The poison of suspicion is terrible in the cryptocurrency industry.

A month after the overnight implosion of the crypto empire of Sam Bankman-Fried, 30, it is another lord of the crypto sphere who is now the subject of the wildest rumors about the solvency of his crypto kingdom.

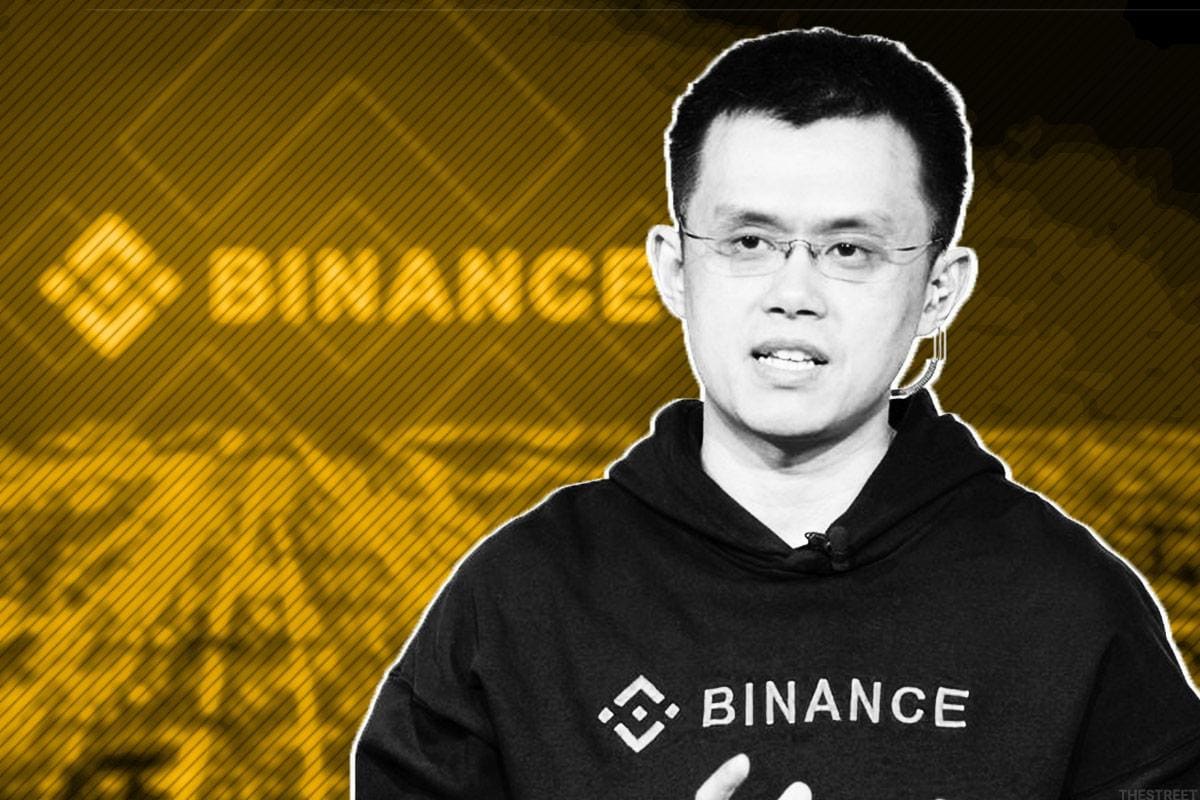

This is Changpeng Zhao, the founder and CEO of Binance, the world's largest cryptocurrency exchange by trading volume. Ironically, it was a tweet from Zhao that sparked the beginning of the end for FTX and its sister company Alameda Research, the two jewels of the Bankman-Fried empire.

On November 6, Zhao announced in a post, on Twitter, that his company had made the decision to sell $530 million worth of FTT coins, a cryptocurrency issued by FTX. Binance had received its coins when the firm sold its stake in FTX in 2021.

