Alibaba (BABA) shares were in focus on Tuesday after Chairman and CEO Daniel Zhang said he would step down from his role.

Zhang is stepping down to focus on the group's cloud division. TheStreet's Martin Baccardax reported that earlier this year, Alibaba unveiled plans to split each of its divisions into a separate company, with plans to pursue individual IPOs "when they are ready."

Alibaba stock, which finished off 0.1% on Friday after hitting its highest level since April 19, fell 4.5% on Tuesday. At last check on Wednesday, the stock was off 1%, setting up a potential three-day losing streak.

Don't Miss: Can AMD Stock Make New Highs? First, Here's Where Support Must Hold

Some investors argue that the stock is being unfairly punished amid “positive change at the top.”

While Alibaba has become a dominant force in e-commerce — with many calling it the Amazon (AMZN) of China — U.S. investors have not treated it as such.

Not helping sentiment is that the company has sparred with the Chinese government and that Chinese companies listed on U.S. exchanges have faced delisting risk.

Still, one could make a good argument for Zhang leading Alibaba's soon-to-be-spun-off cloud division. Amazon’s cloud unit — AWS — is a major contributor to its top- and bottom-line results.

Trading Alibaba Stock

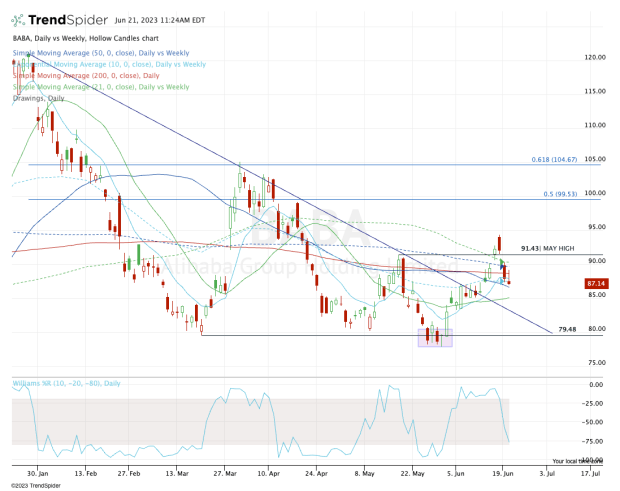

Chart courtesy of TrendSpider.com

Alibaba stock consolidated nicely in early June, then saw a four-day rally that sent it to multimonth highs.

The rally also put the stock in a monthly-up rotation by clearing the May high near $91.50. Lastly, that rally put Alibaba above all its major daily moving averages and most of its key weekly moving averages.

Just a few days later, Alibaba has traded back below the May high while dipping below the 10-day, 200-day, 10-week, 21-week and 50-week moving averages.

Basically, the $87 to $90 zone contains a number of key moving averages. If the stock breaks below this level and fails to regain it, that's a significant blow to the bulls.

Don't Miss: Walmart Stock Has Been on Fire. Here's the Dip-Buying Opportunity

If the shares can’t regain this area, then $85 is in play, which was recent support and currently marks the 21-day moving average. Failure to hold this level could open the door all the way down to the $78 to $80 area.

On the upside, the bulls want to see Alibaba stock regain $90 (and thus all its daily moving averages) and ideally regain last month’s high at $91.43.

Above the recent high of $94.29 and the shares could push to the $99 to $100 area.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.