Dividing up an inheritance can lead to a lot of tension, drama, and resentment. Not only are you dealing with the grief of losing someone you love but now you also have to consider the financial needs of others. In some cases, there are no easy answers. You’re forced to make tough choices about who (not) to give money to.

Redditor u/Spiritual_Alps3413, who recently lost her husband, went viral on the AITA community after asking for everyone’s take on her sensitive situation at home. She wanted their advice on her decision not to use her inheritance to support her spouse’s daughter from a previous relationship financially. The internet reacted really strongly to the post. Read on for the full story. Bored Panda has reached out to the author via Reddit, and we’ll update the article as soon as we hear back from her.

Losing a loved one is one of the worst things that can happen. If you receive an inheritance from them, it’s often bittersweet

Image credits: djoronimo / envato (not the actual photo)

A widow asked the internet for advice after her husband’s daughter from a previous relationship begged her for a cut of the inheritance

Image credits: Karolina Kaboompics / pexels (not the actual photo)

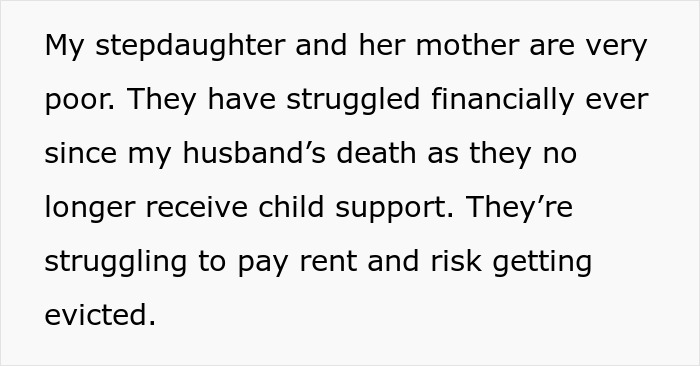

Image credits: Spiritual_Alps3413

There’s no rush to decide what to do with the inheritance, especially if you’re still grieving

Investopedia suggests that if you inherit a large sum of money, you should consider putting it into a federally insured bank or credit union account while you figure out exactly what you want to do with it. You might also want to hire a financial planner

Take things slowly. You don’t have to rush anywhere. The odds are that if you received a sizeable inheritance, you were very close to the person who passed away.

So, the joy of a financial boon is mixed with the grief of losing a loved one. You still need to come to terms with the loss. That should be your priority. While we never truly ‘get over’ losing a loved one, we can learn to live with their absence. But that takes a lot of time, emotional support from our loved ones, and at times the help of a grief counselor.

One of your first steps after inheriting money might be to pay off any debt that you have at the moment. You should prioritize high-interest debt first, e.g. if you’ve gone overboard with using credit cards before.

Next, you’ll want to invest the rest of the money. Take your time. Talk to some experts. Consider your tolerance for risk. Nobody can make the decision for you. Generally speaking, it’s best to diversify your investments and invest over time (hello, dollar-cost averaging) instead of in one big chunk of cash.

Meanwhile, this doesn’t mean that you can’t enjoy yourself with a bit of that money, even if it can feel like a mixed blessing at times. You can and should splurge a little bit. Just try not to go overboard. It’s better to think about the far-off future, not just about short-term pleasure. You potentially have enough money to turn your inheritance into generational wealth.

