Comcast lost more linear pay TV customers in Q1, 614,000, than in any previous quarter, the cable conglomerate revealed Thursday.

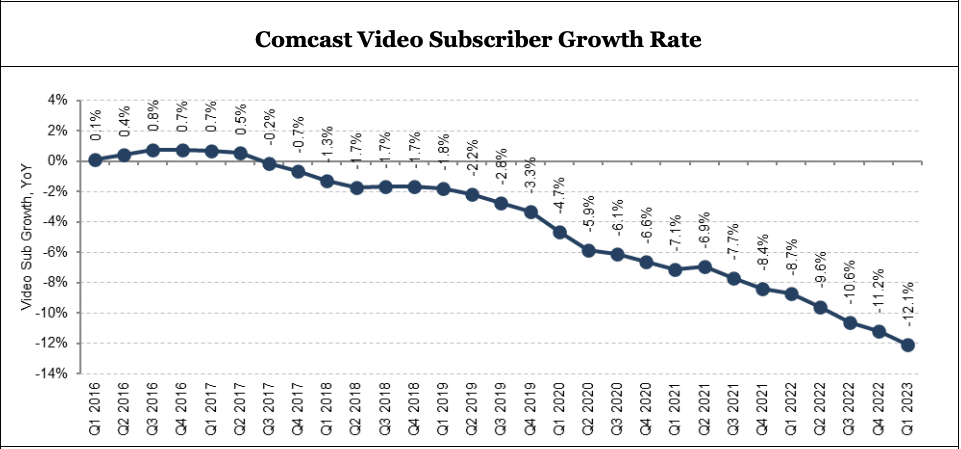

The total amounted to about 3.8% of its remaining base of 16.142 million Xfinity TV souls exiting 2022. For the year, Comcast lost 2.034 million pay TV customers in 2022 — 512,000 of them in the comparable first quarter of last year.

Long story short, Comcast is already well on pace to exceed its 12% rate of linear pay TV attrition from last year.

(Our sibling pub, Broadcasting+Cable, has all of Comcast’s top-line numbers in this report. You can also read Comcast's Q1 2023 earnings release here.)

Vanity-wise, with No. 2-sized cable operator Charter Communications losing video customers at a much slower rate — just 4.3% last year — Xfinity TV could very well become the No. 2 pay TV operator itself later this year, trailing Charter's Spectrum TV. (Note: Charter reports Q1 earnings Friday.)

Comcast, of course, recognized the inevitable erosion of the linear pay TV business long ago. And Wall Street — which sent Comcast share prices up around 7% as of midday trading Thursday — now pays far more attention to other parts of the Philadelphia conglomerate’s complex business, “connectivity” most chiefly among them.

Add Next TV to your Twitter feed today! Follow @ThisIsNextTV to keep up to date on the latest business and technology news of the video entertainment industry

The real concern surrounding Comcast Thursday is that it added only 5,000 domestic broadband customers across home and business product lines in Q1 — a flatlined dynamic the company had carefully warned investors about.

Comcast added 262,000 total broadband customers in the first quarter last year, and 460,000 in the first quarter of 2021.

Comcast believes that ongoing advances in its network infrastructure -- its promising symmetrical multi-gig speeds across its national network over the next three years -- will rekindle growth.

Also Read: Michael Cavanagh Set To Run NBCUniversal for the Long Term

You’d think Wall Street would absolutely be going nuts about the sudden flatlining of what is a foundational element to the technology/media/tech business — the fate and health of the No. 1 U.S. broadband supplier — but equity analysts are kind of strangely sanguine about it.

For their part, analysts see the slowdown in broadband customer growth as more a matter of market saturation — a problem that will be solved, somewhat, by new technologies that enable smoother, more cost-efficient entry into less saturated rural areas.

“Comcast, like all of their broadband peers, is facing a slowing market rather than runaway share loss,” MoffettNathanson principal and senior analyst Craig Moffett said in an investor note Thursday.

As for video cord-cutting, Comcast said a big reason why the latest numbers are so big is that fewer customers are signing up for broadband. And with that, there are fewer who are taking the Big Cable Bundle. Churn and disconnects haven’t accelerated, the company said, it's more a matter of “connects” decelerating.

Also Read: Fine With Flat? Comcast Lost 26K Broadband Subscribers in Q4 ... Why Investors Are OK With That

As for those ditching Xfinity TV, they're not going anywhere — most, or many, are keeping their Xfinity Internet.

“The loss of domestic video subscribers is, of course, primarily of loss of a service previously attached to broadband; it is generally not the loss of a customer,” analyst Moffett noted.

Meanwhile, Comcast continues to make headway in consumer wireless, adding another 355,000 customer lines in the first quarter to reach 5.7 million lines.

And it continues to shift its own video priorities to streaming. In its NBCUniversal division — still reeling following Sunday’s sudden ouster of embattled former CEO Jeff Shell — the company reported the addition of 2 million more paid Peacock subscribers.

The SVOD service, which finished 2021 with just 10 million paid subs, now has 22 million. (Comcast also reported a $704 million quarterly EBITDA loss on Peacock in the quarter, which was 54% larger than a year ago.)

However, as much as Comcast's business is diversified and probably just fine, plus a major merger or acquisition or two in the coming months or year, the rate of increase for cord-cutting for the No. 1 pay TV operator has to be concerning to those still vested in the linear networks business … such as all of pro sports.

The regional sports networks business, for example, has devolved very quickly from one that delivered 50% margins into a business in which 15-20% is now considered OK. A big chunk of that erosion has come from declines in distribution.

As the Bally Sports bankruptcy is showing us, big media business deals and associated incurred debt can quickly turn to soar when foundational elements such as the pay TV ecosystem decay more quickly than anticipated.

Comcast’s Q1 report includes just the first of several indicators on the remaining state of pay TV, but it’s the biggest indicator. And it wasn’t good.