Winter has a sneaky way of draining bank accounts while everyone is busy admiring holiday lights and pretending they love the cold. One minute you’re sipping something warm and feeling cozy, and the next minute you’re wondering how a single season managed to torch your budget. Winter expenses don’t always arrive with flashing warning signs, which is why they feel so brutal when they finally show up. They creep in quietly, stack on top of each other, and then politely wreck your financial plans. By the time spring rolls around, many households are left asking the same question: where did all that money go?

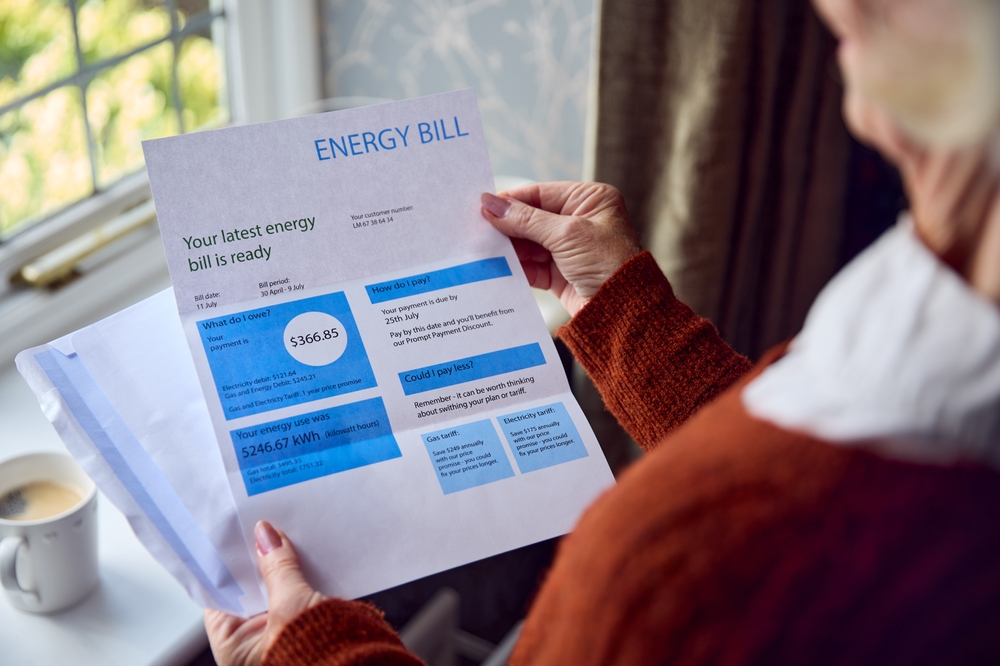

1. Heating Bills That Refuse To Play Nice

Heating costs are the undisputed heavyweight champion of winter expenses, and they rarely show mercy. As temperatures drop, furnaces work overtime, energy usage spikes, and utility bills quietly double or triple. Even households that consider themselves energy-conscious often underestimate how much constant heating really costs. Drafty windows, aging systems, and poorly insulated homes all amplify the damage. By the time winter peaks, many people are paying more to heat their home than they do for groceries.

2. Vehicle Costs That Multiply In The Cold

Winter is brutal on cars, trucks, and SUVs, even when you do everything “right.” Cold weather drains batteries faster, thickens fluids, and exposes weak tires that managed to survive the rest of the year. Snow, ice, and salt lead to increased wear and tear, which means more frequent maintenance and surprise repair bills. Fuel costs can rise too, especially when engines idle longer just to stay warm. Add in winter tires or emergency roadside services, and suddenly driving becomes far more expensive than expected.

3. Grocery Bills That Quietly Balloon

Winter grocery shopping has a way of inflating costs without anyone noticing until the receipt prints. Seasonal produce becomes more expensive, comfort foods take over carts, and people cook more meals at home that rely on pricier ingredients. Holiday leftovers, hosting guests, and stocking up “just in case” all contribute to higher totals. Even snacks seem to multiply when families spend more time indoors. Over several months, these small increases can add hundreds of dollars to household spending.

4. Home Repairs That Never Wait For Spring

Winter has impeccable timing when it comes to breaking things inside your home. Pipes freeze, heaters fail, roofs leak, and doors suddenly stop sealing properly at the worst possible moment. Emergency repairs often cost more because they can’t be postponed and frequently require immediate professional help. Cold weather can also reveal hidden problems that went unnoticed during warmer months. What starts as a minor issue can quickly turn into a major expense if it’s ignored.

5. Childcare And School-Related Costs That Add Up

Families with children often feel winter expenses hit from multiple angles at once. Snow days, school closures, and weather-related disruptions can lead to unexpected childcare costs. Kids also need winter clothing, boots, and gear that they may outgrow by next year. Extracurricular activities don’t stop just because it’s cold, and indoor programs often cost more than outdoor ones. By the end of winter, parents may realize they spent far more on child-related expenses than planned.

6. Mental Health And Comfort Spending You Don’t Budget For

Winter doesn’t just affect wallets directly; it also influences spending habits in subtle emotional ways. Shorter days and colder weather push people toward comfort spending, like takeout, streaming services, and impulse online purchases. Small indulgences feel justified when morale dips, but they quietly pile up. Many households don’t track these expenses closely because each one feels harmless on its own. Over time, emotional spending becomes one of winter’s most underestimated financial drains.

Winter’s Real Cost Deserves Honest Conversation

Winter expenses aren’t just inconvenient; they’re often underestimated, misunderstood, and brushed aside until the damage is done. When households pretend these costs are minor or unavoidable, it becomes harder to plan for them realistically. Talking openly about winter spending can help people prepare better and feel less alone when the bills start stacking up. Everyone has their own winter financial horror stories, from shocking heating bills to surprise repairs that ruined a month’s budget.

Make sure to give us your thoughts, experiences, or survival tips in the comments section below and join the conversation.

You May Also Like…

8 Holiday Behaviors That Lead to Financial Stress Long After the Decorations Come Down

Holiday Pressure: Do You Actually Know Who Pushes You to Overspend Every December?

The Ultimate List of Holiday Activities to Brighten Up Your Winter

10 Household Products That Became Cheaper — And More Toxic

Transform Your Home Sale: Expert Tips to Attract Buyers and Boost Value

The post 6 Winter Expenses That Hit Households Harder Than Anyone Admits appeared first on Everybody Loves Your Money.