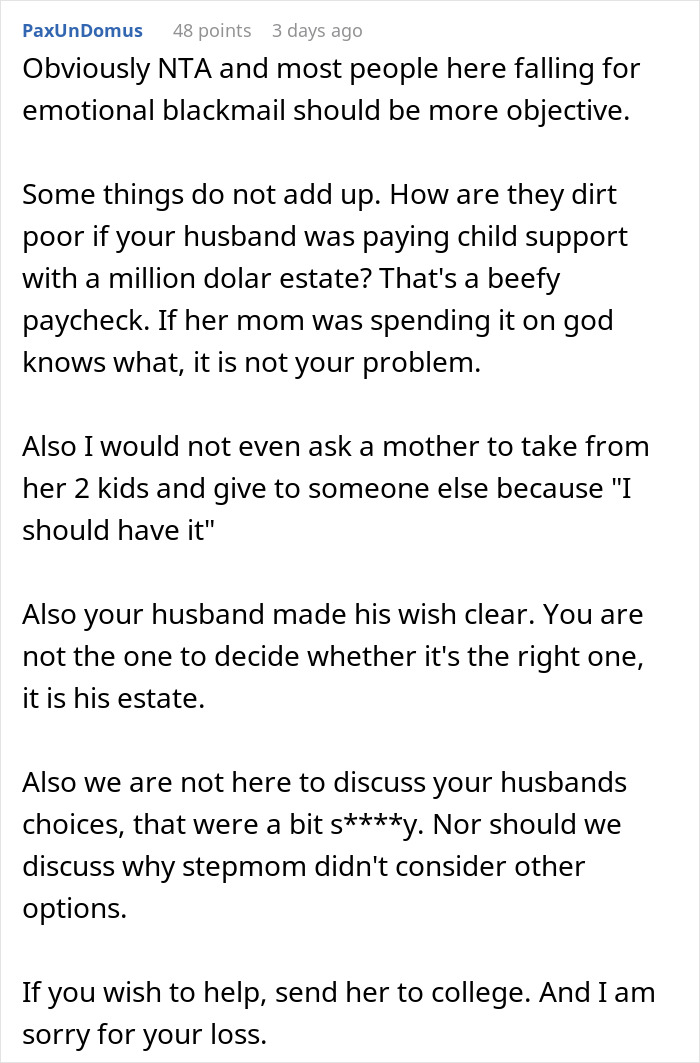

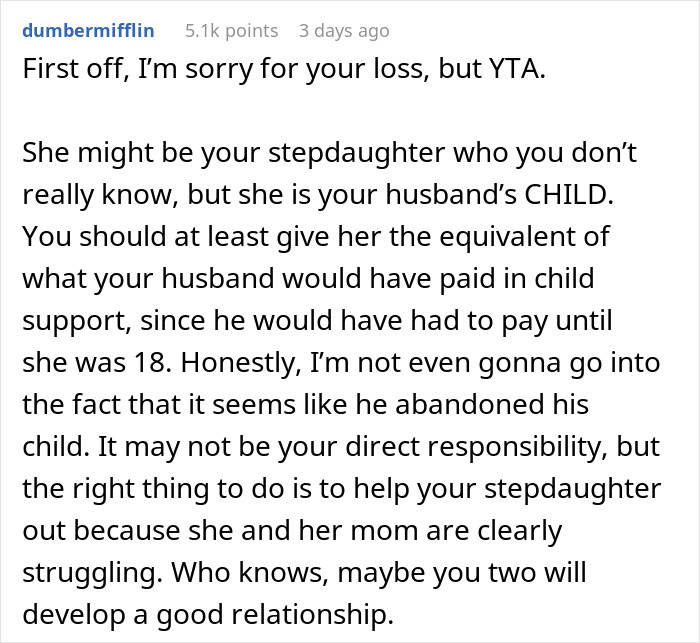

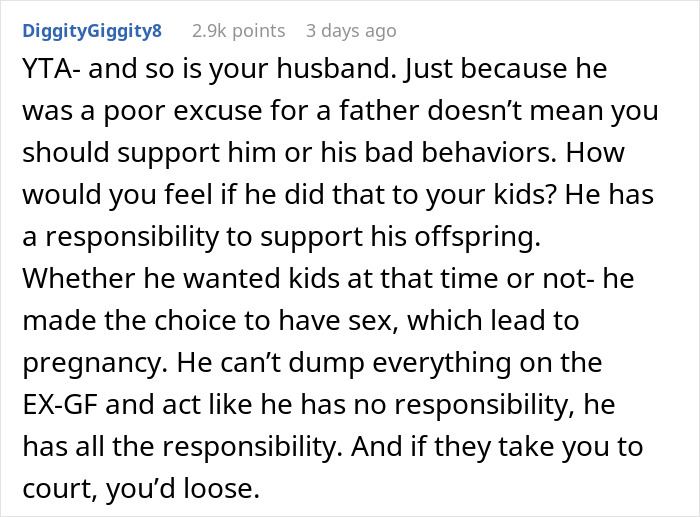

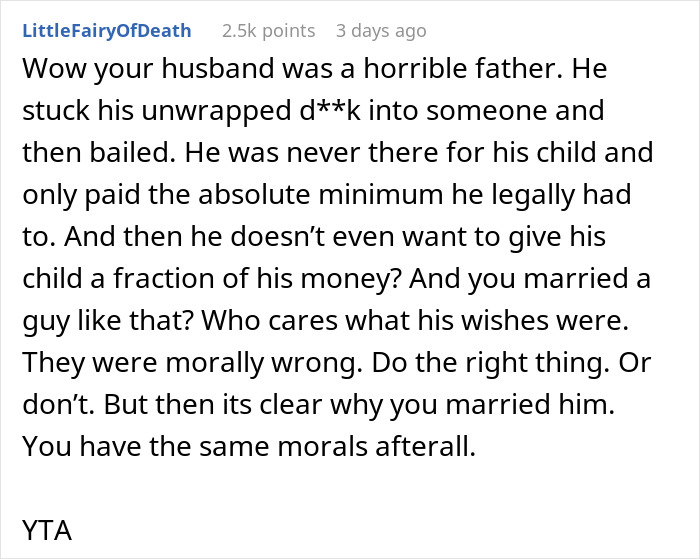

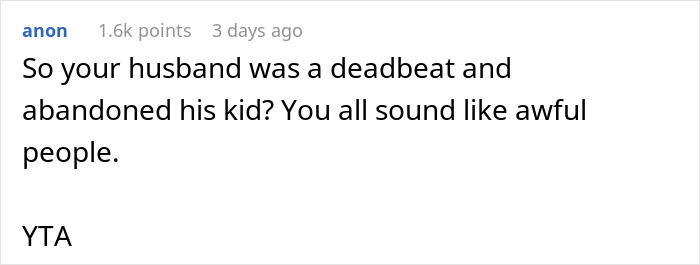

