Deep-pocketed investors have adopted a bullish approach towards Rivian Automotive (NASDAQ:RIVN), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RIVN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Rivian Automotive. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 33% bearish. Among these notable options, 3 are puts, totaling $207,348, and 6 are calls, amounting to $276,695.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $10.0 and $17.5 for Rivian Automotive, spanning the last three months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Rivian Automotive options trades today is 17995.5 with a total volume of 9,175.00.

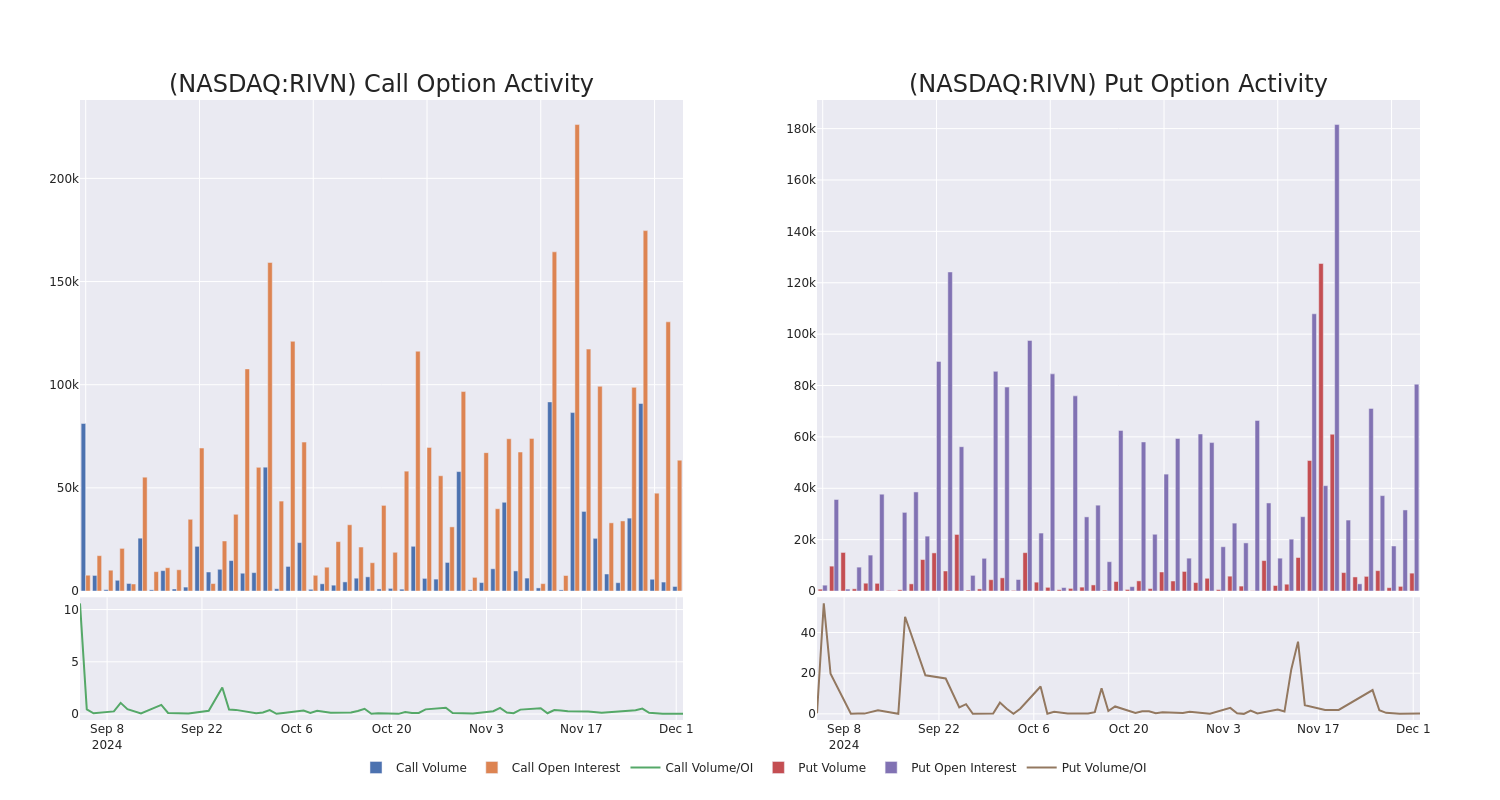

In the following chart, we are able to follow the development of volume and open interest of call and put options for Rivian Automotive's big money trades within a strike price range of $10.0 to $17.5 over the last 30 days.

Rivian Automotive 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIVN | PUT | SWEEP | BEARISH | 06/20/25 | $3.8 | $3.7 | $3.8 | $14.00 | $114.0K | 3.0K | 300 |

| RIVN | CALL | TRADE | BULLISH | 12/18/26 | $3.55 | $3.55 | $3.55 | $17.50 | $88.7K | 1.1K | 0 |

| RIVN | PUT | SWEEP | BEARISH | 01/17/25 | $0.39 | $0.25 | $0.39 | $10.00 | $53.9K | 77.4K | 1.5K |

| RIVN | CALL | TRADE | NEUTRAL | 01/15/27 | $5.1 | $4.9 | $5.0 | $12.00 | $50.0K | 2.7K | 214 |

| RIVN | CALL | SWEEP | BULLISH | 01/17/25 | $2.35 | $2.32 | $2.35 | $10.00 | $47.0K | 43.8K | 284 |

About Rivian Automotive

Rivian Automotive Inc designs, develops, and manufactures category-defining electric vehicles and accessories. In the consumer market, the company launched the R1 platform with the first generation of consumer vehicles: the R1T, a two-row, five-passenger pickup truck, and the R1S, a three-row, seven-passenger sport utility vehicle (SUV).

After a thorough review of the options trading surrounding Rivian Automotive, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Rivian Automotive

- Currently trading with a volume of 12,487,128, the RIVN's price is down by -3.11%, now at $11.85.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 79 days.

What Analysts Are Saying About Rivian Automotive

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $14.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Maintaining their stance, an analyst from Guggenheim continues to hold a Buy rating for Rivian Automotive, targeting a price of $18. * An analyst from RBC Capital persists with their Sector Perform rating on Rivian Automotive, maintaining a target price of $12. * An analyst from Mizuho has decided to maintain their Neutral rating on Rivian Automotive, which currently sits at a price target of $12. * Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Rivian Automotive with a target price of $18. * Maintaining their stance, an analyst from Needham continues to hold a Buy rating for Rivian Automotive, targeting a price of $14.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Rivian Automotive options trades with real-time alerts from Benzinga Pro.