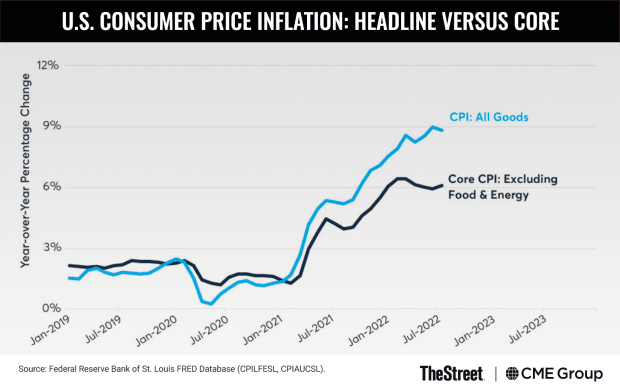

The U.S., along with the U.K., the eurozone countries, and many other nations around the world, are in a deep inflation hole. In the U.S., headline inflation is running at more than 8% on a year-over-year basis, while core inflation, excluding food and energy, is running in the 6% territory.

When will this inflation episode abate? We don’t have a specific view on pace and timing, but we do have some observations as to why inflation may have reached its peak and may decelerate going forward. In particular, we want to tap into the wisdom of Will Rogers, who is quoted as saying, “If you want to get out of a hole, the first thing you need to do is stop digging.”

Below, we examine five of the often-cited possible causes for the inflation episode in the U.S., and we ask the basic question of whether we have stopped digging yet – a key prerequisite for inflation starting to decline.

1. Pandemic Shift in Consumption Patterns

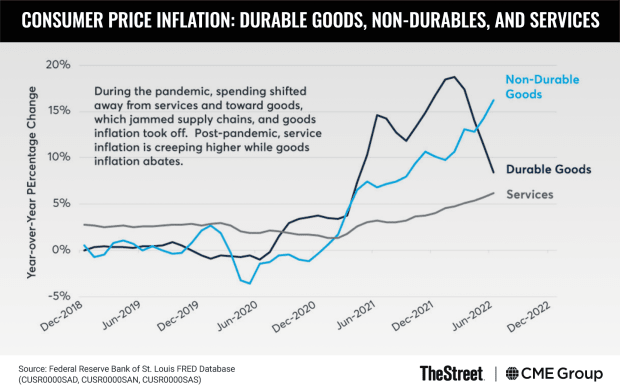

The pandemic dramatically shifted consumption patterns with the partial shutdown of the U.S. economy. The relative share of goods consumption moved upward at the expense of services, with the limits on travel, tourism, dining, etc. For example, in the 12 months from July 2020 through June 2021, durable goods spending was 25% higher than in the calendar year 2019, and non-durable goods spending was up 9%, compared to modest declines in services spending. Not surprisingly, the initial upticks in inflation were most severely felt in the durable goods category, followed by non-durable goods.

More recently, the growth of durable, non-durable, and services spending from January 2022 through June 2022 rose 9%, 10%, and 8%, respectively, compared to the previous six months. That is, spending growth has evened out among these three critical categories.

Our conclusion is that the pandemic-induced boom in spending on goods has run its course and that in the post-pandemic world the U.S. is returning to a more typical balance between goods and services consumption.

2. Supply Chain Disruptions

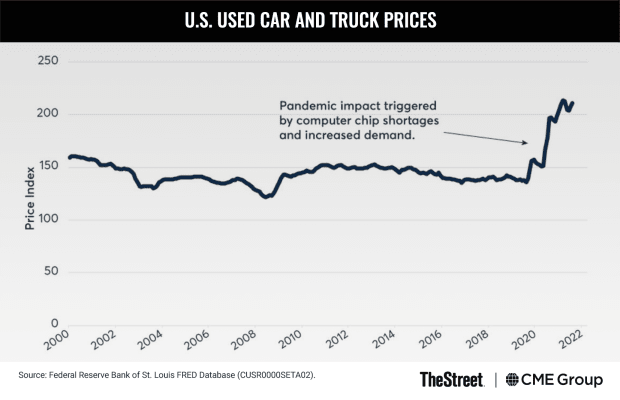

The global goods-producing engine was not remotely ready for the surge in the pandemic-induced demand for goods, especially durable goods, such as automobiles. At the same time, in the early phases of the pandemic, covid was disrupting both the production and transportation of goods. That is, goods markets were hit simultaneously both by demand and supply shocks.

