It’s no secret that buying a home—now, arguably more than ever—might call for a person’s entire life savings. But those who have their mind set on buying a dwelling have likely made their peace with that.

This redditor seemingly did; however, he didn’t find it fair that while he was planning to invest nearly all of his money into their home, his wife had $20k set aside that she refused to contribute, all because of a promise she had made to a group of friends. Scroll down to find the full story below.

Looking for a forever home together can be an exciting chapter in a couple’s life

Image credits: Lucas Pezeta / Pexels (not the actual photo)

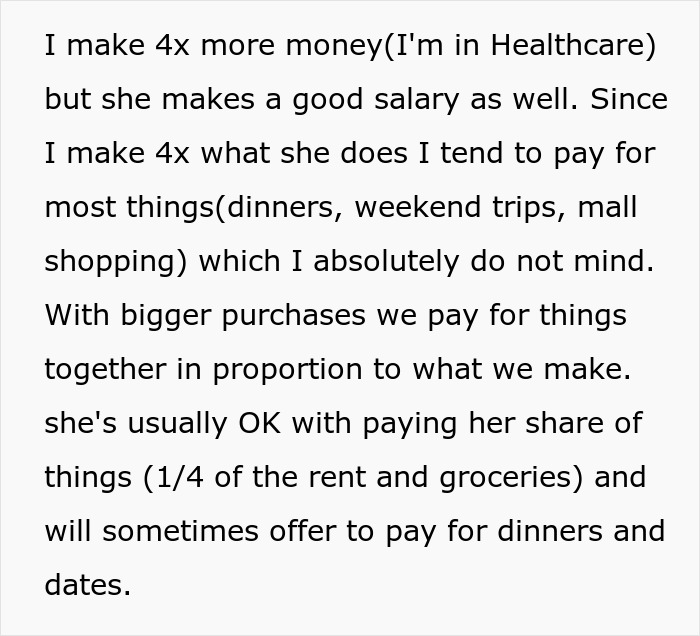

This husband was looking forward to buying a home with his wife, but it quickly got complicated

Image credits: Yan Krukau / Pexels (not the actual photo)

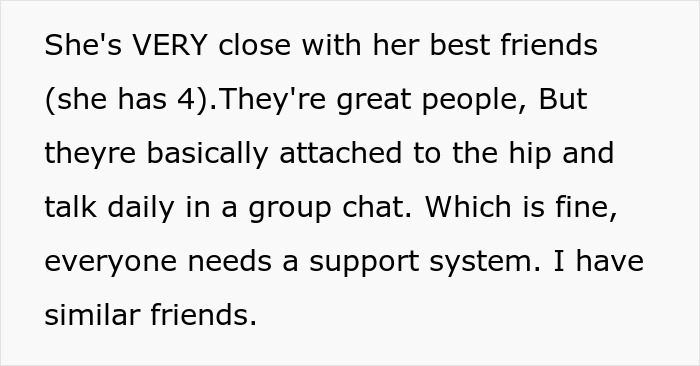

Image credits: Mikhail Nilov / Pexels (not the actual photo)

Image credits: Artistic_Hippo4827

Image credits: Pavel Danilyuk / Pexels (not the actual photo)

The housing market is nowhere nearly the same as it was decades ago

If you have checked the state of the housing market lately, you probably noticed that it’s far from what your grandparents saw back when they were buying a home (for probably around $300 and five grapes). Nowadays, the price for a home is way different than several decades ago, and the situation does not seem to be any brighter in the near future.

Comparing how prices of homes have changed overtime, Statista found that in the 1970s, for instance, the average sales price of new homes in the US was somewhere around $21k. Some 50 years later, though, in 2022, it was roughly $540k.

Posing the question when will home prices be affordable again, Forbes pointed out that while the mortgage rates have been seemingly going down, dwelling prices are still at record heights, out of reach for many. “The upward pressure on home prices is making this the most unaffordable housing market in history,” the chief economist at Bright MLS, Lisa Sturtevant, told Forbes.

The OP shared that the kind of house that he and his wife were looking for required somewhere around $60-70k for a downpayment. And while he was willing to put nearly all of his savings into the downpayment, his significant other said she didn’t want to touch the money she had set aside in the friends’ combined savings account.

Image credits: Kindel Media / Pexels (not the actual photo)

When handling household finances, it’s important to be a team

Situations like the one the OP found himself in only emphasize the importance of making sure that you and your partner are on the same page regarding financial matters. According to the American Psychological Association, not all couples sit down to discuss finances thoroughly. But luckily, it’s never too late to do it. Said source suggests that some good questions to start the conversation off include inquiring from your partner about what their parents taught them about money, what their financial goals were, and what their fears about money were.

According to APA, it’s also important to be a team; whatever that means to you. For some people, being a team entails splitting everything 50/50, for others, it’s taking turns covering certain expenses for a certain period of time. There seem to be plenty of ways to share the load—be it finances, chores, or walking the dog, for that matter—it’s important to find one that works for both partners, in order for it not to take a toll on the relationship.

