S&P 500 medical stocks Cardinal Health, Vertex Pharmaceuticals, Merck, Intuitive Surgical and Insulet are in focus this week.

Medical stocks are coming into favor again — with companies involved in biotech, pharmaceuticals, medical products and more bouncing back.

The major indexes held up well in a holiday-shortened trading week, but many sectors and leading stocks sold off hard. The Nasdaq fell, but recovered the 12,000 level Thursday. Meanwhile, the S&P 500 edged lower while the Dow Jones moved higher.

Many stocks suffered significant damage during the week. However, S&P 500 medical stocks held up, as health-care related plays tend to do well in tricky markets and economic conditions.

Medical stocks are seen as defensive growth because government and private insurance covers the vast majority of health-care costs, making them recession-resistance. But will this rotation into medical stocks continue?

A lot may depend on whether recession fears continue to grow. On Friday, the March jobs report showed slowing hiring and wage growth but also declining unemployment.

S&P 500: Cardinal Health Stock

CAH shares jumped 4.9% to 79.23 this past week. The drug and medical supplies distributor has shot up nearly 16% since it hit a recent low of 68.53 on March 23, just below its 200-day moving average.

Cardinal Health stock is in a five-month consolidation with an 81.67 buy point, according to MarketSmith analysis. While CAH stock is not extended from its 50-day line, a handle or some sort of pause could be helpful.

Cardinal Health, based in Dublin, Ohio, offers a wide assortment of health care services and medical supplies to hospitals, labs, pharmacies and long-term care facilities. The company reports that it serves around 90% of hospitals and 60,000 pharmacies in the U.S.

The company is one of the "Big Three" involved in distributing drugs, medical devices and supplies — alongside McKesson and AmerisourceBergen. They buy medicine and supplies at wholesale prices and then distribute them to hospitals, pharmacies and doctors' offices.

Cardinal Health reports third-quarter 2023 earnings on May 4. Analysts see EPS up 2% to $1.48 with sales increasing 10% to $49.45 billion. In February, Cardinal Health topped Q2 earnings and revenue estimates, with EPS and sales increasing 4% and 13%, respectively.

In late 2022, Cardinal Health experienced a shake-up after activist investor Elliott Management came into the picture. The move prompted several board changes. The company's previous chief executive also retired.

Cardinal Health stock ranks second in the Medical-Wholesale Drug Supplier industry group. The S&P 500 stock has an 83 Composite Rating. CAH has a 91 Relative Strength Rating, an exclusive IBD Stock Checkup gauge for share price movement. The EPS rating is 57.

Insulet Stock

The medical stock edged down 0.4% to 317.72 on the week. Insulet stock gained 18% since a recent low of 269.06 on March 10.

On March 13, PODD stock shot up more than 8% on news that it would join the S&P 500 index, moving above its 50-day moving average. Since then it has moved sideways, trading in line with the S&P 500. Insulet stock is currently in a five-month long consolidation with a 320.10 buy point. Shares have moved above and below the buy point over the past few weeks.

The U.S.-based company sells insulin pumps for genetic type 1 diabetes and the progressive type 2 condition. Diabetes patients need additional insulin to keep their blood sugar in check.

Insulet's devices are body-worn insulin delivery systems. The company recently launched a new device for type 1 patients age 2 and up, dubbed Omnipod 5.

Insulet announced first-quarter financials May 4 with analysts expecting earnings falling 72% with sales growing 12%.

The S&P 500 stock sits third in the Medical-Products industry group. Insulet stock has a 97 Composite Rating. The medical stock has a 91 Relative Strength Rating. The EPS rating for PODD is 73.

Vertex Pharmaceuticals Stock

The medical stock gained 2.1% on the week, closing Thursday at 321.66. Vertex Pharmaceuticals stock hit a recent low of 283.60 on March 8. Since then, the medical stock has surged 13%.

Vertex currently has a 325.29 buy point, according to MarketSmith analysis. Its stock could use a pause after rising for four straight weeks off the bottom of its base.

The consolidation goes back to late January, but VRTX stock has effectively been moving sideways since early December. Shares are up 11% so far in 2023.

The Boston-based global biotech company dominates the cystic fibrosis treatment market. Vertex also has other products in late-stage clinical development that target sickle cell disease, Type 1 diabetes and certain genetically caused kidney diseases. That includes a gene-editing partnership with Crispr Therapeutics. Vertex will use Crispr's gene editing technology to develop type 1 diabetes cell therapies.