For example, computer chip shortages hit new car production especially hard, leading to a major surge in the prices of used cars. On the transport side, many of the goods in high demand were produced in China, and shipping costs from Shanghai to Los Angeles soared.

While it takes billions of dollars and years of planning and construction to build new computer chip factories, suggesting a lengthy multiyear period to resolve many supply chain challenges, there is clear evidence in prices that the worst is over. Shipping costs from Shanghai to Los Angeles are well off their peaks, even if they remain well above pre-pandemic norms. While we are probably a few years away from resolving the vast majority of supply chain challenges, there is no question that progress has been made and that supply chain disruptions are no longer pushing prices higher and higher, even if in many cases prices remain elevated.

3. Pandemic Emergency Fiscal Stimulus

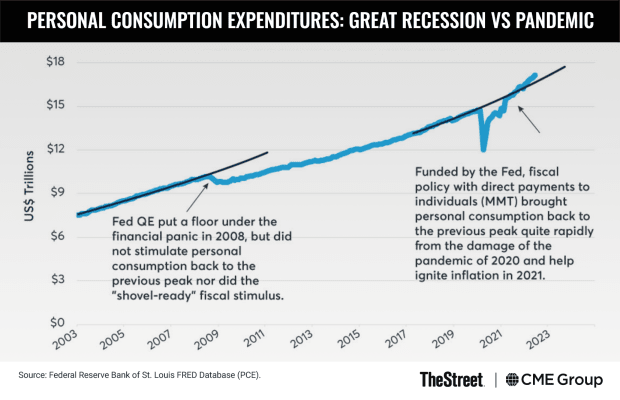

Both the Trump and Biden administrations provided trillions of dollars of emergency fiscal spending during 2020 and early 2021 to offset the worst of the pandemic’s impact on job losses. Much of the emergency government spending was made in the form of direct transfer payments to individuals, of which a considerable amount was spent within months of being received. Indeed, one of the main differences in the fiscal response to the Great Recession in 2008-2009 and the pandemic in 2020 was the massive fiscal response to assist individuals to keep spending even if they had lost their jobs.

The result was that personal consumption expenditures rapidly regained their pre-pandemic peak, while after the Great Recession, there was no quick recovery at all in personal consumption, which makes up roughly two-thirds of the U.S. economy.

The point we want to make is that the emergency fiscal spending has run its course and is not being renewed. Indeed, the U.S. government federal budget deficit, which hit $2.4 trillion in the fiscal year 2021, is on track to come in at $637 billion in the fiscal year 2022, and decline further in 2023, according to the projections from the Congressional Budget Office (CBO). The inflation impetus from fiscal spending during the pandemic was, no doubt, massive, but fiscal policy as a source of future inflation is no longer in play.

4. Central Bank Asset Purchases

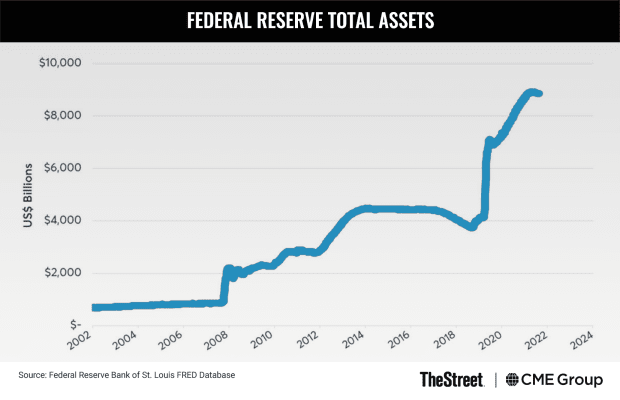

When the government embarks on a major new spending program, it has the choice of financing the new spending by raising taxes, selling debt to the public or selling debt to the central bank. The latter is what goes by the name of Modern Monetary Theory, and this is what happened in 2020 and 2021 in the U.S. The trillions of dollars of new spending by the federal government were largely bought by the Federal Reserve, limiting the amount of new borrowing required from the public sector.

