Gold (GCJ26) and silver (SIH26) prices were briefly higher in early U.S. trading Monday after dropping to four-week lows overnight and in the aftermath of last Friday’s record-setting session that has the entire global marketplace edgy to start the trading week and the month.

All commodity futures traders on Friday could not help but keep their eyes glued to record-setting price downdrafts and extreme volatility in gold and silver futures. The same could be the case today and for the next few days.

Silver’s 26% plunge on Friday was the biggest on record, while gold dropped 9% in its worst day in more than a decade. Overnight, March silver dropped to a low of $71.20 an ounce, after hitting a record high of $121.785 last Thursday.

April gold futures overnight hit a low of $4,423.20 an ounce after last Thursday hitting a record high of $4,626.80. Both metals had posted solid rebounds from the overnight lows, as of this writing.

The CME Group over the weekend raised margin requirements again for the two metals futures contracts.

Traders in stock and financial markets are also spooked by the mammoth plunges and extreme volatility in gold and silver prices, with global stock markets lower overnight.

Part of the pressure on the metals is due to President Donald Trump last Friday nominating Kevin Warsh to lead the Federal Reserve, which sent the U.S. dollar index ($DXY) higher. Warsh has been known to be more hawkish on U.S. monetary policy.

Some blamed the bloodbath in gold and silver markets on Chinese speculators loading up on leveraged long-side bets using futures and options — and possibly not understanding the potential implications of the huge leverage involved. Bloomberg reported that Chinese metals traders have racked up losses totaling at least 1 billion yuan after one of their counterparties fled the country leaving deals unfinished. Xu Maohua, a metals dealer also known as “The Hat,” went into hiding. He was reportedly central to a network that helped the state-owned SDIC Commodities subsidiary boost sales via irregular deals that skirted Chinese government rules.

Partial U.S. Government Shutdown Also Could Support Early Week Gains in Gold, Silver

The federal government went into a partial shutdown over the weekend while waiting for the U.S. House of Representatives to approve a funding deal Trump worked out with Democrats. The gold and silver markets are seeing some renewed safe-haven demand amid the uncertainty of this matter.

“The funding lapse is likely to be short, with the House returning from a break on Monday and the Republican president fully supporting the spending package. The shutdown affects agencies including the Treasury, Defense, Homeland Security, Transportation, Health and Human Services and Labor Departments, but some parts of the government are already fully funded through the end of the federal fiscal year,” Bloomberg reported.

U.S.-Iran Tensions Supporting Gold, Silver, Pressuring Oil

Also supporting some safe-have bids in gold and silver early this week are still-elevated U.S.-Iran tensions.

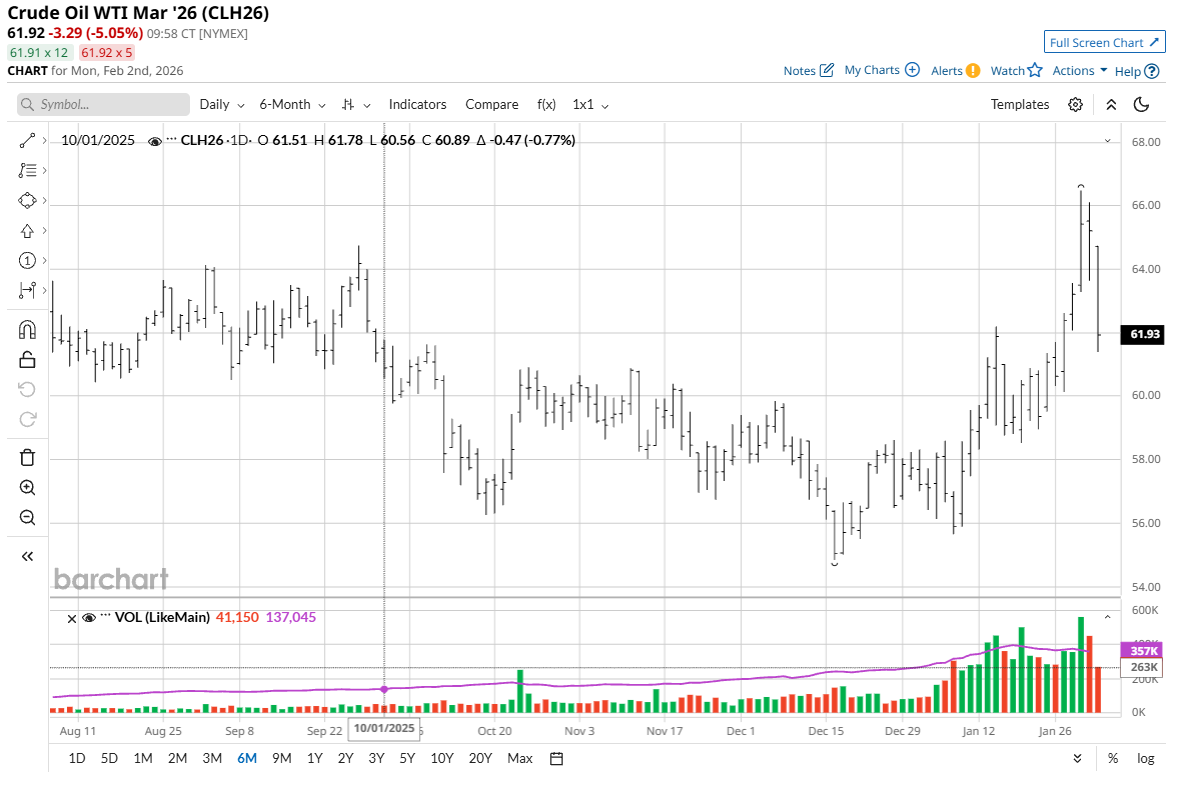

However, on Sunday Iran ratcheted down its rhetoric against the U.S. by saying it hopes diplomatic efforts to avert a war with the U.S. will bear fruit within days, according to the Islamic Republic’s foreign ministry and as reported by Bloomberg. Multiple countries in the Middle East have acted as intermediaries to exchange messages with the U.S., and Iran’s priority in talks is sanctions relief. Oil prices (CLH26) fell sharply in early trading today, partly because of the heightened diplomatic maneuvers, with Brent crude (CBJ26) dropping around 4.5% to $66.20 a barrel. Nymex crude oil futures were trading around $62.00 a barrel early today, down around $3.00.

Crude oil prices are still up so far this year because of the still-high chances of conflict in the oil-rich Middle East. Earlier in the weekend, Iran’s Supreme Leader Ayatollah Ali Khamenei warned of a “regional war” as tensions continued to mount over potential U.S. strikes on Tehran. Iran’s army chief has renewed warnings that Tehran could strike Israel if attacked by the U.S. Iran’s Foreign Minister said Tehran is ready to “embrace a fair and equitable nuclear deal” that would ensure “no nuclear weapons” and guarantee the lifting of sanctions.

I enjoy hearing from my Barchart readers all over the world. I always try to respond to all your emails to me. My email address is jim@jimwyckoff.com.