Investors with a lot of money to spend have taken a bullish stance on Alibaba Gr Hldgs (NYSE:BABA).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with BABA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 45 uncommon options trades for Alibaba Gr Hldgs.

This isn't normal.

The overall sentiment of these big-money traders is split between 77% bullish and 20%, bearish.

Out of all of the special options we uncovered, 25 are puts, for a total amount of $2,165,752, and 20 are calls, for a total amount of $1,100,793.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $70.0 to $180.0 for Alibaba Gr Hldgs during the past quarter.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Alibaba Gr Hldgs options trades today is 4901.85 with a total volume of 21,852.00.

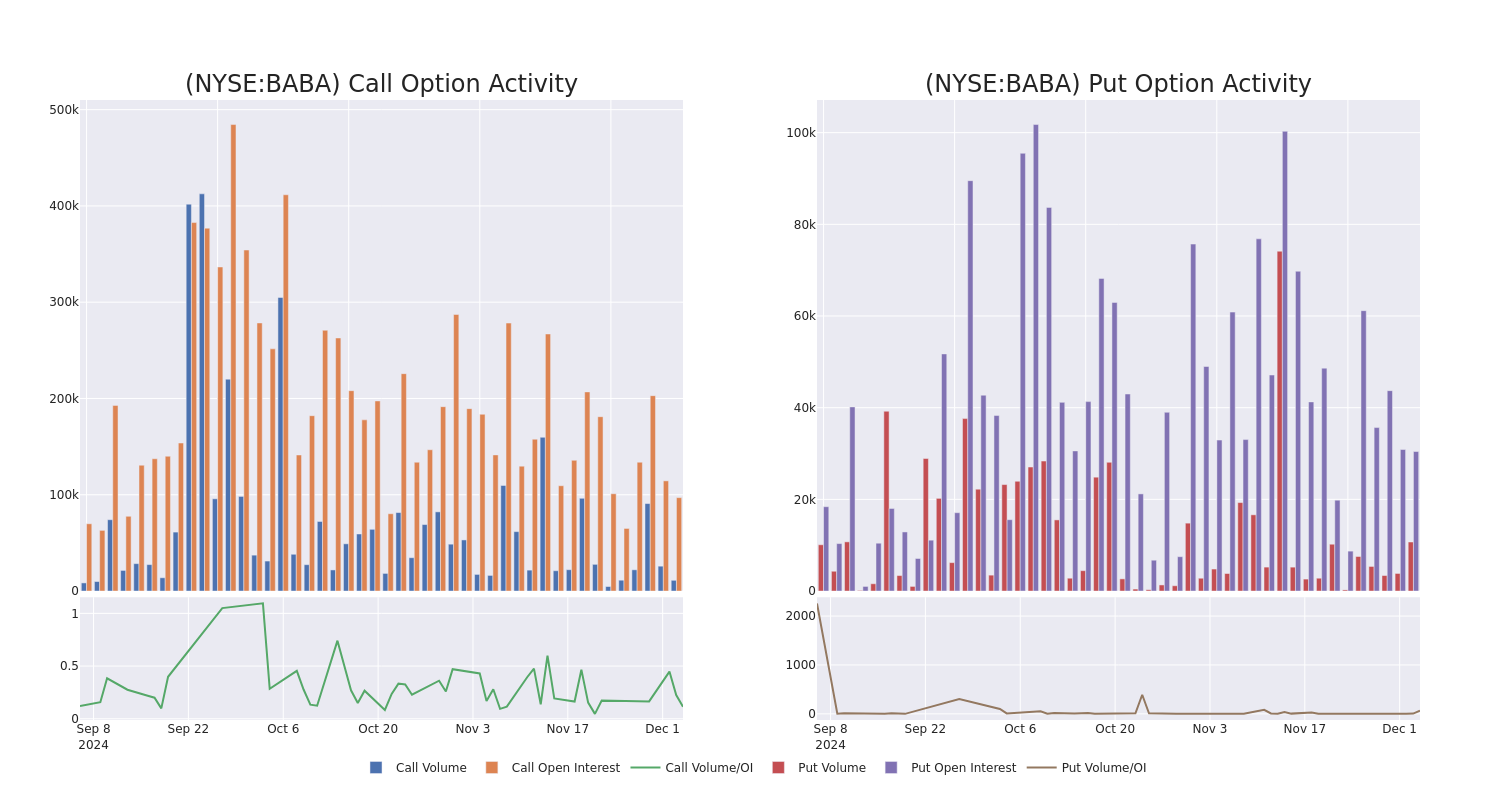

In the following chart, we are able to follow the development of volume and open interest of call and put options for Alibaba Gr Hldgs's big money trades within a strike price range of $70.0 to $180.0 over the last 30 days.

Alibaba Gr Hldgs 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BABA | PUT | TRADE | BULLISH | 06/20/25 | $4.0 | $3.85 | $3.9 | $75.00 | $780.0K | 5.1K | 2.0K |

| BABA | PUT | SWEEP | BULLISH | 09/19/25 | $36.05 | $36.0 | $36.05 | $120.00 | $472.2K | 1.0K | 136 |

| BABA | CALL | SWEEP | BULLISH | 01/17/25 | $2.39 | $2.35 | $2.39 | $90.00 | $131.6K | 20.9K | 1.4K |

| BABA | PUT | SWEEP | BULLISH | 12/20/24 | $9.95 | $9.85 | $9.85 | $94.00 | $98.5K | 24 | 205 |

| BABA | CALL | SWEEP | BULLISH | 01/17/25 | $4.3 | $4.2 | $4.3 | $85.00 | $96.7K | 14.0K | 1.5K |

About Alibaba Gr Hldgs

Alibaba is the world's largest online and mobile commerce company as measured by gross merchandise volume. It operates China's online marketplaces, including Taobao (consumer-to-consumer) and Tmall (business-to-consumer). The China commerce retail division is the most valuable cash flow-generating business at Alibaba. Additional revenue sources include China commerce wholesale, international commerce retail/wholesale, local consumer services, cloud computing, digital media and entertainment platforms, Cainiao logistics services, and innovation initiatives/other.

In light of the recent options history for Alibaba Gr Hldgs, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Alibaba Gr Hldgs

- Trading volume stands at 7,614,865, with BABA's price down by -1.12%, positioned at $84.72.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 63 days.

What The Experts Say On Alibaba Gr Hldgs

4 market experts have recently issued ratings for this stock, with a consensus target price of $119.75.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Barclays has decided to maintain their Overweight rating on Alibaba Gr Hldgs, which currently sits at a price target of $130. * Reflecting concerns, an analyst from Benchmark lowers its rating to Buy with a new price target of $118. * Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Alibaba Gr Hldgs with a target price of $113. * In a cautious move, an analyst from Benchmark downgraded its rating to Buy, setting a price target of $118.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Alibaba Gr Hldgs with Benzinga Pro for real-time alerts.