While enterprise software firms struggle to generate revenue from generative artificial intelligence, cloud computing leader Amazon.com is making bank on the trend, an analyst says. Amazon stock rose Friday.

In the AI gold rush, Amazon is selling the "picks and shovels," as the saying goes. And the companies developing AI software and services may or may not strike it rich.

"This 19-month gen AI propaganda cycle has delivered de minimis revenue for most companies in the enterprise software industry, and we doubt much will change in the foreseeable future," Monness Crespi Hardt analyst Brian White said in a client note Friday.

"On the other hand, the leading cloud service providers have already begun to benefit from the tech zeitgeist, including Amazon's AWS, and we expect this phenomenon will usher in an even brighter future," he said.

Some enterprise software stocks have reached "frothy" levels amid an investor rotation out of semiconductor stocks, White said. He didn't name specific stocks, but predicted "a sharp sell-off" in enterprise software shares ahead.

Amazon Stock Is Recent Breakout

Meanwhile, White reiterated his buy rating on Amazon stock with a price target of 225. On the stock market today, Amazon stock rose 1.2% to close at 200.

Generative AI "has proven a revenue mirage for the enterprise software industry," he said.

White's report comes days after economist Ed Yardeni warned of a bubble in AI stocks such as Nvidia.

Last week, Goldman Sachs head of global equity research, Jim Covello, said AI's economic benefits are exaggerated. In a report, Covello said investor sentiment on AI stocks could turn negative.

White's report is the latest from a Wall Street official to throw cold water on the AI megatrend.

"Given the current stage of the gen AI development cycle, we believe it's too early to make bold bets in the enterprise software space," White said. "Moreover, we believe gen AI will simply be a feature that is incorporated into enterprise software, a capability that all vendors will offer, making it table stakes."

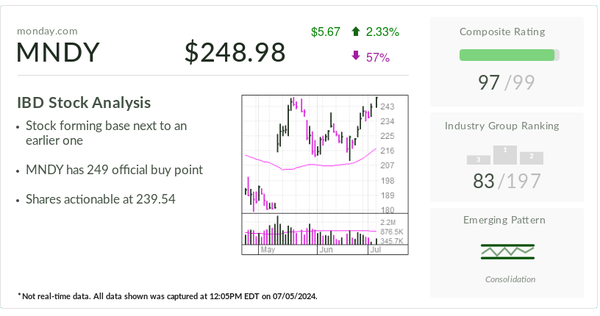

Amazon stock is on two IBD lists: Leaderboard and SwingTrader.

On June 26, Amazon stock broke out of a flat base at a buy point of 191.70, according to IBD MarketSurge charts. The 5% buy zone extends to 201.29, based on IBD trading principles.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.