Shares of Nutrien (NYSE:NTR) rose by 11.00% in the past three months. Before having a look at the importance of debt, let us look at how much debt Nutrien has.

Nutrien's Debt

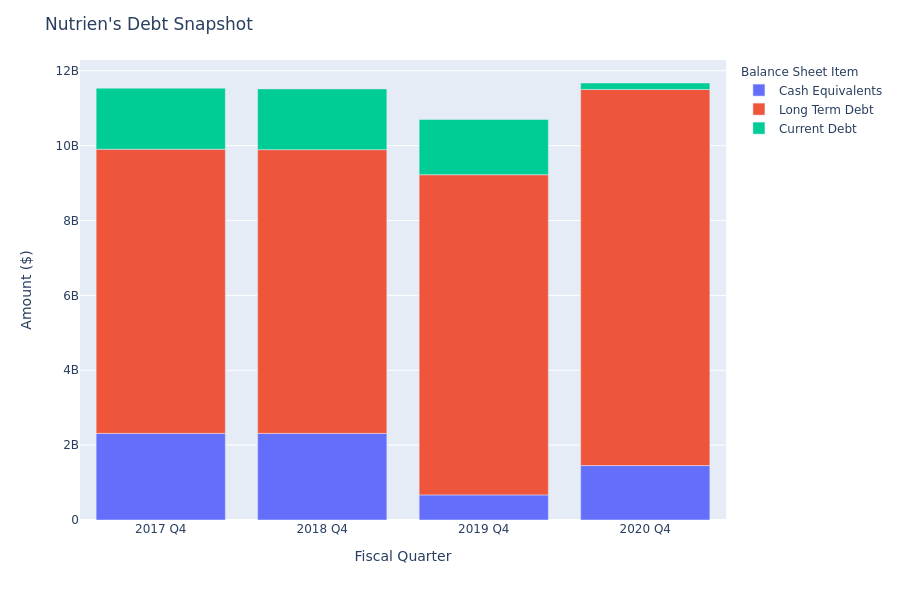

Based on Nutrien's financial statement as of February 26, 2021, long-term debt is at $10.05 billion and current debt is at $173.00 million, amounting to $10.22 billion in total debt. Adjusted for $1.45 billion in cash-equivalents, the company's net debt is at $8.77 billion.

Let's define some of the terms we used in the paragraph above. Current debt is the portion of a company's debt which is due within 1 year, while long-term debt is the portion due in more than 1 year. Cash equivalents include cash and any liquid securities with maturity periods of 90 days or less. Total debt equals current debt plus long-term debt minus cash equivalents.

To understand the degree of financial leverage a company has, shareholders look at the debt ratio. Considering Nutrien's $47.19 billion in total assets, the debt-ratio is at 0.22. Generally speaking, a debt-ratio more than one means that a large portion of debt is funded by assets. As the debt-ratio increases, so the does the risk of defaulting on loans, if interest rates were to increase. Different industries have different thresholds of tolerance for debt-ratios. A debt ratio of 25% might be higher for one industry and average for another.

Importance Of Debt

Debt is an important factor in the capital structure of a company, and can help it attain growth. Debt usually has a relatively lower financing cost than equity, which makes it an attractive option for executives.

Interest-payment obligations can impact the cash-flow of the company. Having financial leverage also allows companies to use additional capital for business operations, allowing equity owners to retain excess profit, generated by the debt capital.

Looking for stocks with low debt-to-equity ratios? Check out Benzinga Pro, a market research platform which provides investors with near-instantaneous access to dozens of stock metrics - including debt-to-equity ratio. Click here to learn more.