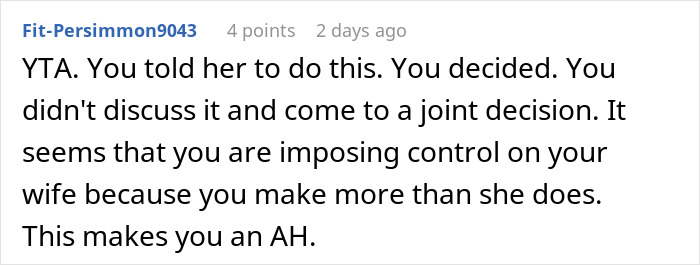

Unsurprisingly, financial matters is something quite a few couples disagree on or even fight about, which rarely ever makes the relationship any better. But it wasn’t only the couple that found themselves fostering differing views towards handling money; fellow netizens, too, seemingly had different opinions, which they shared in the comments under the post.

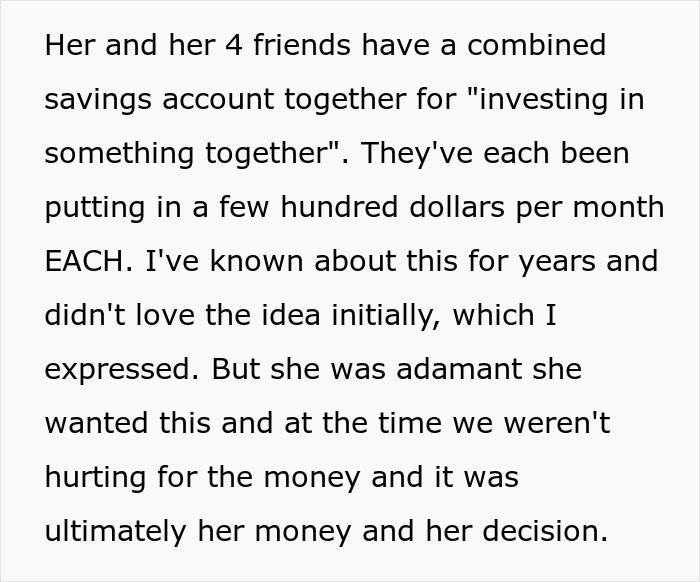

