Energy Transfer (NYSE:ET) is set to give its latest quarterly earnings report on Wednesday, 2024-11-06. Here's what investors need to know before the announcement.

Analysts estimate that Energy Transfer will report an earnings per share (EPS) of $0.34.

Anticipation surrounds Energy Transfer's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

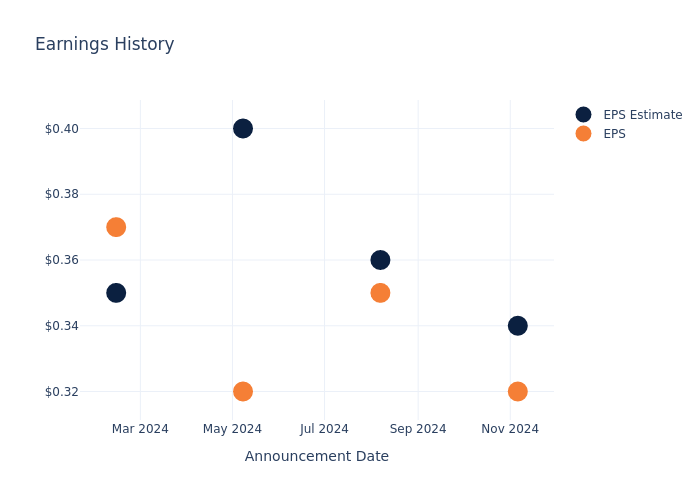

Performance in Previous Earnings

In the previous earnings release, the company missed EPS by $0.01, leading to a 1.98% increase in the share price the following trading session.

Here's a look at Energy Transfer's past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.34 | 0.36 | 0.40 | 0.35 |

| EPS Actual | 0.32 | 0.35 | 0.32 | 0.37 |

| Price Change % | -2.0% | 2.0% | -2.0% | 2.0% |

Market Performance of Energy Transfer's Stock

Shares of Energy Transfer were trading at $19.26 as of December 06. Over the last 52-week period, shares are up 45.36%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Opinions on Energy Transfer

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Energy Transfer.

With 4 analyst ratings, Energy Transfer has a consensus rating of Buy. The average one-year price target is $21.5, indicating a potential 11.63% upside.

Comparing Ratings Among Industry Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of ONEOK, Williams Companies and Kinder Morgan, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- For ONEOK, analysts project an Neutral trajectory, with an average 1-year price target of $105.5, indicating a potential 447.77% upside.

- Williams Companies received a Neutral consensus from analysts, with an average 1-year price target of $55.42, implying a potential 187.75% upside.

- The prevailing sentiment among analysts is an Buy trajectory for Kinder Morgan, with an average 1-year price target of $26.93, implying a potential 39.82% upside.

Peer Analysis Summary

Within the peer analysis summary, vital metrics for ONEOK, Williams Companies and Kinder Morgan are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Energy Transfer | Buy | 0.16% | $3.84B | 3.21% |

| ONEOK | Neutral | 19.91% | $1.72B | 4.12% |

| Williams Companies | Neutral | 3.67% | $1.56B | 5.72% |

| Kinder Morgan | Buy | -5.32% | $2.09B | 2.04% |

Key Takeaway:

Energy Transfer ranks highest in gross profit among its peers. It is in the middle for consensus rating and return on equity. However, it ranks lowest in revenue growth.

About Energy Transfer

Energy Transfer owns one of the largest portfolios of crude oil, natural gas, and natural gas liquid assets in the US, primarily in Texas and the US midcontinent region. Its pipeline network totals 130,000 miles. It also owns gathering and processing facilities, one of the largest fractionation facilities in the US, fuel distribution assets, and the Lake Charles gas liquefaction facility. It combined its publicly traded limited and general partnerships in October 2018.

Energy Transfer's Financial Performance

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Over the 3 months period, Energy Transfer showcased positive performance, achieving a revenue growth rate of 0.16% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Energy sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Energy Transfer's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 5.37%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Energy Transfer's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 3.21%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.91%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.7.

To track all earnings releases for Energy Transfer visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.