The company will pay $100 million upfront while future payments will include royalties.

In early February, the biotech company reported better-than-expected Q4 earnings per share and in-line sales. It also offered full-year 2023 revenue guidance of $9.55 billion to $9.7 billion for its cystic fibrosis treatment Trikafta, at the top end of analyst estimates.

Wall Street expects Vertex to report Q1 financials in early May. Analysts predict EPS dropping 13% to $3.06 with revenue growing 11% to $2.33 billion.

The S&P 500 stock ranks third among the medical stocks in the Medical-Biomed/Biotech industry group. VRTX has a 96 Composite Rating. The medical stock has an 84 Relative Strength Rating. The EPS rating for Vertex Pharmaceuticals stock is 97.

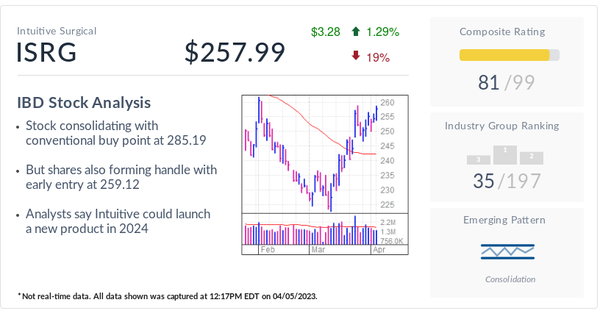

S&P 500: Intuitive Surgical Stock

This medical stock edged up 0.6% this week to 256.90. Intuitive Surgical stock has climbed 15% from its March 13 low of 222.65.

ISRG stock has an official 285.19 buy point. It has a handle, but the midpoint is just below the midpoint of the base, making it technically invalid. Still, investors could use 259.12 as an early entry, 10 cents above the March 27 high.

The California-based company develops, manufactures and markets robotic surgery products. Intuitive Surgical is known for its da Vinci Surgical System.

The S&P 500 stock was Wednesday's IBD Stock Of The Day with Wall Street awaiting news about the company's next robotic surgery system.

Intuitive Surgical earnings are due April 20, something investors should keep in mind. Analysts forecast first-quarter EPS growing 5% to $1.19 with revenue increasing 7% to $1.59 billion.

After earnings fell in 2022, ISRG stock analysts expect the company to be solidly profitable in the next several years. This year, the analysts surveyed by FactSet expect adjusted earnings of $5.30 per share, growing 13%. They expect sales to increase 11% to $6.9 billion. In 2024, the Street calls for 17% and 13% growth, respectively, for earnings and sales.

The S&P 500 stock is No. 9 in the Medical-Systems/Equipment industry group. Intuitive Surgical stock has an 84 Composite Rating. The medical stock has a 77 Relative Strength Rating. The EPS rating for ISRG is 64.

S&P 500: Merck Stock

Medical stock MRK gained 5.6% this week to 112.33. Since hitting a low of 102.44 on March 24, Merck stock jumped around 10%, regaining its 50-day moving average.

Merck stock has formed a three-month base and is 3% below a 115.59 buy point, 10 cents above its Jan. 6 high. However, Merck is actionable from early entries above a downsloping trendline or a flat line from the March 7 high of 112.18.

Rahway, New Jersey-based Merck reports first-quarter financials on April 27. Analysts predict earnings falling 35% to $1.38 per share with revenue dropping 13% to $13.87 billion.

During the December quarter, Merck earned $1.62 per share, minus some items, on $13.83 billion in sales. Earnings sank 10% year over year, but topped forecasts. Sales also came in north of expectations and grew 2%. In constant currency, sales grew 8% and earnings fell 7%.

For the year, Merck earnings popped 39%.

CEO Robert Davis told investors in February that, "2022 was an exceptional year for Merck."

Is Merck Stock A Buy Right Now Or A Sell Right Now?

There is excitement for an experimental vaccine by Merck and Moderna.

The S&P 500 stock sits seventh in the Medical-Ethical Drugs industry group. Merck stock has an 86 Composite Rating. The medical stock has an 88 Relative Strength Rating. The EPS rating for MRK is 67.

Please follow Kit Norton on Twitter @KitNorton for more coverage.