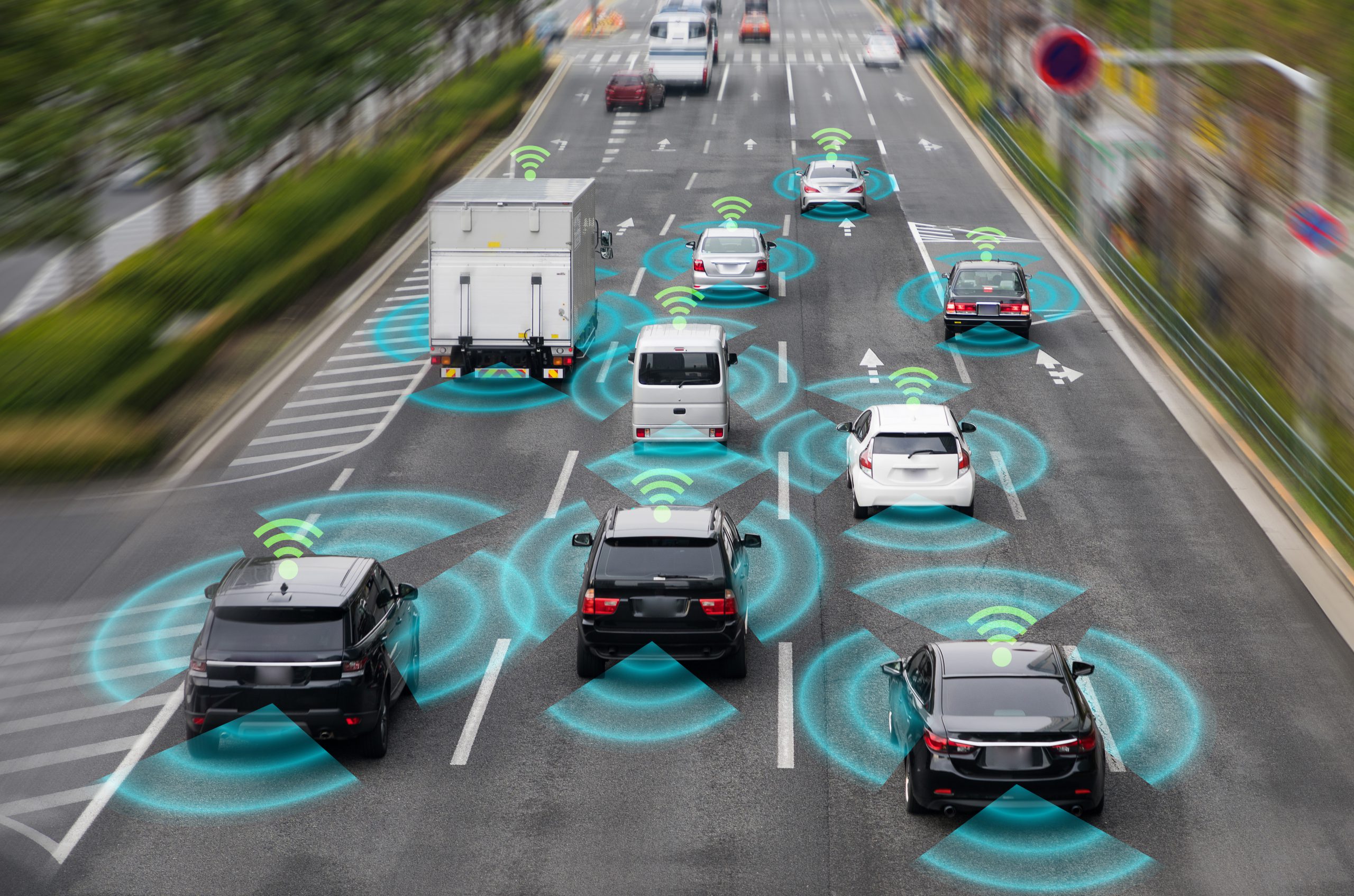

Autonomous vehicles (AV) are the next major revolutionary development for transportation. If we look at previous innovations in transportation like the domestication of horses, bicycles, and automobiles, we see that they had major impacts in terms of how people live, work, and socialize.

We may be a couple of decades away from autonomous vehicles becoming ubiquitous, but they offer similar promises in terms of changing human existence. Auto fatalities would decrease as would traffic congestion. Commuting would become more pleasurable and productive. People would have more flexibility and options when it comes to choosing, where they want to live. Infrastructure and urban life would improve as there would be less need to provide designated parking spaces.

Many investors are interested in this theme because it is likely going to be more than a trillion-dollar industry. One strategy is to try to pick the winners and losers out of the automakers, component providers, and tech companies who are competing in this space. The other option is to bet on the companies that are going to be part of the AV supply chain, as these offer a much higher chance of success.

Here are 2 stocks that will benefit from the AV boom:

ON Semiconductor (ON)

ON designs and builds intelligent sensing and power technologies for its customers in the automotive, telecom, aerospace, and medical industries.

A major reason that ON should be on the radar of investors, interested in under-the-radar growth opportunities, is that it provides exposure to the electric vehicle (EV) and AV industry. ON Semiconductor supplies a variety of products, including silicon carbide-based power modules for acceleration, inverters, LiDAR (remote sensing technology), chargers, body electronics, and the powertrain.

Currently, the company expects automotive revenue to grow at a 17% annual rate over the next three years. This growth should persist well into the decade as EVs are projected to outsell gas-powered vehicles by 2028, according to Credit Suisse. Essentially, ON is a major producer of chips that are integral for these new technologies.

The company's other major segments are also doing well due to strength in end-markets like 5G, cloud computing, power generation, and factory automation.

ON’s combination of value and growth makes it a great ‘buy the dip’ candidate in this bear market. Historically, the stock's forward P/E has vacillated between 20 and 30, but it currently has a forward p/E of 11.5.

ON Semiconductor has an overall B rating in the POWR Ratings system, translating to a Buy. B-rated stocks have posted an average annual return of 21.0% since 1999, which compares favorably to the S&P 500's average annual gain of 8%. Check out ON's complete POWR Ratings breakdown, including component grades for growth, sentiment and momentum, here.

Micron (MU)

MU is one of the leading makers of DRAM and NAND memory chips. These chips are found in all sorts of devices and products including smartphones, PCs, consoles, vehicles, and data centers.

There has been some weakness in the semiconductor industry with concerns over an economic slowdown. So, the near-term outlook is cloudy, and investors should consider dollar-cost-averaging to take advantage of further volatility.

Technologies like AI, machine learning, and cloud computing require massive amounts of memory. As a result, MU is experiencing massive growth as these technologies are increasingly adopted. Spending on these technologies is only in its early innings and is increasingly becoming requirement for companies to stay competitive.

MU’s automotive segment also offers growth upside, and it currently has 50% of the automotive memory market. Cars are increasingly becoming electronic, and all of these functions require memory. And, this will increase with autonomous vehicles as cars will require massive amounts of memory to store all the data that is generated and transmitted.

MU is rated a C according to the POWR Ratings which translates to a Neutral rating. In terms of component grades, it has an A for Value. This isn’t surprising as the company has a foward P/E of 9.3 which is nearly half of the S&P 500. Click here to see more of MU’s POWR Ratings.

ON shares closed at $56.07 on Friday, up $2.02 (+3.74%). Year-to-date, ON has declined -17.45%, versus a -18.31% rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

2 ‘Under the Radar’ Autonomous Vehicle Stocks to Buy on the Dip StockNews.com