took a beating last week after Chinese President Xi Jinping cemented himself an unprecedented third term. This week’s move to the upside could be part of a relief bounce to bring the Hang Seng up from oversold territory.

Read more here about bullish action in China-based stocks.

Although COVID-19 infection levels in China reached their highest in two-and-a-half months Thursday, Alibaba reported strong initial sales for the first checkout window of 2022’s Singles’ Day shopping festival.

Traders and investors will be watching to see how Alibaba performed in the third quarter when the company reports its earnings, expected Nov. 11.

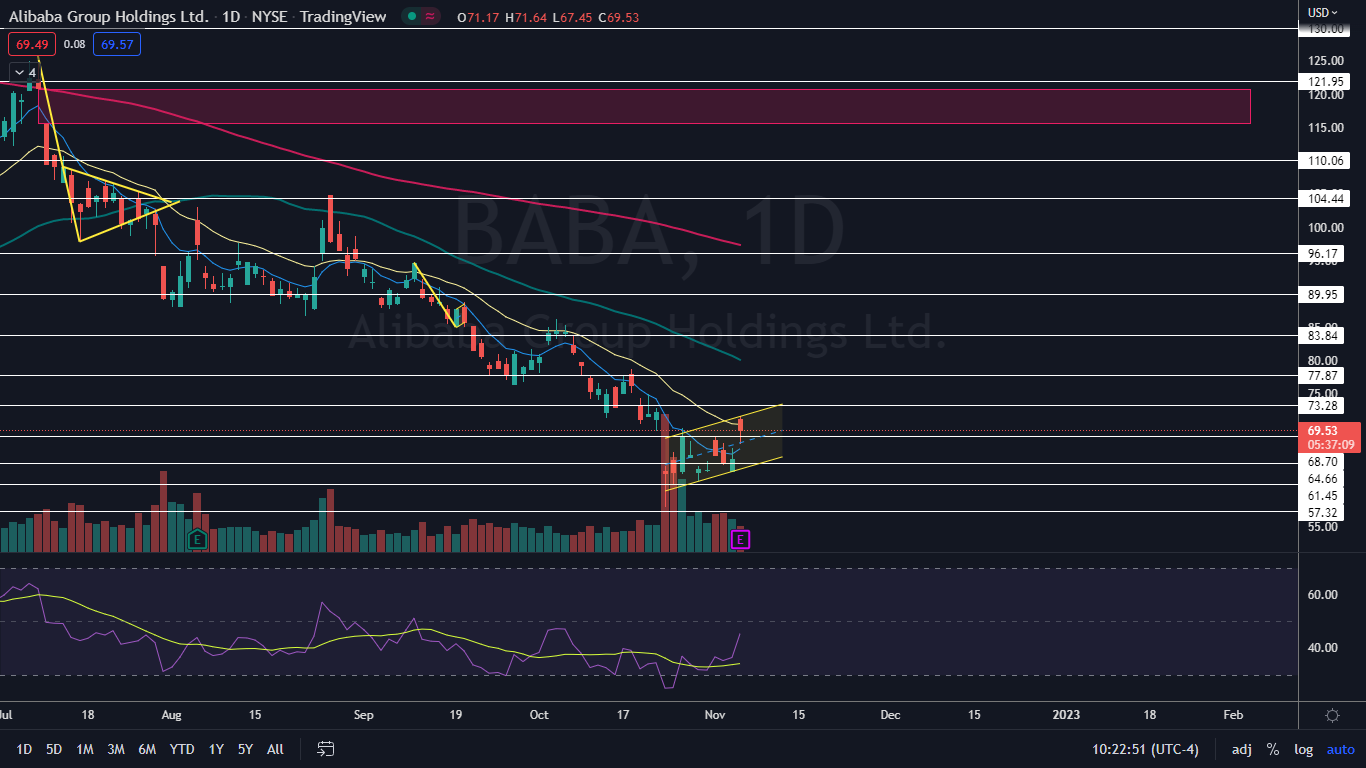

From a technical standpoint, Alibaba looks set to trade higher because the stock has settled into a steady uptrend between two parallel trendlines.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Alibaba Chart: Alibaba’s reaction within its uptrend to two parallel trendlines has settled the stock into a rising channel pattern. The pattern is bullish until a stock breaks down from the lower ascending trendline on higher-than-average volume.

- Alibaba’s most recent higher high was printed on Friday at $71.64 and the most recent higher low was formed at the $63.40 mark on Thursday. On Friday, Alibaba attempted to break up from the upper trend line of the channel and failed but when the stock dropped, it held support at the median line, which is bullish.

- If Alibaba is eventually able to break up from the channel, the stock will regain the 21-day exponential moving average (EMA) as support, which would give bulls more confidence going forward. If Alibaba can regain the level and hold above it for a period of time, the eight-day EMA will eventually cross above the 21-day.

- Alibaba has resistance above at $73.28 and $77.87 and support below at $68.70 and $64.66.