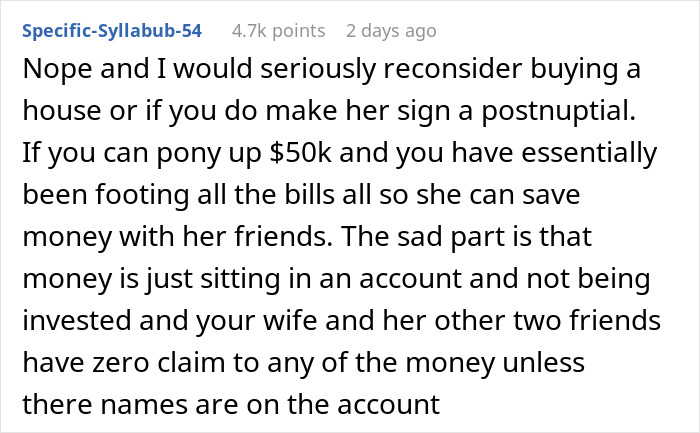

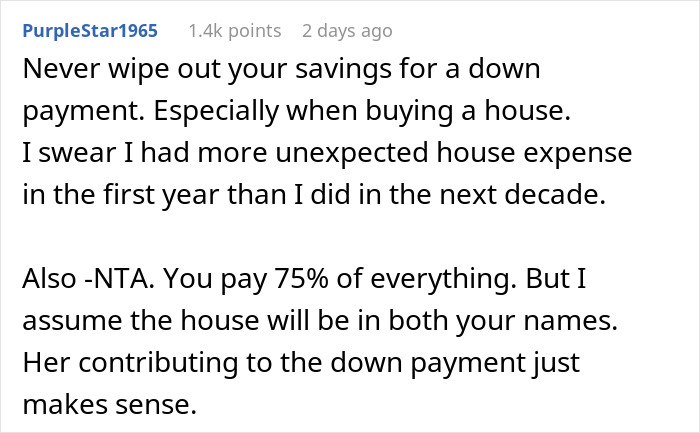

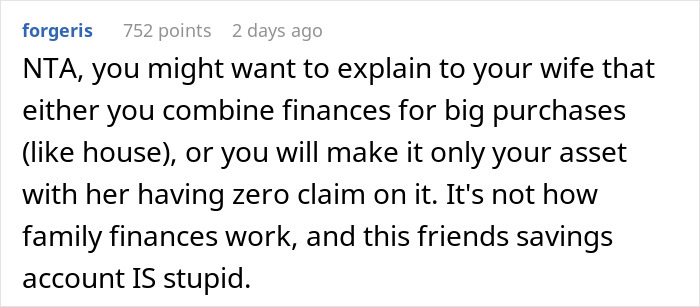

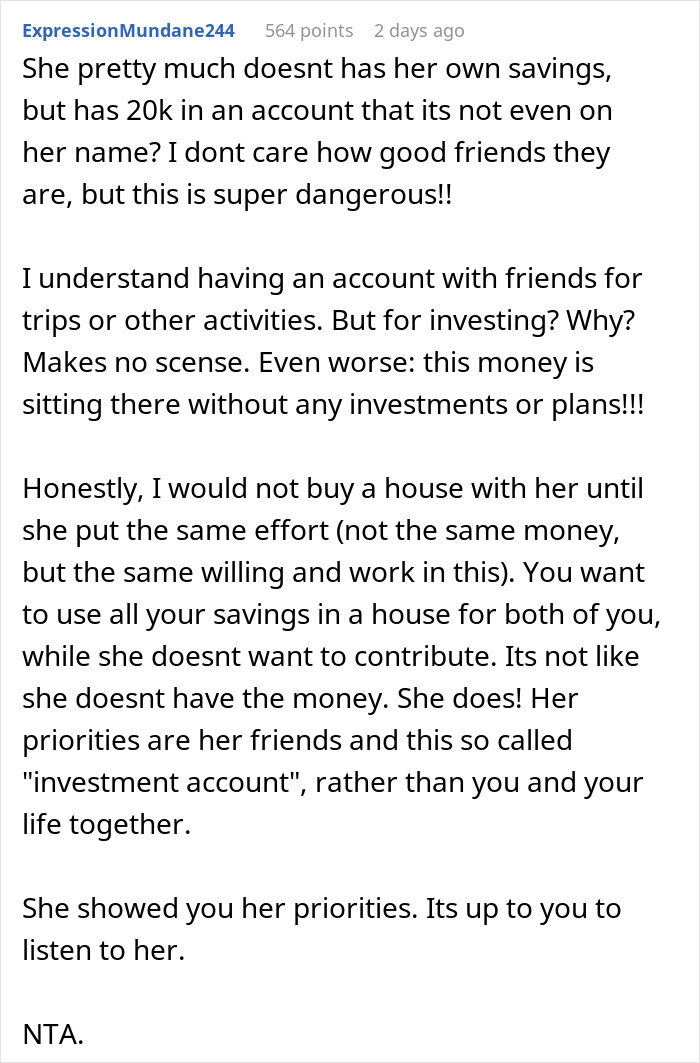

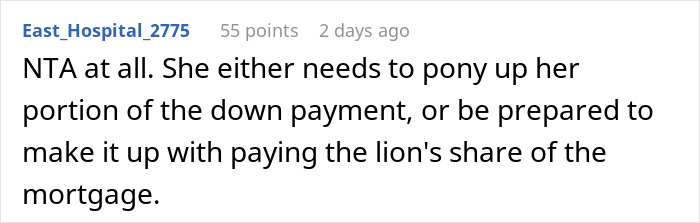

Most netizens didn’t think the husband was being a jerk in the situation

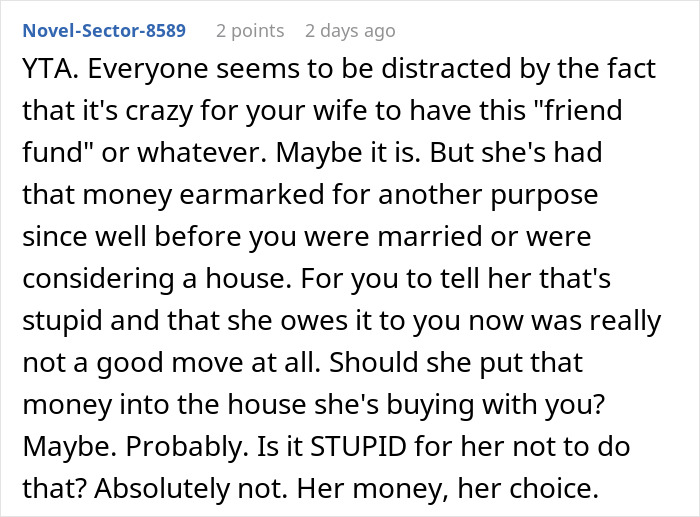

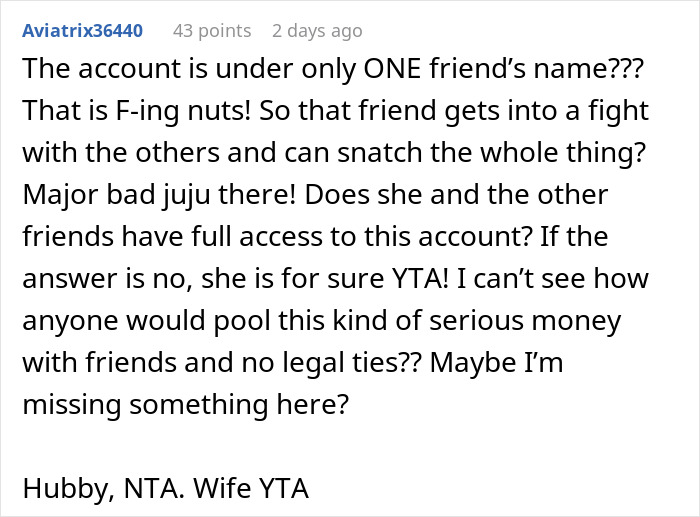

Others shared a different perspective on things