Nvidia’s (NVDA) -) shares have surged this year due to growing demand for its chips by companies and governments developing artificial intelligence applications, such as generative AI programs like ChatGPT.

Optimism that sales of Nvidia’s H100 GPUs, which can cost $40,000, will cause earnings to soar has arguably priced Nvidia’s stock to perfection. However, there could still be room to rally if Nvidia says the right things.

Here are three questions Nvidia shareholders hope to have answered when management reports quarterly earnings after the bell on August 23.

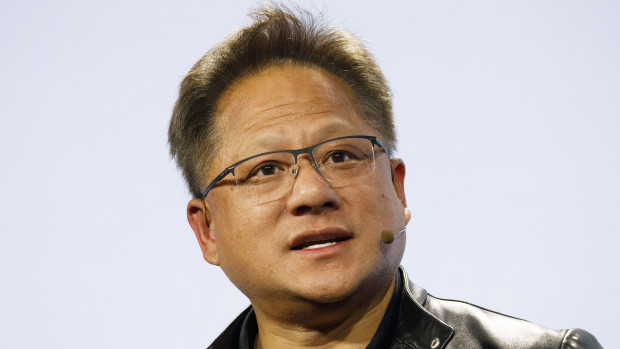

Patrick T. Fallon/Bloomberg via Getty

No. 1: Are any of Nvidia's orders duplicates?

During the supply chain crisis experienced in late 2021 and early 2022, many companies sought to get supply by ordering more than necessary. The strategy may have helped them get supplied more quickly, but it was unsustainable. As supply chains normalized, order volumes retreated.

DON'T MISS: Analysts expect fireworks when Nvidia reports earnings

Nvidia’s H100 chips are reportedly in short supply with long lead times. Yet Nvidia's guidance last quarter suggested orders would accelerate in the second half of the year.

"We are expecting not only the demand that we just saw in this last quarter, the demand that we have in Q2 for our forecast, but also planning on seeing something in the second half of the year...we do plan a substantial increase in the second half compared to the first half," said CEO Jensen Huang during Nvidia's Q1 conference call.

Curious investors will want to hear if management suspects some orders are being inflated or pulled forward to cudgel additional supply or to build inventories. If not, order trends could be more durable, making delivering on future sales and earnings forecasts easier.

More Business of AI:

- Here's the startup that could win Bill Gates' AI race

- Meet your new executive assistant, a powerful AI named atlas

- The company behind ChatGPT is now facing a massive lawsuit

Similarly, it will be important to hear what Nvidia says about demand in China.

Previously, the Financial Times reported that Chinese companies placed $5 billion in orders for the A800 chip Nvidia sells there for AI projects. The risk regulations further restrict access to Nvidia’s chips and could mean Chinese companies order more than they need now to stockpile.

No. 2: Can Nvidia's supply keep up with demand?

Producing enough chips to meet AI-related demand might be easier said than done. CEO Jensen Huang said earlier this year that it could meet orders this year, but that was before the latest wave of interest in these chips.

In addition to private equity firms rushing to secure chips for AI startups, China ordering chips ahead of regulatory risks, and cloud storage players like Microsoft (MSFT) -) and Alphabet (GOOGL) -) buying to meet enterprise demand, global governments are also angling for supply. For example, Saudi Arabia and the UAE reportedly recently ordered thousands of chips for their AI initiatives, including the UAE’s large language model under development.

If Nvidia cannot produce enough of the chips ordered, it could widen the door for competitors like Advanced Micro Devices (AMD) -). AMD is developing a new family of AI-oriented chips to compete directly with Nvidia, and its chips will be ready for testing in the coming months.

No. 3: When will Nvidia's new AI chips be available?

Given the surging demand, competitive threats from AMD and others are expected. However, Nvidia can maintain its leadership in the AI-chip market with new solutions, such as the GH200, which boasts three times the H100's memory.

If the GH200 makes it to market quickly, it could be a catalyst for further upside in Nvidia's stock in 2024.

Nvidia already said the GH200 is in production in May. That chip, which combines its Grace CPU built on Arm architecture and its highest-end H100, could resonate with those wanting to marry AI functionality and CPU flexibility for speed and power advantages.

Nvidia is also developing a DGX GH200 supercomputer boasting 256 Grace CPUs and 256 H100 GPUs, sporting 120 terabytes of CPU and 24 terabytes of GPU memory. This supercomputer would be ideal for AI training and could carry an eye-popping 8-figure price tag.

If Nvidia suggests persistent order trends, adequate supply, and on-time production schedules for next-generation AI chips, the argument for owning Nvidia's stock would become even stronger.

One Stock We Believe Will Win in The AI Race (It's not Nvidia!)