Growth stocks, especially in the biotech sector, often have the potential to deliver outsized returns. A breakthrough in clinical trials or regulatory approvals can rapidly transform a biotech stock.

Here are two such biotech growth stocks that analysts believe are worth the risk.

Growth Stock #1: Celldex Therapeutics

Valued at $1.76 billion by market capitalization, Celldex Therapeutics (CLDX) is a clinical-stage biotech company focused on immunology. It develops antibody-based therapies designed to precisely target parts of the immune system that drive allergic, inflammatory, and autoimmune diseases.

Celldex’s lead program is barzolvolimab, a humanized monoclonal antibody that targets the KIT receptor. It has shown promising clinical results for a variety of allergic and inflammatory disorders, including chronic spontaneous urticaria (CSU), cold urticaria (ColdU), and symptomatic dermographism (SD). The Phase 2 clinical trial for CSU showed sustained and deepening efficacy of barzolvolimab through 52 weeks. Furthermore, Celldex reported positive Phase 2 results in ColdU and SD. Positive results showed that at 20 weeks, up to 66% of ColdU patients and 49% of SD patients had complete responses, exceeding placebo. The findings also revealed increases in quality of life, temperature thresholds, and friction thresholds, as well as a good safety profile that was consistent with previous research.

Driven by these positive developments, in December last year, Celldex initiated a global Phase 3 study evaluating barzolvolimab in patients with ColdU and SD, two chronic inducible urticaria conditions with no approved advanced therapies. Beyond urticaria, the company is still enrolling in Phase 2 studies of barzolvolimab for prurigo nodularis and atopic dermatitis, with preliminary results expected in the second half of 2026. Its other candidate is CDX-622, a bispecific antibody that targets both stem cell factor (SCF) starvation and “neutralization of the alarmin thymic stromal lymphopoietin (TSLP).” It also delivered positive Phase 1 data, with additional data expected in the third quarter of 2026.

As a clinical-stage biotech company, Celldex doesn’t generate any revenue yet. The company reported a net loss of $67 million in the third quarter, driven primarily by higher R&D and operational costs tied to pipeline advancement. At the end of Q3, Celldex had cash, cash equivalents, and marketable securities totaling $583.2 million, which management thinks will be sufficient to sustain anticipated operations until 2027.

