Wall Street’s love affair with cryptocurrency is on the rocks, at least for now.

While 2024 and 2025 were defined by the launch of spot ETFs and Bitcoin’s (BTCUSD) relentless climb toward $100,000, January 2026 has introduced a different vibe. Bitcoin has spent the month struggling to reclaim the six-figure mark, sliding toward $82,000 on Friday afternoon.

Meanwhile, Ethereum (ETHUSD) had stabilized in a choppy, sideways range, then broke down bigtime in late January. The break in the romance isn’t necessarily permanent, but Wall Street’s affection with digital currencies is being put to the test.

To the extent that Bitcoin represents crypto, which is largely true in the aggregate, this chart is concerning. It shows that the iShares Bitcoin Trust ETF (IBIT) is holding on for dear life, with a break below $43 threatening to reverse even more of 2025’s rally. We’ve seen it before.

One reason for the fading crypto buzz had been the spectacular performance of “old-school” assets. Gold (GCG26) and silver (SIH26) are the new market celebrities. Until Friday, that is. It makes me think that Bitcoin and other cryptos are all just part of a big “risk-on” trade. One that might beget margin calls and shrinking speculation as 2026 continues.

There is also the sense that the initial excitement of the ETF era has plateaued.

When IBIT and other crypto ETFs first launched, the inflows were record-breaking. Now, we are seeing more mature behavior, which can feel a bit boring to those used to the dopamine hits of a crypto bull run. Outflows have become more frequent, particularly during weeks of macroeconomic uncertainty or tech-led selloffs. The market is no longer just chasing the story of institutional adoption; it is now scrutinizing the actual utility and the macro-headwinds, like tariff threats and shifting Federal Reserve policies.

If you believe the thrill is truly gone, or at least that the market needs a significant reset, there are direct ways to profit from the downside. You don’t have to just sit on your hands while your IBIT or ETHA shares take a hit.

Short-term tactical tools like the ProShares Short Bitcoin Strategy ETF (BITI) are designed to deliver the inverse of Bitcoin’s daily performance. If Bitcoin drops 5% in a day, BITI should ideally rise by roughly that same amount.

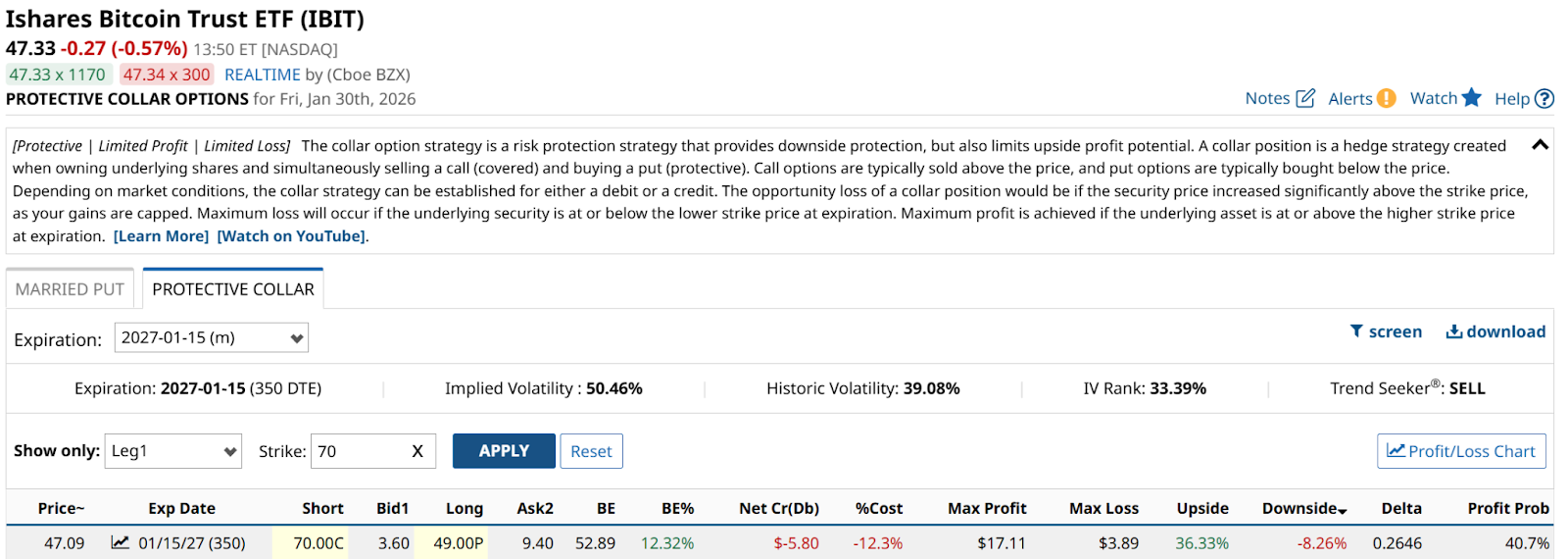

And if you are someone who is looking to buy the dip, IBIT can be collared. Here’s one example that takes advantage of the elevated volatility.

That’s 36% upside to just 8% downside, over a period lasting just short of 12 months. If you think that the most recent leg of IBIT’s collapse will quickly reverse, such a move will cover your cost by itself.

Crypto is still a highly loved asset class. And a high-volatility one. Recent events, here and in precious metals, should remind all traders and investors to abide by a simple rule: first, know thyself. Then decide how to manage risk in a way that puts you in control of your financial destiny.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app.