South Korea has unveiled a ₩26 trillion ($19 billion) support package for its semiconductor industry to maintain its competitive edge in the global market. This initiative aims to bolster chip design and contract manufacturing industries in the country amid fierce international competition, reports Reuters.

"As we all know, semiconductors are a field where all-out national warfare is underway. Win or lose, that depends on who can make cutting-edge semiconductors first," said Yoon Suk Yeol, the President of South Korea, at a meeting with the government.

The President of South Korea announced that the Korea Development Bank would facilitate a ₩17 trillion financial support program to encourage investments in the semiconductor production sector. Emphasizing the critical nature of this industry, Yoon stated that success in producing advanced semiconductors is vital for the country's economic strength.

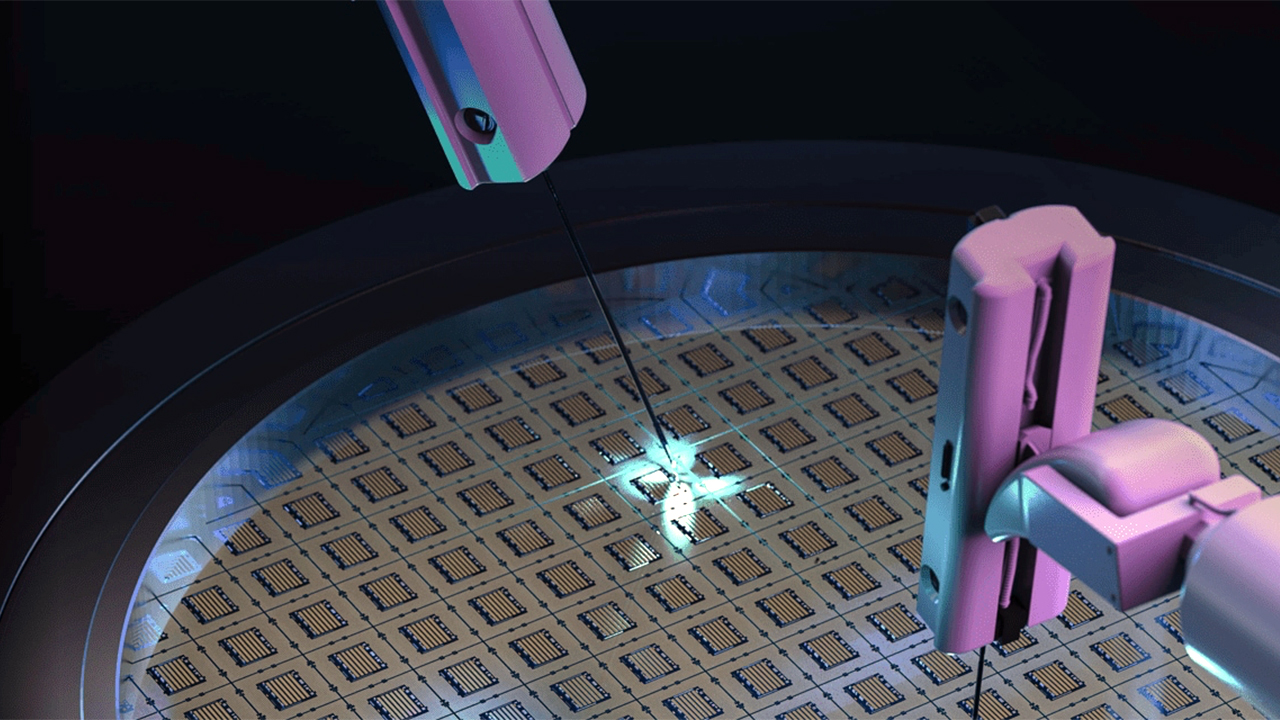

Currently, South Korea, despite being the base for leading memory chip manufacturers like Samsung and SK Hynix, lags behind in areas such as chip design and contract manufacturing. The nation's fabless sector, which involves designing chips while outsourcing production, holds only about 1% of the global market, according to the Reuters report citing South Korean government.

To address these shortcomings, the government plans to create a ₩1 trillion fund to support equipment manufacturers and fabless companies. Additionally, the goal is to increase South Korea's market share in non-memory chips, such as mobile application processors, from 2% to 10%, according to industry minister Ahn Duk-geun.

In addition to announcing its support package for the semiconductor industry, South Korea is developing a major chipmaking complex in Yongin, near Seoul, intended to attract equipment manufacturers and fabless companies. The government plans to cut bureaucratic red tape to expedite the construction process.

Back in January, Yoon also announced extended tax credits to boost domestic semiconductor investments, aiming to enhance employment and attract talent to the industry.

This new comprehensive support package surpasses previous plans and aligns with global trends, where countries like China and the U.S. are heavily investing in their semiconductor industries. By matching or exceeding the support other nations provide, South Korea aims to secure its position in the semiconductor market. Yet, keep in mind that South Korea will invest the lion's share of its package in chip manufacturing, not R&D or chip development.