Shares of Adobe Systems (ADBE) are up on Thursday, climbing 4.8% at last glance following the graphics-software specialist's earnings report.

Adobe delivered a top- and bottom-line beat of Wall Street estimates as sales grew 9.4% year over year. Further, management’s guidance for the current quarter came in slightly ahead of expectations for both revenue and earnings.

Don't Miss: Credit Suisse, Europe Banks Drag Down S&P 500. Here's the SPY Trade.

Put it all together and Wall Street appears to be cautiously optimistic about the results, slowly bidding it higher after the solid headline results. Some investors might have had higher expectations, particularly as tech stocks and even more specifically, large-cap and megacap tech stocks continue to stabilize the U.S. stock market.

That said, Adobe stock has been a laggard vs. its peers. Can this report jumpstart the stock?

Trading Adobe Stock on Earnings

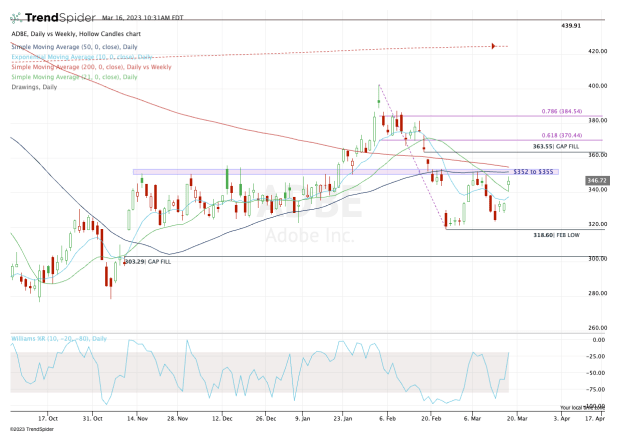

Chart courtesy of TrendSpider.com

Coming into the earnings report, Adobe stock was down 0.9% this year. That lags its peers: All of FAANG is higher year to date, while the Nasdaq was up 9.25% coming into today’s session.

So clearly Adobe has some catching up to do.

For any sustained rally to occur, the bulls need to see Adobe stock clear the $352 to $355 zone. That area was resistance in February and in March. It also includes the 50-day and 200-day moving averages.

Not only that, but the level was major resistance throughout the fourth quarter, with the high for last quarter sitting at $355.67.

If Adobe stock can clear this level, it opens the door to the gap-fill level at $363.55, then the 61.8% retracement near $370.

Don't Miss: Is Microsoft Stock a Buy? Here's the Hurdle It Must Clear.

On the downside, the bulls want to see Adobe stock hold the $340 level and, thus, the 10-day and 21-day moving averages. If it can’t, the earnings gap could be filled down toward $334.

Ultimately, the $352 to $355 area is hugely important. For Adobe stock to enjoy any sort of meaningful rally, it must clear this zone. Keep that in mind regardless of whether you're a bull or a bear in this name.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.