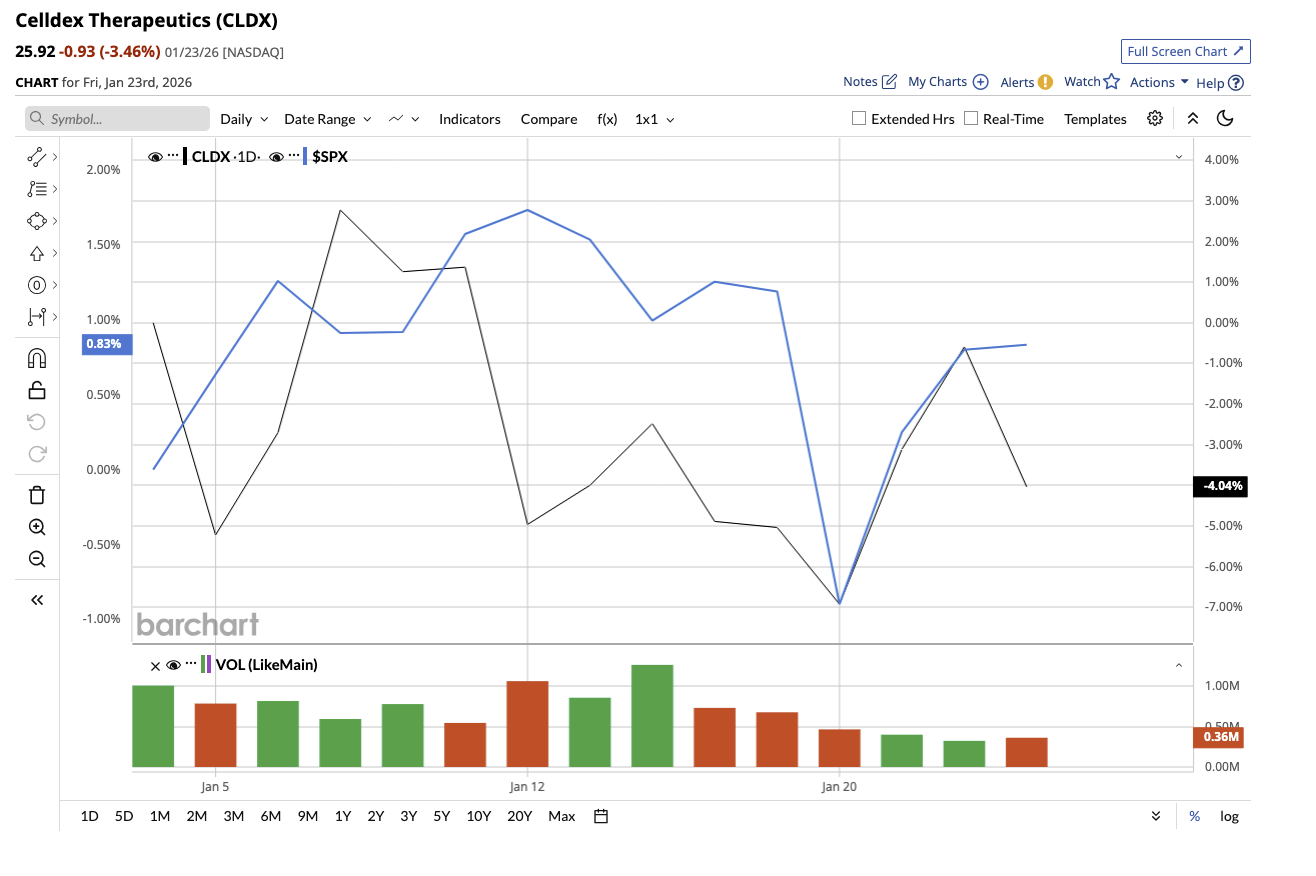

For now, Celldex stock’s performance hinges on clinical trial success. This is typical in a biotech sector where investors with a high risk appetite are willing to handle the short-term volatility for potentially large gains if any therapies get approved and commercialized.

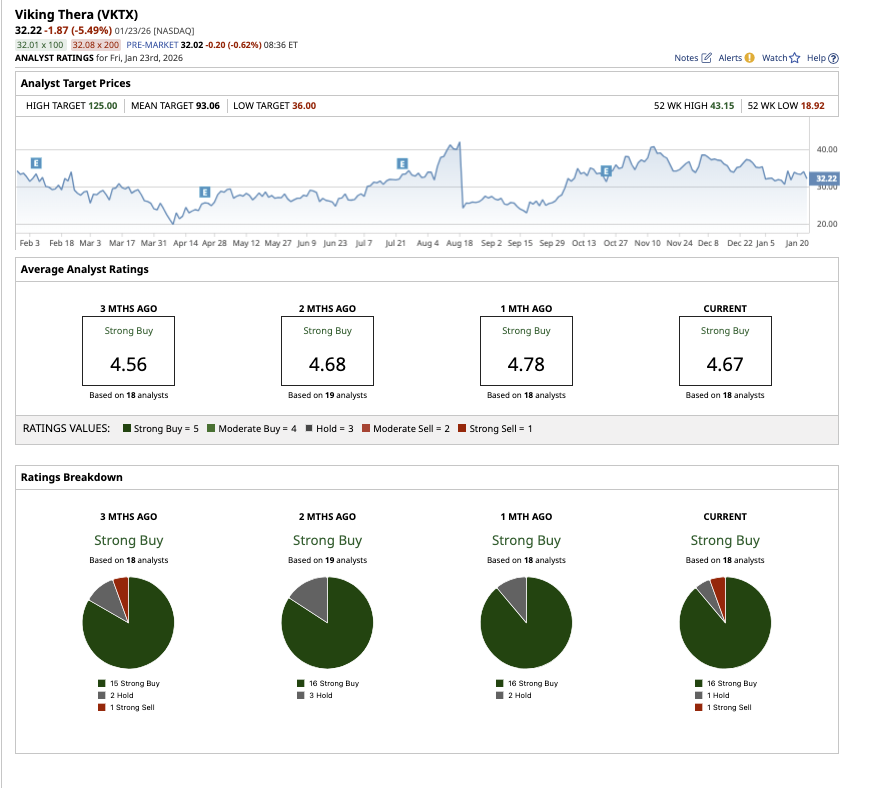

What Does Wall Street Say About CLDX Stock?