In his announcement, he added that the decision to liquidate FTT coins was due to recent revelations which appeared to be about Alameda's balance sheet.

FTX v. Binance

In a November 2 article, Coindesk claimed that most of the balance sheet of Alameda Research, Bankman-Fried's trading platform, was comprised of the FTT token, the cryptocurrency issued by FTX. Clearly, if the token collapsed, Alameda would be left with nothing. This revelation surprised investors who thought the firm had other assets.

The post caused a run on the bank and, five days later, FTX and Alameda filed for Chapter 11 bankruptcy.

Binance and Zhao "put FTX out of business," Shark Tank star Kevin O'Leary, who was a FTX's ambassador, told U.S. Senators on December 14.

But for the past few days, Binance has been at the center of speculation itself, that the platform would not have enough reserves to survive a run on the bank.

It is therefore no surprise that many Binance customers have rushed to try to withdraw their funds, deposited on the platform in the form of cryptocurrencies.

"Binance has had the highest daily withdrawals since June, with over $2B* in net outflows since December 12," data research group Nansen, said on December 13.

Reserves

But Nansen added that the platform has enough liquidity to withstand a major exodus of assets. The firm has $62.6 billion in reserves, which should be enough to satisfy customer withdrawal demands, Nansen estimated.

The problem is that it's tough to really assess the financial health of Binance, because the full accounting of the firm’s assets and liabilities is not available.

This opacity and a controversial decision by Binance, only fuels FUD, a slang in the crypto sphere that refers to Fear Uncertainty and Doubt. The platform paused withdrawals linked to cryptocurrency USDC on December 13, in order to facilitate a "token swap" of USDC stablecoins for its own BUSD stablecoins.

The company explained it as a measure to loosen up liquidity in anticipation of additional withdrawals but for many crypto fans on social media this was bad, as FTX did the same thing just before filing for bankruptcy.

"Things seem to have stabilized," Zhao tweeted on December 14. "Yesterday was not the highest withdrawals we processed, not even top 5. We processed more during LUNA or FTX crashes. Now deposits are coming back in. 🤷♂️💪"

The CEO reiterated that no amount of withdrawals can cause issues for Binance, during an interview with CNBC on December 15. He added that the firm holds assets one-on-one and declared that Binance never uses customers' funds.

"Binance doesn't owe anybody any money," Zhao said when asked about the company's liabilities.

This does not prevent rumors from continuing to circulate on social networks, one of the main information channels for players in the crypto sphere.

As a result, BNB, the cryptocurrency issued by the Binance ecosystem, has been impacted by the FUD: BNB prices are down almost 14% in the last seven days, according to data firm CoinGecko. By comparison, Bitcoin (BTC) prices are down 1.2% in the same period.

TheStreet sent a series of questions to Binance that were not answered.

Opaque

What has also fueled and continues to fuel suspicion around Binance is that the firm is not regulated, unlike its rivals Coinbase (COIN) and Kraken for example. All this means that Binance is not obligated to reveal its accounts and can do what it wants. Customers and investors must believe what the platform tells them. They have no way to verify.

The company also does not say where its headquarters are based. Founded in China, Binance left the country in 2017 before the country banned cryptocurrency trading.

An audit on the state of the firm's reserves took place over the weekend of December 11, to prove that every customer dollar is guaranteed. But in truth, what this so-called game of transparency has shown is that the assets were not fully collateralized and Binance was very selective about its disclosures.

The so-called proof-of-reserves, which was destined to re-establish consumer trust in the platform, was mocked on social media, forcing Binance to play defense.

The other worrying issue is an investigation by the Department of Justice (DoJ) that could lead to money laundering charges against Binance and some of its top executives, including Zhao, Reuters recently reported.

The investigation began in 2018 and is focused on Binance’s compliance with U.S. anti-money-laundering laws and sanctions. At the end of 2020, the DoJ asked Binance to submit internal documents relating to how the firm ensured that users of its platform do not launder money.