Throughout the last three months, 8 analysts have evaluated Cummins (NYSE:CMI), offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 3 | 1 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 2 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 1 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

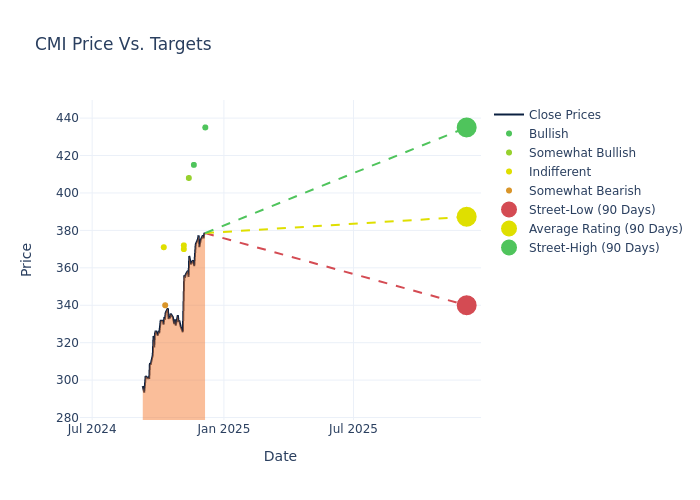

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $385.75, a high estimate of $435.00, and a low estimate of $340.00. This upward trend is apparent, with the current average reflecting a 13.79% increase from the previous average price target of $339.00.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of Cummins's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Volkmann | Jefferies | Raises | Buy | $435.00 | $410.00 |

| Kyle Menges | Citigroup | Raises | Buy | $415.00 | $375.00 |

| David Raso | Evercore ISI Group | Raises | Outperform | $408.00 | $294.00 |

| Jerry Revich | Goldman Sachs | Raises | Neutral | $370.00 | $324.00 |

| David Leiker | Baird | Raises | Neutral | $372.00 | $330.00 |

| Tami Zakaria | JP Morgan | Raises | Underweight | $340.00 | $285.00 |

| Kyle Menges | Citigroup | Raises | Buy | $375.00 | $345.00 |

| Jamie Cook | Truist Securities | Raises | Hold | $371.00 | $349.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Cummins. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Cummins compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Cummins's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Cummins's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Cummins analyst ratings.

Discovering Cummins: A Closer Look

Cummins is the top manufacturer of diesel engines used in commercial trucks, off-highway machinery, and railroad locomotives, in addition to standby and prime power generators. The company also sells powertrain components, which include transmissions, turbochargers, aftertreatment systems, and fuel systems. Cummins is in the unique position of competing with its primary customers, heavy-duty truck manufacturers, who make and aggressively market their own engines. Despite robust competition across all its segments and increasing government regulation of carbon emissions, Cummins has maintained its leadership position in the industry.

Understanding the Numbers: Cummins's Finances

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Cummins's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 0.3%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Cummins's net margin is impressive, surpassing industry averages. With a net margin of 9.57%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Cummins's ROE stands out, surpassing industry averages. With an impressive ROE of 8.14%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Cummins's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.55% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Cummins's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.79.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.