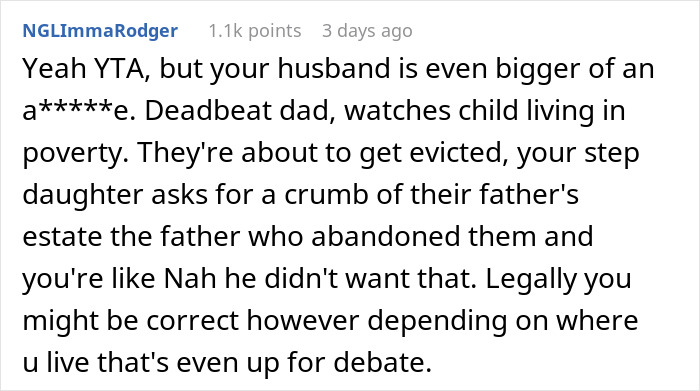

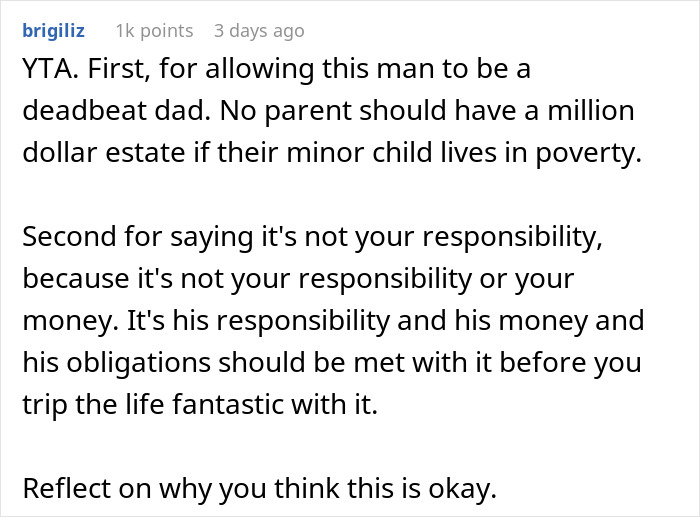

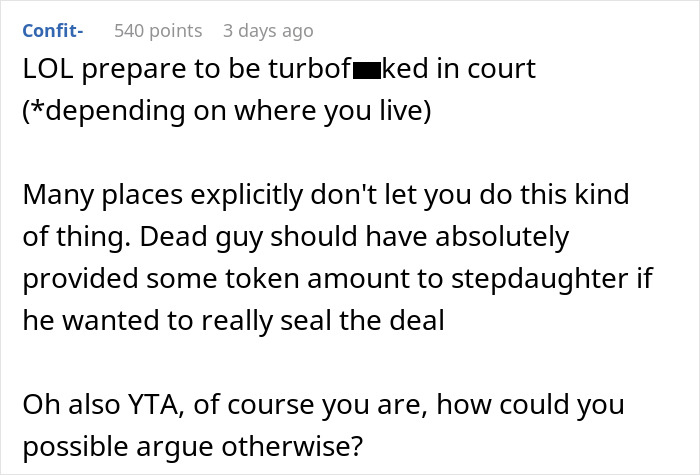

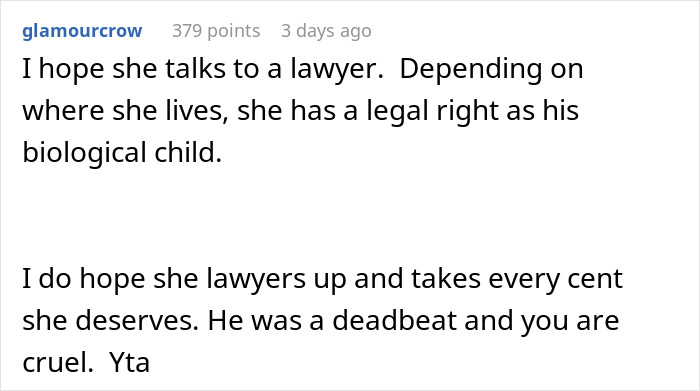

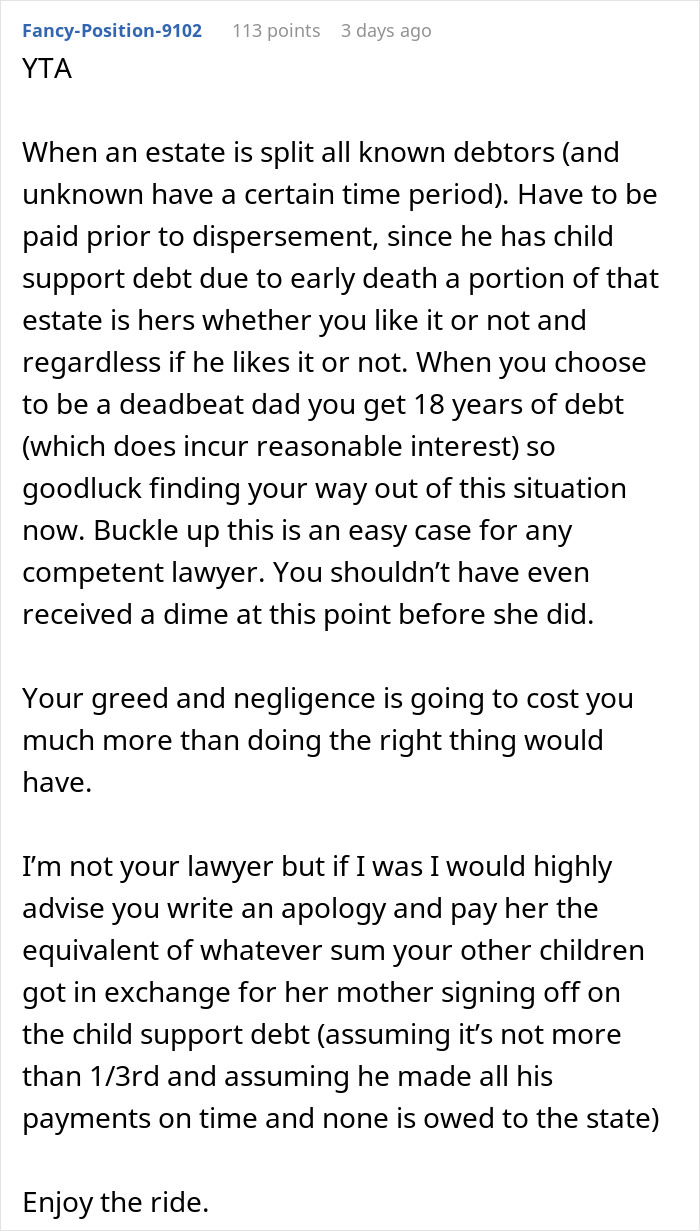

The sprawling AITA online community had an overwhelmingly negative reaction to the author’s story. They were shocked by her decision not to support her husband’s child from another relationship.