With more than half a million patients affected across the U.S. and Europe with various urticaria conditions and limited treatment options available, barzolvolimab — if and when it is successful — could address a major unmet medical need.

This is probably why Wall Street believes CLDX stock is a “Strong Buy.” Out of the 17 analysts covering CLDX stock, 13 rate it a “Strong Buy,” three rate it a “Hold,” and one says it is a “Strong Sell.”

CLDX stock is down 3% so far this year. Nonetheless, the average target price of $53.36 suggests the stock has potential upside of 104% from current levels. The high target price of $90 implies potential upside of 246% over the next 12 months.

Growth Stock #2: Viking Therapeutics

Valued at a market cap $3.58 billion, Viking Therapeutics (VKTX) is another high-risk, high-reward growth stock in the biotech sector. It is a clinical-stage biotech focused on developing new therapies for metabolic and endocrine disorders. Viking's lead obesity treatment, VK2735, has been making significant strides.

Viking is developing VK2735, a wholly owned, long-acting dual GLP-1/GIP receptor agonist for obesity and other metabolic disorders. The Phase 2 results showed statistically significant and progressive weight loss with no observed plateau. Following positive Phase 2 results, Viking advanced the drug into the global VANQUISH Phase 3 program, which includes two large, randomized, placebo-controlled trials.

Alongside this, Viking is also advancing an oral tablet formulation of VK2735 in a Phase 2 VENTURE-Oral Dosing study. Beyond VK2735, Viking is also advancing its broader metabolic pipeline, which includes a dual amylin and calcitonin receptor agonist program, with hopes to file an IND in the first quarter of 2026.

Financially, Viking remains steady for now, ending its third quarter with $715 million in cash, cash equivalents, and short-term investments. Management expects that this strong cash balance will be sufficient to carry VK2735 through Phase 3 development and support future pipeline developments.