A key point to appreciate when government spending is massively increased and associated with equally massive debt purchases by the central bank is the price discovery process is prevented from working. The presumption is that without central bank debt purchases, and without any tax increases, the additional supply of government debt sold to the public would have pushed bond yields higher, perhaps significantly higher. Higher bond yields would have meant higher mortgage rates, and the boom in housing prices that occurred in 2021 might never have happened, impacting durable goods demand associated with house purchases.

Importantly, there is a distinction here between central bank asset purchases that support increased government spending and central bank asset purchases that occur independently of fiscal policy. The latter version of quantitative easing (QE), as it has come to be called, appears to have contributed to significant asset price inflation in the 2010-2016 period, but QE without accompanying fiscal spending does not appear to encourage either faster growth in the real economy or inflation in consumer prices.

That is, what made the Federal Reserve’s asset purchases so important as an inflation driver in 2020-2021 and not in the 2010-2016 period was the linking of the asset purchases to massive new government spending. Regardless of one’s view of the role of central bank asset purchases as a cause of future inflation, the Federal Reserve is now shrinking its balance sheet, and this source of future inflation is no longer occurring.

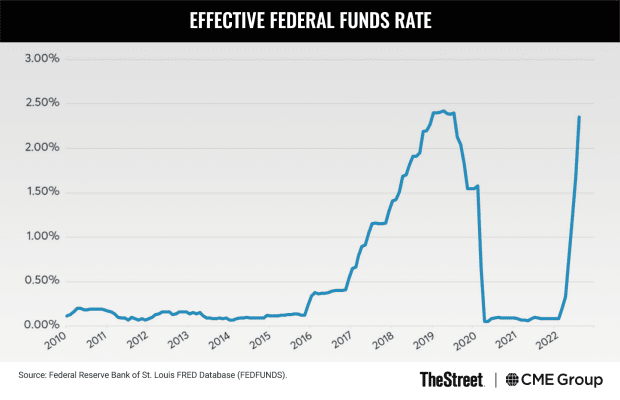

5. Interest Rate Policy

Our last observation is that the era of near-zero short-term interest rates has ended. To the extent that an accommodative interest rate policy was a driver of future inflation, that driver is being withdrawn.

Importantly, the short-term interest rate increases taken by the Federal Reserve in 2022 are often described as an “aggressive tightening” of interest rate policy. Our interpretation is decidedly different. In our interpretation, any level of short-term rates that is below a reasonable view of inflation expectations remains accommodative, just not as accommodative as zero rates. That is, the Federal Reserve, in moving the effective federal funds rate from around 0.10% to 2.33% from January through July 2022, has merely taken its foot off the accelerator, but it has not hit the brakes. This is better described as a withdrawal of accommodation and not a tightening of monetary policy.

Regardless of the preferred interpretation, interest rate policy as a source of future inflation is being withdrawn. And very importantly, a change in interest rate policy is typically thought to impact the real economy with long and variable lags. While mortgage rates have already doubled, the longer-term implications for the housing market have not yet been observed. Put another way, whatever the long-run impact higher rates are going to have on the real economy, it has not been felt yet.

Inflation May Be Sticky, but Is Easing

Every one of the five factors discussed has changed course in the past six to 12 months and is no longer likely to be a source of future inflation, regardless of its role in creating current inflation. That is, if Will Rogers was right that the first step in getting out of a hole is to stop digging, well, the digging has stopped. Inflation may well be a bit sticky and take its time coming down, yet the likely suspects of the root causes of the current inflation episode have all been addressed in full or in part.