5 analysts have shared their evaluations of G-III Apparel Group (NASDAQ:GIII) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 2 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 1 | 0 |

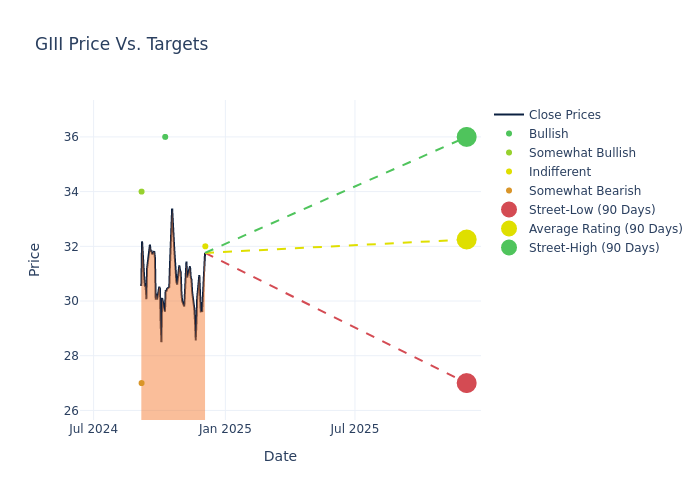

In the assessment of 12-month price targets, analysts unveil insights for G-III Apparel Group, presenting an average target of $32.2, a high estimate of $36.00, and a low estimate of $27.00. Witnessing a positive shift, the current average has risen by 11.03% from the previous average price target of $29.00.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive G-III Apparel Group is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Dana Telsey | Telsey Advisory Group | Maintains | Market Perform | $32.00 | $32.00 |

| Robert Drbul | Guggenheim | Announces | Buy | $36.00 | - |

| Dana Telsey | Telsey Advisory Group | Raises | Market Perform | $32.00 | $29.00 |

| Noah Zatzkin | Keybanc | Raises | Overweight | $34.00 | $32.00 |

| Paul Kearney | Barclays | Raises | Underweight | $27.00 | $23.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to G-III Apparel Group. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of G-III Apparel Group compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into G-III Apparel Group's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on G-III Apparel Group analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know G-III Apparel Group Better

G-III Apparel Group Ltd is a textile company. It makes a wide range of apparel, footwear, and accessories that it sells under its own brands, licensed brands, and private-label brands. G-III has a substantial portfolio for licensed and proprietary brands, anchored by five global power brands: DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger, and Karl Lagerfeld. The company has two reportable operations: Wholesale Operations and Retail Operations. The Wholesale operations segment includes sales of products under brands licensed by from third parties, as well as sales of products under its own brands and private label brands. The retail operations segment consists primarily of Wilsons Leather, G.H. Bass, and DKNY retail stores. It derives most of its revenues from Wholesale operations.

G-III Apparel Group: A Financial Overview

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Negative Revenue Trend: Examining G-III Apparel Group's financials over 3 months reveals challenges. As of 31 July, 2024, the company experienced a decline of approximately -2.27% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 3.76%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): G-III Apparel Group's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.6%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): G-III Apparel Group's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.92%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.42.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.