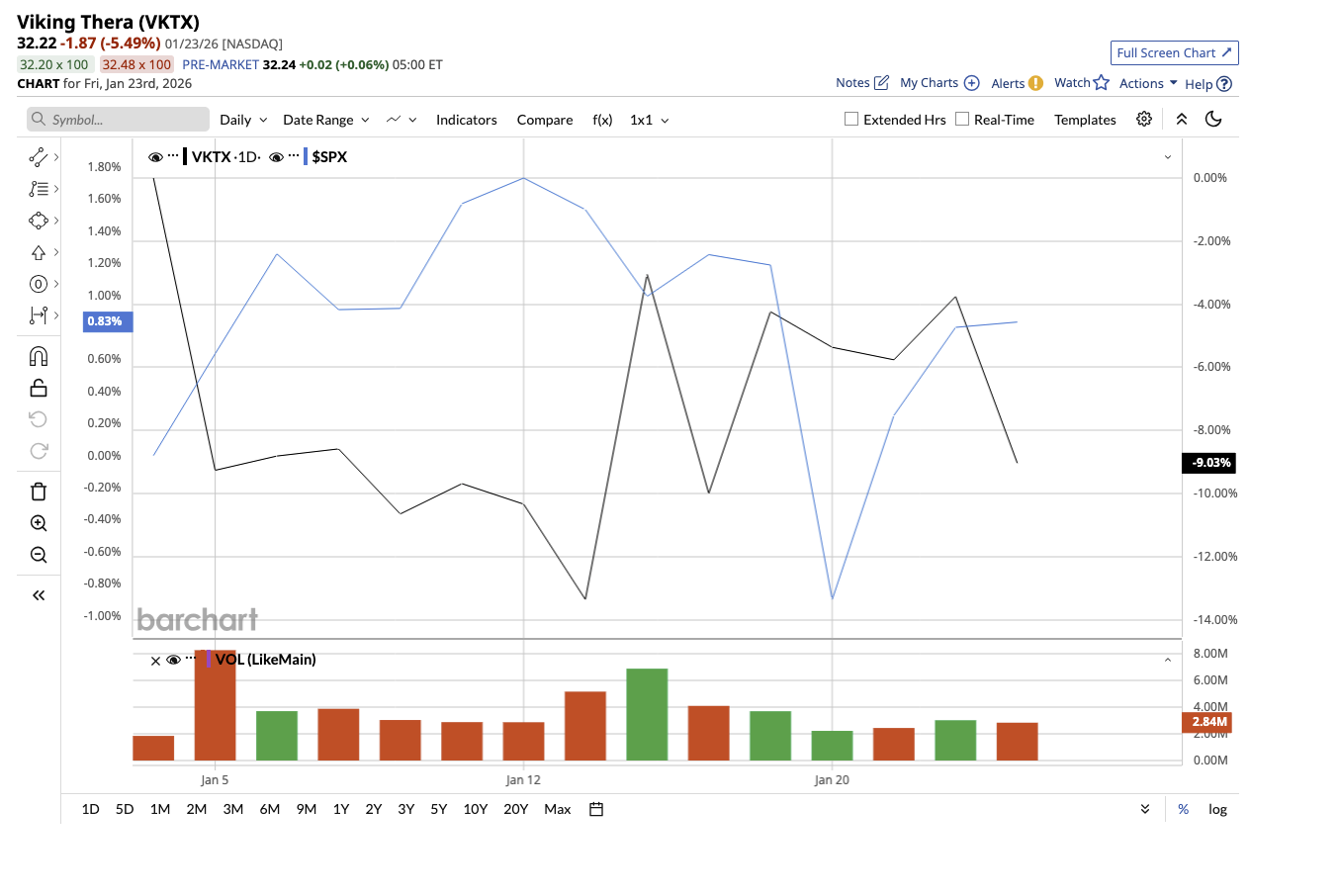

Viking does not yet have any approved products on the market. Like Celldex, its stock performance is dependent on the outcome of ongoing clinical trials and eventual regulatory approval. The markets Viking is targeting — obesity, metabolic disease, and liver problems — are massive and quickly expanding, with obesity and related conditions projected to create enormous demand for effective therapies. This is perhaps why analysts are so optimistic about VKTX stock's long-term prospects.

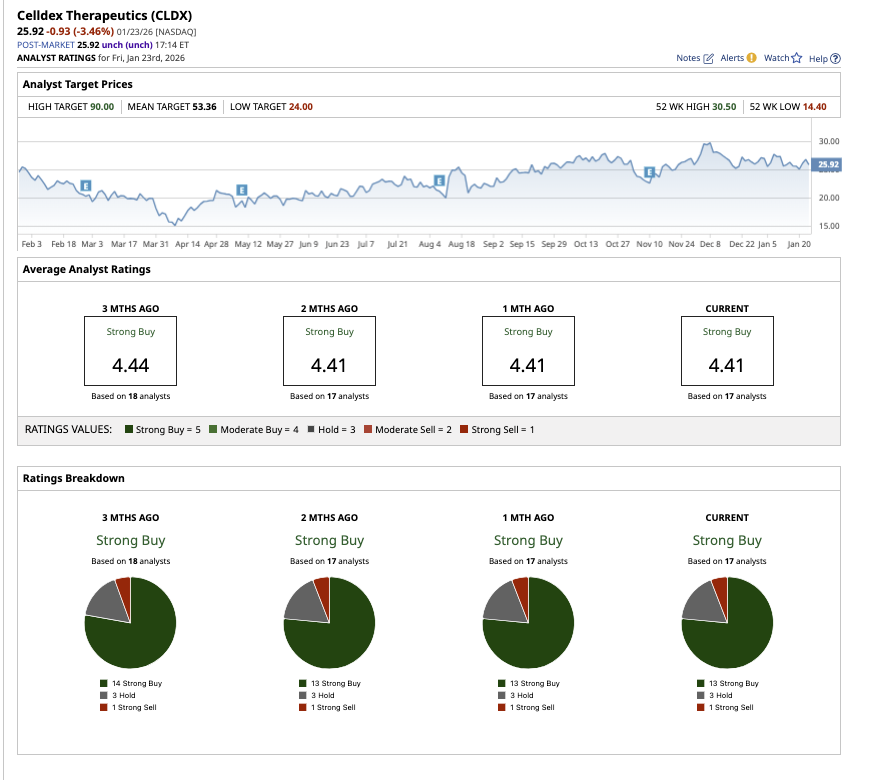

What Does Wall Street Say About VKTX Stock?

On Wall Street, overall, VKTX stock is a consensus “Strong Buy.” Out of the 18 analysts covering the stock, 16 rate it a “Strong Buy,” one rates it a “Hold,” and one says it is a “Strong Sell.” The stock is down 10% so far this year. Nonetheless, the average target price of $93.06 suggests an upside potential of 196% above current levels. The high price estimate of $125 implies 297% potential upside over the next 12 months.