17 analysts have shared their evaluations of Regions Finl (NYSE:RF) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 7 | 3 | 6 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 2 | 0 | 1 | 0 | 0 |

| 2M Ago | 4 | 2 | 2 | 1 | 0 |

| 3M Ago | 1 | 1 | 2 | 0 | 0 |

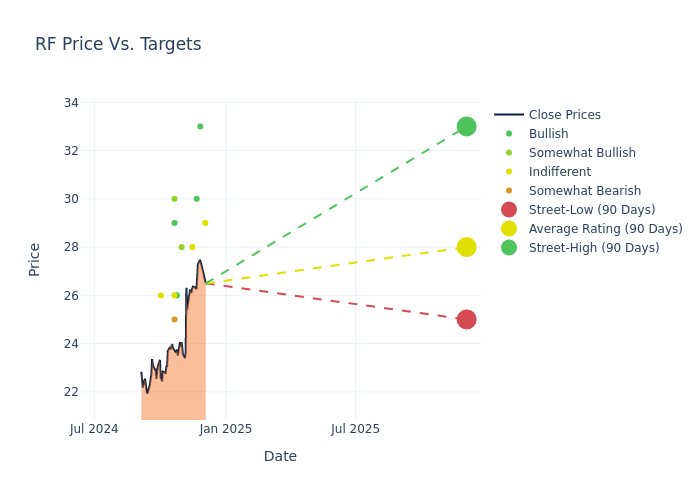

The 12-month price targets, analyzed by analysts, offer insights with an average target of $27.47, a high estimate of $33.00, and a low estimate of $24.00. Marking an increase of 10.01%, the current average surpasses the previous average price target of $24.97.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Regions Finl among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Siefers | Piper Sandler | Raises | Neutral | $29.00 | $25.00 |

| Ryan Nash | Goldman Sachs | Raises | Buy | $33.00 | $29.00 |

| Keith Horowitz | Citigroup | Raises | Buy | $30.00 | $26.00 |

| Whit Mayo | Wells Fargo | Raises | Equal-Weight | $28.00 | $24.00 |

| David Konrad | Keefe, Bruyette & Woods | Raises | Outperform | $28.00 | $27.00 |

| Kevin Heal | Argus Research | Announces | Buy | $26.00 | - |

| Matt O'Connor | Deutsche Bank | Raises | Buy | $26.00 | $24.00 |

| Peter Winter | DA Davidson | Raises | Buy | $29.00 | $27.00 |

| David Chiaverini | Wedbush | Raises | Outperform | $30.00 | $28.00 |

| Brandon King | Truist Securities | Raises | Hold | $26.00 | $25.00 |

| Whit Mayo | Wells Fargo | Raises | Equal-Weight | $24.00 | $22.00 |

| Jason Goldberg | Barclays | Raises | Underweight | $25.00 | $22.00 |

| Ryan Nash | Goldman Sachs | Raises | Buy | $28.00 | $25.00 |

| John Pancari | Evercore ISI Group | Raises | In-Line | $26.00 | $24.50 |

| David Chiaverini | Wedbush | Raises | Outperform | $28.00 | $23.00 |

| Brandon King | Truist Securities | Raises | Hold | $25.00 | $23.00 |

| Keith Horowitz | Citigroup | Raises | Buy | $26.00 | $25.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Regions Finl. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Regions Finl compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Regions Finl's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Regions Finl's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Regions Finl analyst ratings.

About Regions Finl

Regions Financial is a regional bank headquartered in Alabama, with branches primarily in the Southeastern and Midwestern United States. Regions primarily provides traditional commercial and retail banking and also offers mortgage services, asset management, wealth management, securities brokerage, and trust services.

A Deep Dive into Regions Finl's Financials

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Decline in Revenue: Over the 3 months period, Regions Finl faced challenges, resulting in a decline of approximately -3.61% in revenue growth as of 30 September, 2024. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Regions Finl's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 24.92%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Regions Finl's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.75% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Regions Finl's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.29%, the company showcases efficient use of assets and strong financial health.

Debt Management: Regions Finl's debt-to-equity ratio is below the industry average. With a ratio of 0.44, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.