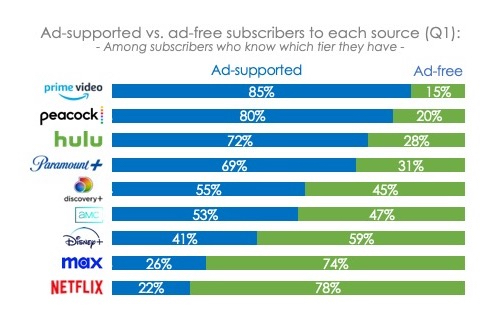

Amazon Prime Video, which only began integrating ad-support in January, now has 85% of its user base on its partially advertising-based tier, according to newly published data from Hub Entertainment Research.

This compares to only 22% for Netflix, which launched its ad-supported tier back in November 2022.

The key difference, as Hub points out, was execution of the strategy -- in order to avoid being defaulted into Amazon's ad-supported tier, Prime members have to make the proactive account-settings change within the app to pay an additional $2.99 to avoid commercials.

It's the other way around for services like Netflix, where users choose to save money by switching to the commercial-laden tiers.

“Virtually overnight, Amazon Prime Video dramatically transformed the video advertising ecosystem,” said Mark Loughney, senior consultant for Hub, in a statement. “Suddenly advertisers have the ability to reach tens of millions of viewers on one platform, with robust targeting capabilities and a vast retail capability. Amazon has immediately launched themselves into ‘must buy’ territory for advertisers and media agencies.”

For its latest Quarterly Churn Tracker, Hub surveyed 6,338 US consumers age 16-74, who watch at least one hour of TV per week, from January - March.

Notably, with the shift of the second largest U.S. subscription video platform to partial ad support, the percentage of domestic SVOD users who stream only commercial-free video dropped 9 percentage points from the fourth quarter to the first quarter, Hub added.

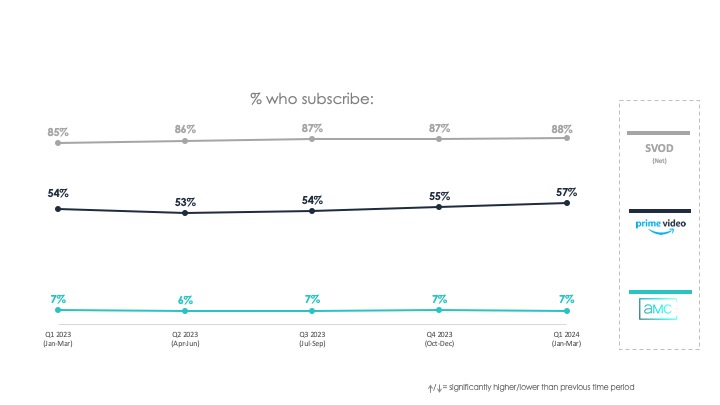

Meanwhile, Hub also found that at least early on, strong-arming its users into watching commercials hasn't harmed Amazon Prime Video's market share within the U.S. SVOD business.