Owning your own home is a proud sign of financial stability and personal success. Knowing that you’ll be able to share it with your partner after you marry can be even more gratifying. However, there are many things to consider when it comes to opening your home to a new spouse, one of them being the question of shared ownership.

This redditor hoped that after she married, her husband would put her name on the deed to his home, making them equal homeowners. But when she brought this up, he told her that he wanted to keep it to himself since he paid for it in full before they met. This majorly upset her, pushing her to look for perspective online.

Scroll down to find the full story and a conversation with real estate lawyer Zachary Soccio-Marandola, who kindly agreed to answer a few questions on the topic.

Sharing a home with your loved one might seem like an exciting prospect

Image credits: westend61 / envatoelements (not the actual photo)

However, this woman’s dream of shared homeownership burst after her fiancé wanted to keep his house solely under his name

Image credits: drazenphoto / envatoelements (not the actual photo)

Later, the author posted an update

Image credits: throwawayhouseprobl

The decision to add a spouse on the deed to a property isn’t always straightforward

Image credits: simonapilolla / envatoelements (not the actual photo)

The decision to add a spouse on the deed to a property isn’t always straightforward, as every situation is unique. Perhaps the partner purchased the home while they were single or have remarried and have children from previous relationships to consider.

The choice also has many potential benefits and pitfalls that the owner has to think through before confirming it. On one hand, “adding a spouse to title can formalize shared ownership, with the biggest benefit being estate planning benefits such as automatic transfer if one spouse passes,” says real estate lawyer Zachary Soccio-Marandola.

It can simplify the estate planning process and shared ownership can offer a layer of protection that some couples may find appealing. Also, in case any of the spouses have debts, creditors can’t claim jointly owned assets.

On the other hand, in cases of divorce or separation, having both partners on the title can lead to disputes over equal division of property, especially if one spouse has contributed to the home significantly more than the other.

15% of American couples have signed a prenup in 2022

Image credits: dvatri / envatoelements (not the actual photo)

Proving that one party had a bigger financial input than the other can be difficult once someone is added to the deed. After divorce, the laws require each spouse to receive a fair share of the marital assets.

“If a married couple wants to keep certain assets separate, they can prepare a prenuptial agreement in accordance with local laws,” says Soccio-Marandola. Typically, it lists what possessions and debts each person owns and spells out their rights to these assets during and after the marriage.

Such agreements have a history of being quite controversial, as they’re often imposed by wealthier partners to protect their fortune. However, when it’s done right and used correctly, it can be a fair way for both parties to divide assets and responsibilities. Besides, judges look carefully through such documents to ensure no spouse is wronged by prenups.

As a matter of fact, these agreements aren’t just for protecting assets—they can also shield partners from debts their significant other may accumulated before meeting them.

As divorce is becoming more prevalent, it’s not surprising that many people try to find ways to protect themselves and their finances. A 2022 Harris poll found that around 15% of Americans signed a prenup. This figure has significantly increased since 2003, when it was just at 3%. It’s even more popular among younger generations like Gen Z and Millennials, with 40% of them reporting having signed such an agreement.

“They don’t want to make the same mistakes [as their parents]. Some of us saw real disasters,” says Julia Rodgers, a former family law attorney and founder of HelloPrenup. This makes complete sense, as Boomers were most likely to get married and divorced at a young age.

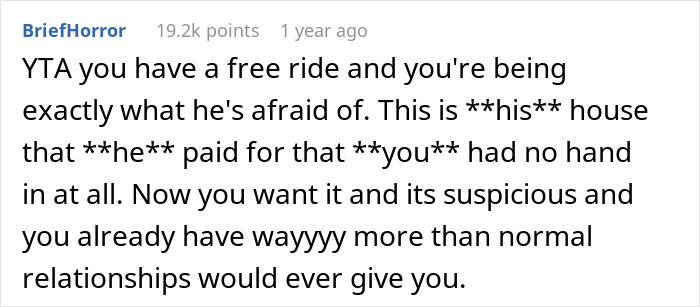

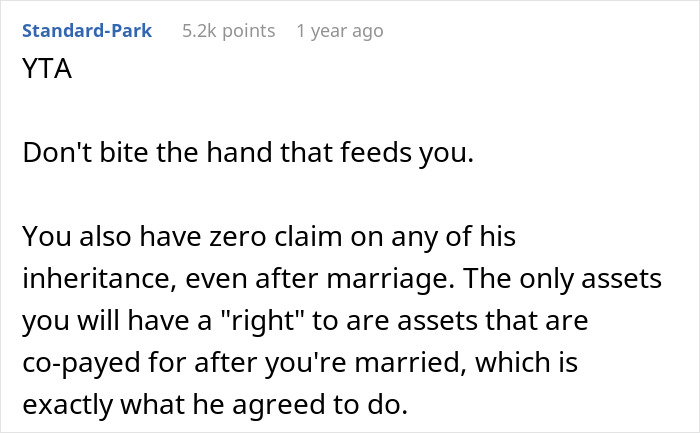

A lot of readers said that demanding to be put on a deed was a jerk move

Others weren’t as harsh, saying they need a prenup