You didn't sell your S&P 500 stocks in May, right? Hope not.

If you invested $10,000 in January in the top-performing stock in the S&P 500 at the time and reinvested that in each month's top performer, including First Solar in May, you'd have $40,427 now, says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSurge.

That's an impressive four-month gain of 304%. It's quite a feat given the S&P 500 itself is up a solid 10% so far this year. The same $10,000 invested in the S&P 500 would be worth just $10,976 now. That's a gain of just $976. The S&P 500 gained 2.3% in May, pushing it up for the fourth month from January to May.

Will The S&P Keep Rolling In June 2024?

Hindsight is 20-20. And, clearly, few if any investors could have picked the top stock in each of the past five months, as it's not a repeatable strategy. But the staggering numbers this year remind investors amazing gains can be scooped up by diligent investors even when the S&P 500 starts to fade.

In fact, even in a month the index rose, the S&P offered many ways to make even more money. And nearly half of the stocks in the S&P 500 gained during May. And of those, seven stocks jumped more than 25% in just one month.

Top S&P 500 Stock Of May: First Solar

The S&P 500 itself was impressive in May. But you could have done even better still.

First Solar, a maker of solar-power equipment, saw its shares jet 53.1% in the month. That's the best top monthly gain by any S&P 500 stock this year.

And First Solar's stunning gain came following the company on May 1 announcing a first-quarter profit of $2.20 a share. That topped views by nearly 9%. That was also a rise of 450% from the company's profit in the same year-ago period.

Reading The S&P 500 So Far This Year

Monthly S&P 500 winners show how investors ducked and weaved all year.

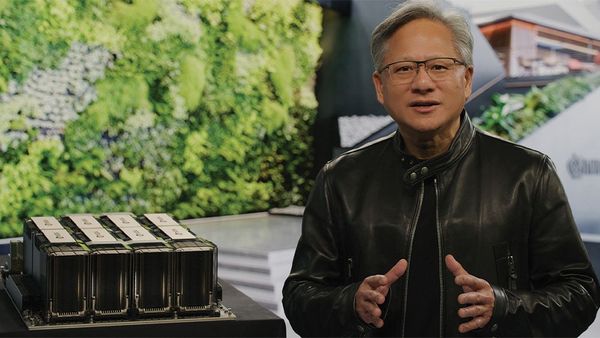

The AI rally dominated in January. And of course, AI king Nvidia ruled with a 24.2% monthly rise. February the whole S&P 500 jumped 5.2%, its best monthly gain this year so far. And that month the AI-fueling utility Constellation Energy won with a 38.6% rise.

And then in March, the semiconductors lit it up. Micron Technology jumped 30.1%. And then investors pulled back in April due to worries about inflation. The S&P 500 dropped 2.6% in April, while gold miner Newmont took off 17.9%.

May was the First Solar rally.

What's Coming Next For The S&P 500?

The big question, though, is: Will the S&P 500's winning streak keep going in June 2024? Historically, investors famously like to sell in May and go away until November.

June is usually pretty lousy for stocks. It's the fourth-worst month for the S&P 500 going back to 1950, says the "Stock Trader's Almanac." The S&P 500 rises just 0.02% in June on average. And it fell nearly 46% of the time.

Keep in mind, though, June like May can be somewhat unpredictable. Maybe it'll be a pleasant surprise like in May.

How To Turn $10,000 Into $26,406 In 4 Months

| Month | Top S&P 500 stock | Symbol | Monthly gain | Sector | S&P 500 monthly ch. | Starting balance | Cumulative value of $10,000 investment in January reinvested in best stock each month |

|---|---|---|---|---|---|---|---|

| January | Nvidia | NVDA | 24.2% | Information Technology | 1.6% | $10,000 | $12,420 |

| February | Constellation Energy | CEG | 38.6% | Utilities | 5.2% | $12,420 | $17,214 |

| March | Micron Technology | MU | 30.1% | Information Technology | 3.1% | $17,214 | $22,397 |

| April | Newmont | NEM | 17.9% | Materials | -2.6% | $22,397 | $26,406 |

| May | First Solar | FSLR | 53.1% | Information Technology | 2.3% | $26,406 | $40,427 |