A funny thing happened to 2023's robust stock market rally. It's stalled at least for now. Traditionally, markets in the fourth quarter, especially November and December, cheer investors, and many market watchers are bullish, some wildly so.

Here are seven things that may affect stocks this week and next.

Was the August stall inevitable?

In a word: Yes.

One could hardly miss making money in stocks in the first half of the year, and most of the major indexes hit 52-week highs regularly into July with optimism rising for setting new all-time highs.

Related: JPMorgan's Jamie Dimon delivers a stern warning to remote workers

But market history is very clear: Stock prices do not rise forever. A wild ride up will soon produce a slump. Just look at the 2008 financial crisis or 2021 when stocks hit all-time highs.

The 2023 summer stall began to emerge in mid-to-late July as big-cap stocks, including (or especially) red-hot chip-maker Nvidia (NVDA) -), started to give off overbought signals.

After 2022's slump, the Nasdaq-100 Index (^NDX) -) hit a 52-week high on May 18 and hit new 52-week highs almost daily for the next two months. On July 16, it closed at 15,841.26, up 44.8% for the year and just 4.4% below its 2021 all-time high of 16,573.34.

The July 16 close may well be its high for the year. The index hit a 52-week high the next day at 15,932.05 and has been stuck below that level for 37 trading days. It's now 7.8% below that 2021 peak.

The major indexes were down in August, not horribly but noticeably, and September has opened lower, too. The August declines for the Nasdaq Composite and the Standard & Poor's 500 indexes were just the second monthly declines of the year for each.

Nvidia, by the way, hit an all-time intraday high of $502.66 on Aug. 24 with a market cap of nearly $1.2 trillion. Shares have fallen 9.3% from that peak. But they are still up 211% on the year.

Can one ignore the Fed yet?

In a word: No.

The Federal Reserve has been the biggest brake on stock prices since announcing its campaign to bring inflation down in December 2021. Since early 2022 through July, the Fed has raised its key rate from less than 1% to 5.25% to 5.5%.

The rate increases have trickled through all of the economy, setting off a slump in home sales and the 2022 bear market in stocks. Every Fed meeting since 2022 has brought worries and speculation beforehand and, often, big volatility after a rate-decision announcement.

The Fed's interest-making body, the Federal Open Market Committee, meets Sept. 19-20. The committee may leave rates alone but has suggested one more rate increase may be ahead this year.

Is inflation still a problem?

For the Fed, inflation is first among equals as a problem.

Before the Fed meets on Sept. 19, they will have two key inflation reports in hand: the Consumer Price Index and the Producer Price Index reports.

The consensus estimate is the CPI will show a 0.6% gain for the month, up from 0.2% in July. The year-over-year gain would be 3.6%, up from 3.2% in July.

The PPI estimate for the PPI is a small increase for August and a 1.2% increase year over year, up from 0.8% in July.

The question is if these reports freak out the inflation fighters at the Fed and result in a rate increase.

Are business profits still pressured?

Maybe not.

Stock prices reflect economic conditions, but profit growth is most important.

Earnings estimates have been soft all year, but FactSet has noticed the estimates are rising and sees estimated third-quarter earnings for S&P 500 stocks up 0.5% from a year ago.

It may not sound like much. But in a Friday note, John Butters, senior earnings analyst at FactSet, wrote if earnings do grow 0.5% in the quarter, that will be the first quarter with higher earnings growth since the third quarter of 2022.

That would be a bullish signal for many investors.

Will bond yields continue to move lower?

Credit markets suggest yields and interest rates could move lower still.

Interest rates have moved higher most of the year. But those rates stalled in August, too.

The closely watched 2-year Treasury yield hit a closing high of 5.084% on Aug. 24, up more than 14.9% on the year. By Friday, the yield had fallen back to 4.974%.

The 10-year Treasury yield hit its closing high at 4.336% on Aug. 21. The rate has slipped to 4.71%.

The modest changes in these yields mirrors what's been happening recently with mortgage rates.

For most of us, these are modest but welcome signs.

Would a UAW strike affect the markets?

The United Auto Workers may authorize a strike this week (as soon as Thursday) against General Motors (GM) -), Ford Motor Co. (F) -), and Chrysler owner Stellantis (STLA) -).

Related: Think the looming UAW strike won't affect consumers? Think again.

The Big Three still have huge impacts on such states as Michigan, New York, Ohio, Tennessee, Indiana, and Illinois, with tentacles reaching everywhere, including Canada and Mexico.

An auto shutdown could affect the economies of all three countries.

Could Russia and China tensions hurt the market?

They're affecting markets and stocks now.

China is increasingly interested in growing its influence in East Asia. And it has become an intense economic competitor with the United States.

Apple (AAPL) -) has been drawn into that competition. Reports this past week suggested China wants to limit Apple's presence, especially its iPhones. The shares fell nearly 6% on the week.

Sales to customers in China represents about 19% of Apple's total revenue. And many of its products and components are manufactured there.

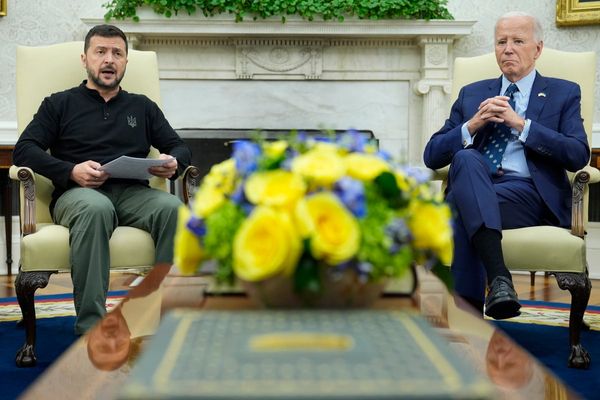

The Ukraine-Russia War, which erupted in 2022, has been a contributor to global inflation. The two countries combined are among the world's biggest grain exporters. Plus, Russia is a major producer of oil, coal and natural gas.