From their perspective, she knows that his teenage daughter is struggling financially. On top of that, the author is now in a position to help someone in need, whom her husband had allegedly neglected all of these years.

It’s up to every individual to decide how charitable or frugal they want to be with the money they’ve received

Speaking purely objectively, nobody is owed anything. Nobody is entitled to anything. How charitable someone is or isn’t, is up to them.

Just because you inherit a lot of money, win the lottery, or get a massive promotion at a lucrative company does not automatically make you responsible for solving everyone’s problems. The reality is that it’s up to the person who receives the inheritance to do what they want with it. Meanwhile, everyone else is free to judge these decisions as they wish.

Subjectively speaking, it would be the decent thing to do to help out those in need, who directly ask you for assistance, and who have some sort of positive relationship with you. And if you don’t help them out, you risk angering them.

But the reality is that unless you’re planning on handing out your entire inheritance, you’ll have to draw the line somewhere.

Where that line will be depends on what you value as an individual. Someone who is slightly more frugal and practical might look to take care of their very closest family members’ welfare first.

In the meantime, someone who is more charitable and liberal with their budgeting might want to help out everyone in their social circle who needs the money. Even their distant family whom they don’t even know all that well.

But don’t be naive, there will always be someone in need, whether they’re your closest pals, mere acquaintances, or complete strangers trying to take advantage of your goodwill.

Coming into a lot of money very quickly will attract a lot of interest, both from folks in actual need and those looking to make a quick buck. Distinguishing between the two can be hard at times.

What are your thoughts on the entire situation, Pandas? What would you have done if you were in the author’s shoes? Where would you personally draw the line at handing out your inheritance? How charitable would you be if you came into a lot of money? Share your thoughts in the comments.

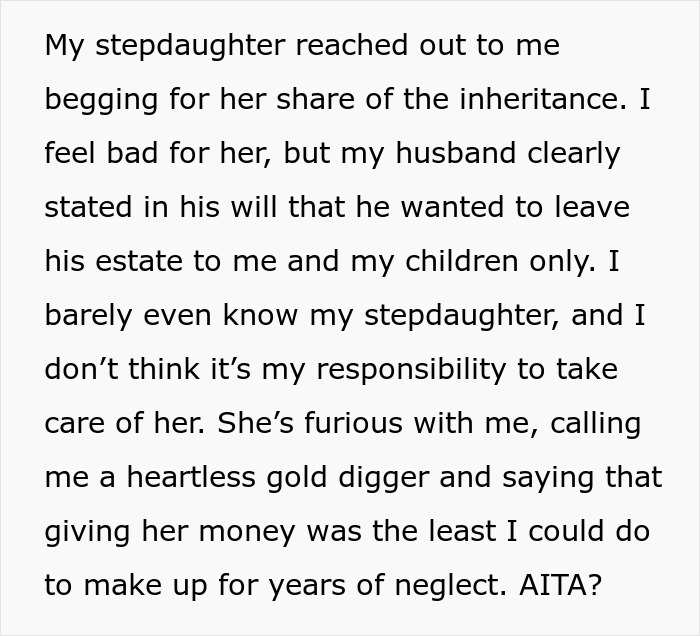

Many readers were very critical of the author’s decision. Here are some of their thoughts on the delicate situation

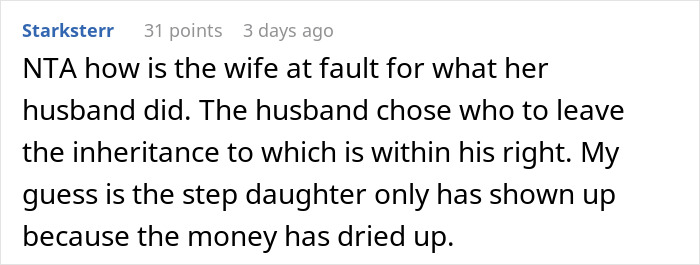

However, a few people were on the woman’s side and thought she wasn’t in the wrong