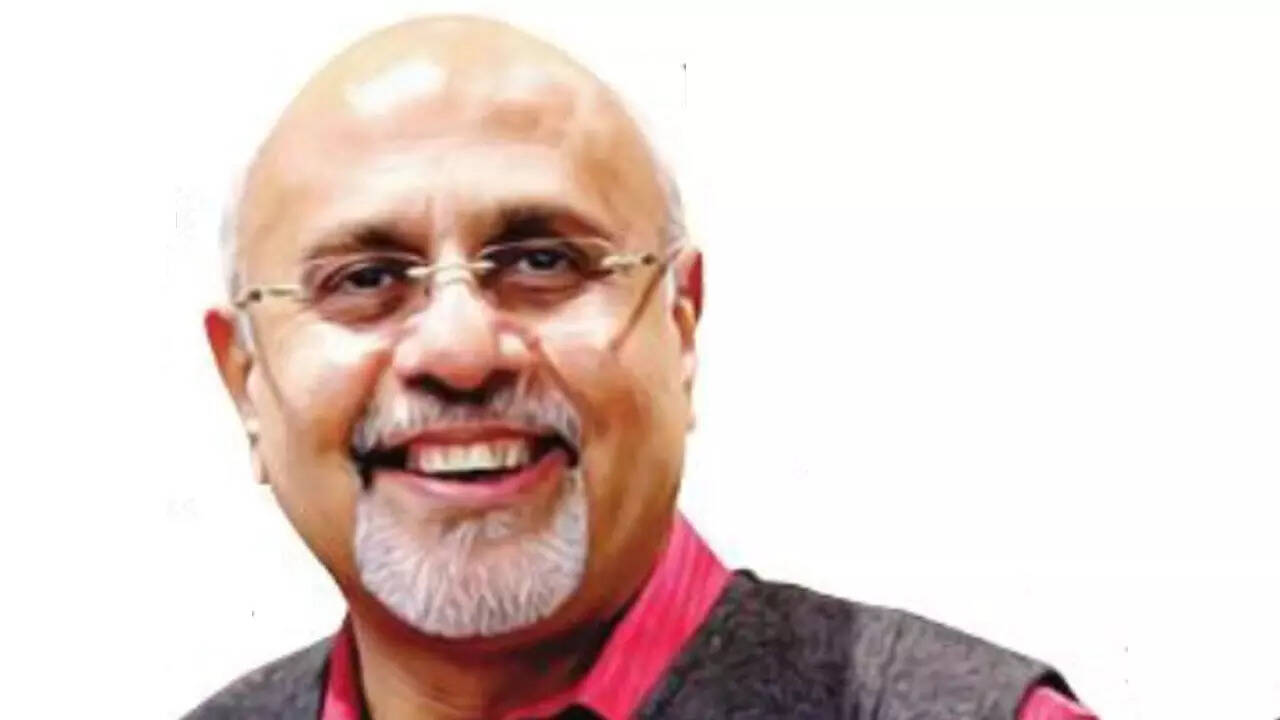

AHMEDABAD: Come Tuesday, February 1, Ahmedabad based tax expert, Mukesh Patel, will be in his office by 10am sharp. Sipping his tea, he will go through the pre-budget commentary and gear up to cover the 47th Union Budget presentation of his career.

After hearing Union finance minister Nirmala Sitharaman deliver the budget speech, his inning for his day will begin – shuffling between news debate panels, going through printed copies of the budget document and the finance bill word by word for hours, making notes, highlighting important developments and preparing his budget analysis speeches.

Patel’s workday typically ends at 5am the next day, after which he catches up on rest and prepares for a slew of meetings and budget analysis lectures over the next week or so. Ever since 1977, when Patel covered his first budget, his work schedule has remained so.

“Back in 1977, I travelled to Delhi as a representative of a Gujarati daily newspaper and covered the budget presented by then finance minister H M Patel. The budget coverage continued clinically over 20 years till 1996, when there was no live coverage of proceedings through radio or television,” recalls Patel.

A young law graduate in 1977, Patel drew inspiration and trained for covering budgets under jurist and economist, Nani Palkhivala. “For two years, Palkhivala invited me to his office at Tata House in Mumbai and to his budget talks at Brabourne stadium, where he taught me the finer aspects of budget analysis, from reading and dissecting the fine print of the budget and finance bill to articulating its nuances for the public during the course of the speech,” said Patel, who over the next four decades continued delivering budget analysis lectures through his budget yatras across 40 cities and towns in Gujarat.

“Every year, five to seven days after the Budget are blocked for my marathon budget yatra run,” he

said.

He was associated with The Times of India as a columnist from 1998 to 2015. When Patel was pursuing law in the mid1970, India was described as the highest taxed nation in the world. With peak rates of income tax being 97. 75%, wealth tax at 5%, gift tax at 75% and estate duty at 85%.

“I have been witness to the sliding down of the peak income tax rate to 30% in 1997, abolition of estate duty in 1985, rationalization of wealth tax in 1992 followed by its complete abolition in 2015 and the scrapping of gift tax in 1998 followed by the reintroduction of income tax on gifts in 2004,” he said, recounting key milestones of his journey.

Thanks to his experience, the tax guru was appointed to the Easwar committee for simplification and rationalization of tax laws and administration and to the task force for drafting a new income tax law from 2015 to 2019.