Planet Labs (NYSE:PL) is gearing up to announce its quarterly earnings on Monday, 2024-12-09. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Planet Labs will report an earnings per share (EPS) of $-0.04.

Planet Labs bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

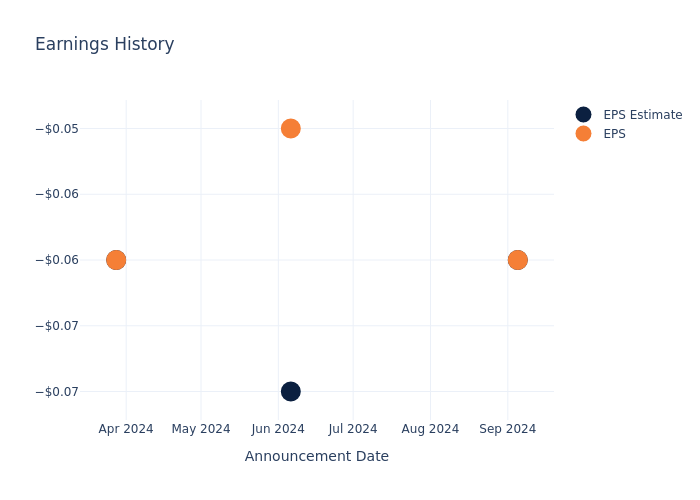

Performance in Previous Earnings

During the last quarter, the company reported an EPS missed by $0.00, leading to a 28.23% drop in the share price on the subsequent day.

Here's a look at Planet Labs's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.06 | -0.07 | -0.06 | -0.08 |

| EPS Actual | -0.06 | -0.05 | -0.06 | -0.05 |

| Price Change % | -28.000000000000004% | 11.0% | 0.0% | -5.0% |

Stock Performance

Shares of Planet Labs were trading at $4.09 as of December 05. Over the last 52-week period, shares are up 71.85%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on Planet Labs

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Planet Labs.

The consensus rating for Planet Labs is Outperform, based on 3 analyst ratings. With an average one-year price target of $3.7, there's a potential 9.54% downside.

Comparing Ratings with Peers

This comparison focuses on the analyst ratings and average 1-year price targets of CRA Intl, Innodata and NV5 Global, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- CRA Intl received a Outperform consensus from analysts, with an average 1-year price target of $212.0, implying a potential 5083.37% upside.

- The consensus among analysts is an Buy trajectory for Innodata, with an average 1-year price target of $34.0, indicating a potential 731.3% upside.

- The consensus outlook from analysts is an Neutral trajectory for NV5 Global, with an average 1-year price target of $25.0, indicating a potential 511.25% upside.

Analysis Summary for Peers

The peer analysis summary outlines pivotal metrics for CRA Intl, Innodata and NV5 Global, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Planet Labs | Outperform | 13.64% | $32.31M | -7.94% |

| CRA Intl | Outperform | 13.69% | $52.56M | 5.76% |

| Innodata | Buy | 135.57% | $21.33M | 45.35% |

| NV5 Global | Neutral | 5.62% | $129.51M | 2.10% |

Key Takeaway:

Planet Labs is positioned at the bottom for Revenue Growth among its peers. It ranks at the bottom for Gross Profit as well. The company is also at the bottom for Return on Equity. Overall, Planet Labs is lagging behind its peers in terms of financial performance metrics.

Delving into Planet Labs's Background

Planet Labs PBC is an Earth-imaging company. The company provides daily satellite data that helps businesses, governments, researchers, and journalists understand the physical world and take action.

Financial Milestones: Planet Labs's Journey

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3 months period, Planet Labs showcased positive performance, achieving a revenue growth rate of 13.64% as of 31 July, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Planet Labs's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -63.29%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Planet Labs's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -7.94%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Planet Labs's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -5.8%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Planet Labs's debt-to-equity ratio is below the industry average. With a ratio of 0.05, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Planet Labs visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.