Looking into the current session, Waters Inc. (NYSE:WAT) is trading at $308.36, after a 0.1% drop. Over the past month, the stock fell by 16.24%, but over the past year, it actually increased by 17.73%. With questionable short-term performance like this, and great long-term performance, long-term shareholders might want to start looking into the company's price-to-earnings ratio.

Assuming that all other factors are held constant, this could present itself as an opportunity for shareholders trying to capitalize on the higher share price. The stock is currently below from its 52 week high by 27.99%.

Also check out these big insider trades here

The P/E ratio measures the current share price to the company's EPS. It is used by long-term investors to analyze the company's current performance against its past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also shows that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Most often, an industry will prevail in a particular phase of a business cycle, than other industries.

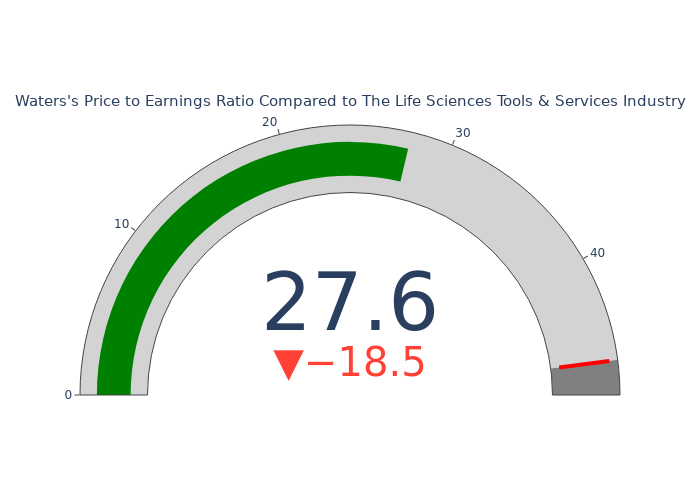

Compared to the aggregate P/E ratio of the 46.1 in the Life Sciences Tools & Services industry, Waters Inc. has a lower P/E ratio of 27.64. Shareholders might be inclined to think that the stock might perform worse than its industry peers. It's also possible that the stock is undervalued.

Price to earnings ratio is not always a great indicator of the company's performance. Depending on the earnings makeup of a company, investors can become unable to attain key insights from trailing earnings.