If you don’t have a credit history, you might have a low or non-existent FICO credit score (the three-digit number that financial institutions use to determine an individual’s creditworthiness).

Unfortunately, a good credit score is necessary for a lot of common situations—trying to secure a car loan, get a credit card, or pass a rental application for an apartment, to name a few.

Attempting to build a good credit score from scratch is sort of like trying to get a job without experience. It’s a catch-22; in order to build credit, you need to borrow money, and in most cases, in order to borrow money, you need a decent credit score.

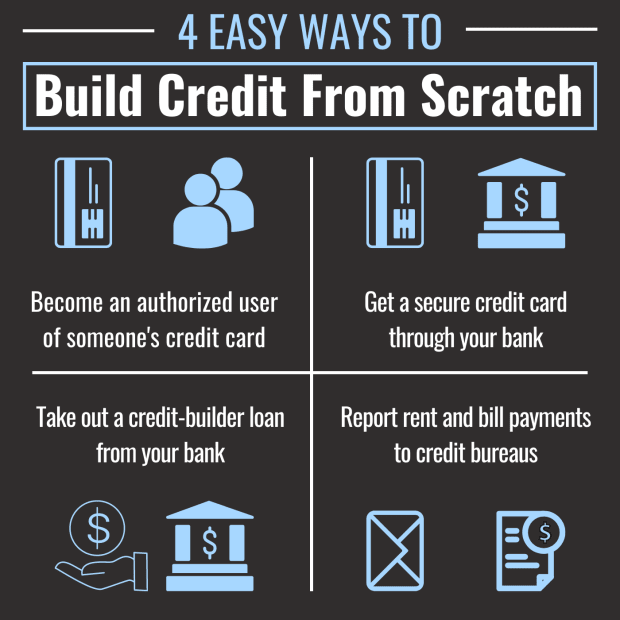

So, just how can you start to build credit from scratch? Try one of the four options below. They are not mutually exclusive, so trying a few at once may help you establish a score more quickly.

Remember—building and using credit does not require spending more money than you have. Credit can be a double-edged sword, so do your best to avoid spending more than you can pay back.

1. Become an Authorized User of Someone Else’s Credit Card

To use credit (i.e., to be the primary account holder of a credit account like a personal loan or credit card), an individual must be at least 18 years of age. However, there is a way that even those under 18 can get a head start on their credit-building mission—assuming they have an adult friend or relative who trusts them enough to risk their own credit score.

Many credit cards allow (and encourage) account holders to add “authorized users” to their accounts. An authorized user is a trusted person who has been granted access to an account holder’s line of credit. This allows the authorized user to circumvent the credit score requirements that are typically necessary for credit card approval so they can benefit from the account holder’s on-time payments.

Only the primary account holder is responsible for the credit card’s payments, but payments are typically reported to the three main credit bureaus (Experian, Equifax, and TransUnion) in both individuals’ names. This allows the authorized user to accumulate a credit history, which is the foundation of a credit score.

Safety Notes

- This sort of relationship can be risky for both parties. An authorized user does not need to carry a card or make purchases to benefit from a primary account holder’s on-time payments, but they are legally allowed to, despite the latter carrying all of the liability.

- A primary account holder can remove any authorized users from their credit account at any time by contacting the account’s administrator.

- If the primary account holder misses payments or fails to keep their credit card utilization relatively low, the effect on the authorized user’s credit score could be negative instead of positive.

2. Get a Secure Credit Card Through Your Bank

A “secure” credit card account is so-called because it is secured (on the bank’s end) by a cash deposit made by the account holder and held by the bank as collateral.

In other words, you give your bank a sum of money—say, $300—and they give you a credit card with a $300 limit. You spend money the card, then make on-time payments, which the bank then reports to the bureaus, helping you build credit over time.

The bank doesn’t have to worry about you defaulting on your balance because it is already holding the maximum amount you are allowed to spend. If you fail to pay your balance, the bank will pay itself with the money you deposited as collateral.

With a secured credit card, you are essentially spending money you’ve borrowed from yourself in order to establish credit history.

Safety Notes

- So long as you make your payments, the deposit you use as collateral should be returned to you after a set period of time or if/when you close the account. If possible, try to keep the account open, as the length of your credit history affects your score.

- Secure credit cards often have higher interest rates than traditional cards, so it’s best to pay off your full balance each month to avoid incurring interest.

- Some secure cards come with maintenance fees.

3. Take Out a Credit-Builder Loan From Your Bank

A credit-builder loan works very similarly to a secure credit card. You take out a loan for, say, $500, but you don’t use it—your bank keeps that money in a collateral account.

You then use your income to pay the balance off incrementally over, say, one year. These payments are reported to the bureaus, helping you build credit.

When the loan is paid off, your bank releases the $500 from the collateral account and returns it to you. Or, better yet, if you don’t need the money right away, you can use it as collateral for a secured credit card (see item 2 on this list).

Safety Notes

- Credit builder loans do charge interest, so by taking one out, you are essentially paying to build credit.

- Any missed payments will be reported to the credit bureaus after 90–180 days and impact your credit score negatively.

4. Use a Service to Report Rent and Bill Payments to Credit Bureaus

Rent and bill payments aren’t typically reported to the credit bureaus unless they are unpaid and go into collections. In other words, paying on time doesn’t help you build credit, but failing to pay can certainly hurt your credit.

Nowadays, however, certain services exist that allow renters and billpayers to have their payments reported to the three bureaus—usually for a monthly fee—to help them build or improve their credit.

By creating an account with a data furnisher like LevelCredit or PayYourRent, you can pay to have your monthly rent payments shared with the credit bureaus. Another service, known as Experian Boost, allows you to report other bill payments (like phone, utilities, and even streaming services like Hulu), although only to Experian, one of the three main credit bureaus.

Safety Notes

- Some of these services cost money, and it's up to you to decide whether the benefits are worth the price.

- Since rent and utility payments aren’t used as heavily as loan and credit card payments in credit reports, it is unclear how much of an impact reporting this information will have on your score.

General Tips for Building and Maintaining Good Credit

- Pay your bills on time: By far, the most important factor in maintaining good credit is paying your bills—especially credit card and loan payments—on time. Set up autopay whenever possible.

- Leave accounts open: Your credit age—how long you’ve been successfully borrowing and paying back money—affects your score. Don’t close credit card accounts just because you don’t use them anymore. Leaving them open (so long as they don’t charge an annual fee) benefits you.

- Maintain multiple credit accounts: One factor that affects your credit score is your credit utilization—this is the ratio of the total money you owe to your total credit limit. The lower this ratio is, the better it is for your score. Even if you only use one credit card, having three credit card accounts open with no balance is a good way to minimize your utilization.

- Don’t apply for too many lines of credit at once: When you apply for a credit card or loan, it shows up as a “hard inquiry” on your credit report. This is not a bad thing, but too many inquiries over a short period can temporarily lower your score. Try to space out applications by a few months when possible.